DEF 14A: Definitive proxy statements

Published on October 5, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||

| x | Definitive Proxy Statement | |||||||||||||

| o | Definitive Additional Materials | |||||||||||||

| o | Soliciting Material Pursuant to § 240.14A-12 | |||||||||||||

| (Name of Registrant as Specified in its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Payment of Filing Fee (Check all boxes that apply): | |||||

| x | No fee required. | ||||

| o | Fee paid previously with preliminary materials. | ||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||||

Dear Stockholder,

We cordially invite you to attend the ResMed Inc. annual stockholders meeting on Thursday, November 16, 2023, at 12:00 p.m. US Pacific Time, which is Friday, November 17, 2023, at 7:00 a.m. Australian Eastern Time. To provide expanded stockholder access and participation, the annual meeting will be held completely virtually via live interactive audio webcast on the internet. You will be able to attend, vote, and submit your questions online during the annual meeting at www.virtualshareholdermeeting.com/RMD2023. You will not be able to attend the annual meeting in person.

Your vote is important. We are promoting the use of the internet to provide proxy materials to stockholders, as we believe this is an efficient, cost-effective, and environmentally responsible method for facilitating our annual meeting. Please read “VOTING INSTRUCTIONS AND GENERAL INFORMATION – Voting Instructions” in the proxy statement to understand your options for casting your vote.

Very truly yours,

Michael J. Farrell

Chair of the Board

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF RESMED INC.

| ||

| Date: |

Thursday, November 16, 2023, at 12:00 p.m. US Pacific Time

Friday, November 17, 2023, at 7:00 a.m. Australian Eastern Time

|

||||

| Live webcast: | www.virtualshareholdermeeting.com/RMD2023 | ||||

| Items of business: |

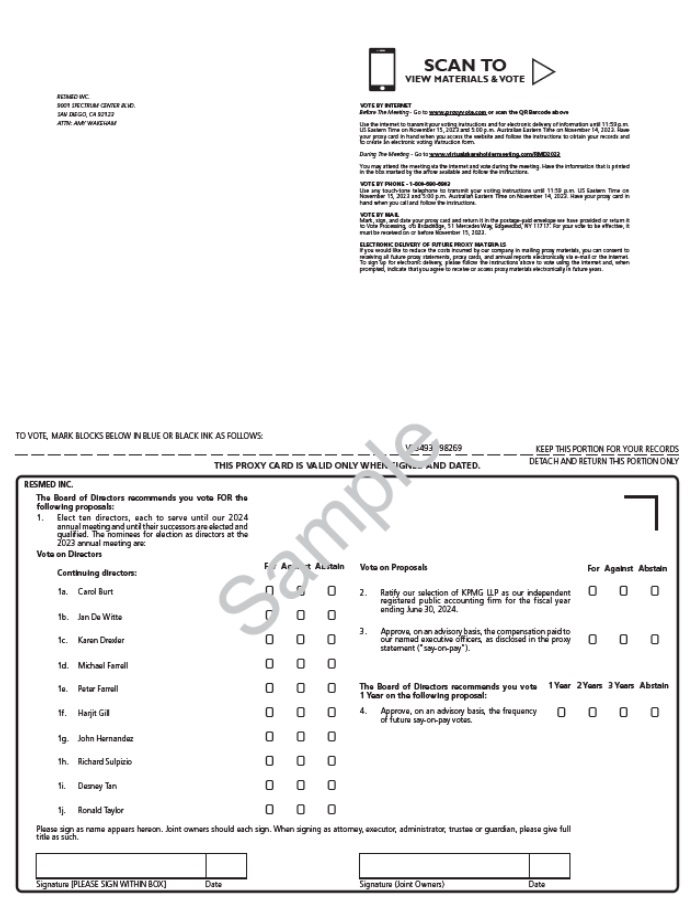

1.Elect ten directors, each to serve until our 2024 annual meeting and until their successors are elected and qualified. The nominees for election as directors at the 2023 annual meeting are Carol Burt, Jan De Witte, Karen Drexler, Michael "Mick" Farrell, Peter Farrell, Harjit Gill, John Hernandez, Richard "Rich" Sulpizio, Desney Tan, and Ronald "Ron" Taylor.

2.Ratify our selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2024.

3.Approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in this proxy statement (“say-on-pay”).

4.Approve, on an advisory basis, the frequency of future say-on-pay votes.

5.Transact other business that may properly come before the meeting.

|

||||

| Record date: | You are entitled to vote only if you were a ResMed stockholder at the close of business on September 20, 2023, at 4:00 p.m. US Eastern Time (or September 21, 2023, at 6:00 a.m. Australian Eastern Time). |

||||

| Meeting attendance: |

Stockholders may attend the annual meeting online at www.virtualshareholdermeeting.com/RMD2023 by using the 16-digit control number included on your notice of internet availability of proxy materials, on your proxy card, or on the voting instruction form provided by your broker, bank, or other nominee.

|

||||

Please read Voting instructions and general information in the proxy statement.

|

|||||

By order of the board of directors,

Michael Rider

Secretary

TABLE OF CONTENTS

| ||

VOTING INSTRUCTIONS AND GENERAL INFORMATION

| ||

Why am I receiving these materials?

ResMed’s board of directors is soliciting your proxy to vote at our 2023 annual meeting of stockholders and any continuation, postponement, or adjournment of the meeting. The meeting is scheduled for Thursday, November 16, 2023, at 12:00 p.m. US Pacific Time, which is Friday, November 17, 2023 at 7:00 a.m. Australian Eastern Time, and will be held virtually at www.virtualshareholdermeeting.com/RMD2023. If you owned shares of our common stock or CHESS Units of Foreign Securities, as of 4:00 p.m. US Eastern Time, on September 20, 2023, we invite you to attend the annual meeting online and vote on the proposals described below under the heading “Voting matters and board recommendations.” You will be able to attend, vote, and submit your questions online from any remote location that has internet connectivity during the annual meeting at www.virtualshareholdermeeting.com/RMD2023 by entering the 16-digit control number included in your Notice of Internet Availability of the proxy materials, on your proxy card, or on the instructions that accompanied your proxy materials.

Why is the meeting being held virtually this year?

We believe that a virtual meeting will provide expanded stockholder access and participation, improved communications, as well as being cost-effective, and environmentally responsible. You will be able to attend, vote, and submit your questions online during the annual meeting. You will not be able to attend the annual meeting in person. Stockholders may attend the annual meeting online at www.virtualshareholdermeeting.com/RMD2023 by using the 16-digit control number included on your notice of internet availability of proxy materials, on your proxy card, or on the voting instruction form provided by your broker, bank, or other nominee.

When are proxy materials available?

We expect to first make this proxy statement available to our stockholders and our holders of Clearing House Electronic Subregister System (CHESS) Units of Foreign Securities, on the internet on or about October 5, 2023, and to mail notice and access materials on or about October 5, 2023.

Important Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting To Be Held on November 16, 2023 (US time)/November 17 (Australian time).

Our annual report on Form 10-K was filed with the US Securities and Exchange Commission (SEC), on August 10, 2023. You can review our 10-K on our website, at investors.resmed.com, and at the website where our proxy materials, including the notice of the annual meeting, this proxy statement and a form of proxy card are posted, at www.proxyvote.com and www.investorvote.com.au.

Please access and review the proxy materials before voting.

Voting Instructions

Voting matters and board recommendations:

| Matter | Vote recommendation | ||||

Proposal 1: Elect the ten nominees identified in this proxy statement to the board of directors

|

FOR each director nominee | ||||

Proposal 2: Ratify selection of independent registered public accountants

|

FOR | ||||

Proposal 3: Advisory vote to approve executive compensation

|

FOR | ||||

Proposal 4: Advisory vote to approve the frequency of future say-on-pay votes

|

ONE YEAR | ||||

Who can vote at the annual meeting?

You are entitled to vote or direct the voting of your ResMed shares if you were a stockholder of record, a beneficial owner of shares held in street name, or a holder of CHESS Units of Foreign Securities, as of 4:00 p.m. US Eastern Time, on September 20, 2023 (or September 21, 2023 at 6:00 a.m. Australian Eastern Time), the record date for our annual meeting. As of the record date, there were 147,085,101 shares of ResMed common stock outstanding, excluding 41,836,232 treasury shares. Treasury shares will not be voted. Each stockholder has one vote for each share of common stock held on the record date. As summarized below, there

1

are some distinctions between shares held of record, those owned beneficially in street name, and those held through CHESS Units of Foreign Securities.

What does it mean to be a stockholder of record?

If, on the record date, your shares of common stock were registered directly in your name with our transfer agent, Computershare, then you are a “stockholder of record.” As a stockholder of record, you are entitled to vote on all matters to be voted on at the annual meeting. Whether or not you plan to attend the annual meeting online, we urge you to vote by the internet at www.virtualshareholdermeeting.com/RMD2023, by telephone, or (if you are reviewing a paper copy of this proxy statement) to fill out and return the proxy card that was included with the proxy statement, to ensure your vote is counted.

What does it mean to beneficially own shares in “street name?”

If, on the record date, your shares of common stock were held in an account at a broker, bank, or other financial institution (we will refer to those organizations collectively as a “broker”), then you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker. The broker holding your account is considered the stockholder of record for purposes of voting at our annual meeting. As the beneficial owner, you have the right to direct your broker on how to vote the shares in your account. The information you receive from the broker will include instructions on how to vote your shares. In addition, you may request paper copies of the proxy statement and voting instructions by following the instructions on the notice provided by your broker.

Your broker is not permitted to vote on your behalf on any matter to be considered at the annual meeting (other than ratifying our appointment of KPMG LLP as our independent registered public accounting firm) unless you specifically vote in accordance with the instructions provided by your broker. We encourage you to communicate your voting decisions to your broker before the deadlines described elsewhere in this proxy statement to ensure that your vote will be counted.

What does it mean to be a holder of CHESS Units of Foreign Securities?

CHESS Units of Foreign Securities are depository interests issued by ResMed through CHESS, and traded on the Australian Securities Exchange, or ASX. The depository interests are frequently called “CUFS”, or “CDIs.” If you own ResMed CUFS or CDIs, then you are the beneficial owner of one share of ResMed common stock for every ten CUFS or CDIs you own. Legal title is held by CHESS Depositary Nominees Pty Limited. CHESS Depositary Nominees is considered the stockholder of record for purposes of voting at our annual meeting. As the beneficial owner, you have the right to direct CHESS Depositary Nominees on how to vote the shares in your account. As a beneficial owner, you are invited to attend the annual meeting, but because you are not a stockholder of record, if you want to vote your shares and/or ask questions in person at the virtual annual meeting, you must request and obtain a valid proxy from CHESS Depositary Nominees giving you that right, and must satisfy the annual meeting admission criteria described below.

You will receive a notice from Computershare allowing you to deliver your voting instructions over the internet. In addition, you may request paper copies of the proxy statement and voting instructions by following the instructions on the notice provided by Computershare.

Under the rules governing CUFS and CDIs, CHESS Depositary Nominees are not permitted to vote on your behalf on any matter to be considered at the annual meeting unless you specifically instruct CHESS Depositary Nominees how to vote. We encourage you to communicate your voting decisions to CHESS Depositary Nominees before the deadlines described elsewhere in this proxy statement to ensure that your vote will be counted. Please refer to the information provided to you by Computershare for more information regarding how to request a proxy or control number in order to vote or ask questions at the virtual annual meeting.

How do I vote my shares before the annual meeting?

If you are a holder of common stock listed on the New York Stock Exchange (NYSE), you may vote before the meeting by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the internet or on a paper copy, and (2) for shares held as a record holder and shares

2

held in “street name.” You may request paper copies of the proxy statement and proxy card by following the instructions on the notice described below.

| Holder | Method of voting | ||||

| Holders of record | If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the internet, you may vote by submitting a proxy over the internet or by telephone by following the instructions on the website referred to in the notice of internet availability of proxy materials previously mailed to you. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating, and signing the proxy card that was included with the proxy statement and promptly returning it in the pre-addressed, postage-paid envelope provided to you, or by using the toll-free number, or by submitting a proxy over the internet using the instructions on the proxy card. | ||||

| Shares held in “street name” | If you hold your shares of common stock in street name, you will receive a notice from your broker with instructions on how to vote your shares. Your broker will allow you to deliver your voting instructions over the internet. | ||||

| Holders of CUFS or CDIs listed on the ASX | If you hold our CUFS or CDIs, you will receive a notice from Computershare, which will allow you to make your voting instructions over the internet. | ||||

Internet voting closes for the following time zones:

•In Australia at 5:00 p.m., November 14, 2023, Australian Eastern Time for holders of CHESS Units of Foreign Securities listed on the ASX.

•In the US at 11:59 p.m., November 15, 2023, US Eastern Time for shares traded on the NYSE.

How do I attend and vote at the annual meeting?

To attend and vote at the annual meeting you need to access the meeting via live audio webcast at www.virtualshareholdermeeting.com/RMD2023 using the 16-digit control number included on your notice, on your proxy card, or on the voting instruction form. Online check-in will begin approximately 15 minutes prior to the scheduled meeting time, and we recommend that you log in to the virtual annual meeting during this timeframe to ensure you are logged in when the meeting starts.

Attendance at the annual meeting will not, by itself, result in any vote or revocation of vote. You must follow the instructions at www.virtualshareholdermeeting.com/RMD2023 to vote your shares at the annual meeting. Even if you intend to attend the annual meeting online, we encourage you to vote before the deadlines described elsewhere in this proxy statement. If you own ResMed CUFS or CDIs, please refer to the instructions provided by Computershare for information regarding how to request a proxy in order to vote your shares at the virtual annual meeting.

What if during the check-in time or during the annual meeting I have technical difficulties or trouble accessing the virtual meeting website?

If you encounter any difficulties accessing the virtual meeting during the check-in or the meeting, please call the technical support number posted on the virtual shareholder meeting log-in page.

Will there be a question and answer session during the annual meeting?

As part of the virtual annual meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during the meeting that are pertinent to ResMed and the meeting matters, as time permits. Only stockholders that have accessed the annual meeting as a stockholder by following the procedures outlined above in “How can I attend and vote at the annual meeting?” will be permitted to submit questions during the annual meeting. If you have questions, you may type them into the dialog box provided at any point during the meeting (until the floor is closed to questions). Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

•irrelevant to the business of ResMed or to the business of the annual meeting;

3

•related to material non-public information of ResMed, including the status or results of our business since our last earnings release;

•related to any pending, threatened or ongoing litigation;

•related to personal grievances;

•derogatory references to individuals or that are otherwise in bad taste;

•substantially repetitious of questions already made by another stockholder;

•in excess of the two question limit;

•in furtherance of the stockholder’s personal or business interests; or

•out of order or not otherwise suitable for the conduct of the annual meeting as determined by the Chair or Secretary in their reasonable judgment.

Additional information regarding the Q&A session will be available in the “Rules of Conduct” available on the virtual shareholder meeting webpage for stockholders that have accessed the annual meeting by following the procedures outlined above in “How can I attend and vote at the annual meeting?”

How can I revoke my proxy or change my vote?

You may revoke your proxy and change your vote at any time before the proxy is exercised by any of the following methods:

| Holder | Method of voting | ||||

| Holders of record and shares held in street name listed on the NYSE |

•Delivering written notice of revocation to our secretary at our principal executive office located at 9001 Spectrum Center Boulevard, San Diego, California 92123 USA;

•Delivering another timely and later dated proxy to our secretary at our principal executive office located at 9001 Spectrum Center Boulevard, San Diego, California 92123 USA;

•Revoking by internet or by telephone before the following times:

In Australia by 5:00 p.m. AU Eastern Time on November 14, 2023, for holders of CHESS Units of Foreign Securities listed on the ASX

In the United States by 11:59 p.m. US Eastern Time on November 15, 2023, for shares traded on the NYSE

•Attending the 2023 annual meeting online and timely voting your shares at www.virtualshareholdermeeting.com/RMD2023. Please note that your attendance at the meeting will not revoke your proxy unless you vote at the meeting.

|

||||

| Holders of CUFS or CDIs listed on the ASX | You must contact the Chess Depository Nominee to obtain instructions on how to revoke your proxy or change your vote. Refer to the instructions provided by Computershare for information regarding how to request a proxy in order to vote your shares at the virtual annual meeting. Please note that your attendance at the meeting will not revoke your proxy unless you vote at the meeting. | ||||

What happens if I return the proxy card to ResMed but do not make specific choices?

If you submit a proxy, we will vote your shares according to your choice. If you submit a proxy but do not make specific choices, we will vote your shares as follows: (1) FOR each of the ten nominees to our board identified in this proxy statement; (2) FOR ratifying our selection of KPMG; (3) FOR approving, on a non-binding, advisory basis, the compensation we paid our named executive officers and (4) ONE YEAR, on a non-binding, advisory basis, as the frequency of future say-on-pay votes .

4

What does it mean if I received more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign, and return each proxy card to ensure that all of your shares are voted.

General information

What are broker non-votes and how are they counted?

If your broker holds your common stock in street name and you have not provided your broker with voting instructions, your broker may vote your shares in its discretion on proposals which NYSE rules consider “routine.” The only proposal considered “routine” in our meeting is the proposal to ratify the selection of our independent registered public accounting firm. If you do not provide direction to your broker for that proposal, your broker may exercise its discretion to vote your shares. The election of directors, the advisory vote on executive compensation, and the advisory vote on the frequency of future say-on-pay votes are not considered “routine”, and brokers do not have discretionary authority to vote on these matters without your direction. You must indicate to your broker how you wish to vote on any non-routine matter with respect to any shares you hold in street name or they will be considered a “broker non-vote.”

Broker non-votes will not affect the outcome of the election of our directors, the advisory vote to approve our executive compensation, or the advisory vote on the frequency of future say-on-pay votes, as these matters are determined based on the number of votes cast and broker non-votes are not considered votes cast.

Your vote is important. Please submit your proxy, or provide instructions to your brokerage firm, bank, or the CHESS Depositary Nominees. This will ensure that your shares are voted at our annual meeting.

How many shares must be present or represented to conduct business at the annual meeting?

A quorum of stockholders is necessary to hold a valid annual meeting. A quorum will be present if a majority of the outstanding shares entitled to vote are represented at our annual meeting. Shares represented by proxies that reflect abstentions or broker non-votes will be counted as shares represented at our annual meeting for purposes of determining a quorum. If there are insufficient votes to constitute a quorum at the time of the annual meeting, we may adjourn the annual meeting to solicit additional proxies.

On the record date, we had outstanding 147,085,101 shares of common stock (excluding treasury shares), the holders of which are entitled to one vote per share. Accordingly, an aggregate of 147,085,101 votes may be cast on each matter to be considered at our annual meeting, and at least 73,542,551 shares must be represented at the meeting to have a quorum.

What is the voting requirement to approve each of the proposals?

Proposal 1 – Directors will be elected by a majority of the votes cast, which means that the number of votes cast “for” a candidate for director must exceed the number of votes cast “against” that candidate. You will have the option to vote "for" "against" or "abstain" for each nominee. Abstentions and broker non-votes do not count as a vote cast either “for” or “against” and will not affect the outcome of the election.

Under our board’s policy, in uncontested elections, an incumbent director nominee who does not receive the required votes for re-election will continue to serve but is expected to tender a resignation to the board. The nominating and governance committee, or another duly authorized committee of the board, will decide whether to accept or reject the tendered resignation, generally within 90 days after the election results are certified. We will publicly disclose the board’s decision on the tendered resignation and the rationale behind the decision.

Proposal 2 – The proposal to ratify our selection of KPMG LLP as our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast. Abstentions do not count as votes cast and thus will not affect the outcome of this proposal. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm, so we do not expect broker non-votes to result from the vote on proposal 2. Any broker non-votes that may result will not affect the outcome of this proposal.

Proposal 3 – The advisory vote to approve our executive compensation (“say-on-pay” vote) requires the affirmative vote of a majority of the votes cast. Abstentions and broker non-votes do not count as votes cast and

5

thus will not affect the outcome of this proposal. As an advisory vote, the results of this vote will not be binding on the board or the company. However, the board values the opinions of our stockholders and will consider the outcome of the vote when making future decisions on our named executive officers’ compensation, and our executive compensation principles, policies, and procedures.

Proposal 4 – The advisory vote on the frequency of future advisory say-on-pay votes requires the affirmative vote of a majority of shares cast. Abstentions and broker non-votes do not count as votes cast and thus will not affect the outcome of this proposal. If none of the frequency alternatives (every one year, two years or three years) receive a majority of the votes cast, we will consider the frequency with the highest number of votes cast “for” by stockholders to be the frequency that has been selected by our stockholders. As an advisory vote, the results of this vote will not be binding on the board or the company. However, the board values the opinions of our stockholders and will consider the outcome of the vote when establishing the actual frequency of future advisory say-on-pay votes.

Who pays the costs of proxy solicitation?

The cost of soliciting proxies will be borne by us. After the original delivery of the notice and other proxy soliciting materials, further solicitation of proxies may be made by mail, telephone, facsimile, electronic mail, and personal interview by our regular employees, who will not receive additional compensation for the solicitation. We will also request that brokerage firms and other nominees or fiduciaries deliver the notice and proxy soliciting material to beneficial owners of the stock held in their names, and we will reimburse them for reasonable out-of-pocket expenses they incur.

How can I see a list of stockholders?

Under Delaware law, a list of stockholders entitled to vote at our annual meeting will be available for ten days before our annual meeting at our principal executive office, located at 9001 Spectrum Center Boulevard, San Diego, California, 92123 USA, between the hours of 9:00 a.m. and 4:00 p.m. US Pacific Time. If you are interested in viewing the list, please contact Investor Relations by email at InvestorRelations@resmed.com.

How will I receive my proxy materials?

We are furnishing proxy materials (proxy statement and annual report on Form 10-K) to our stockholders by the internet, instead of mailing printed copies of proxy materials to each stockholder. Accordingly, we are sending a notice of internet availability of proxy materials to our stockholders of record. If your shares are listed in street name on the NYSE, brokers who hold shares on your behalf will send you their own similar notice. If you hold CUFS or CDIs listed on the ASX, you will receive your notice from Computershare. If you received the notice by mail, you will not automatically receive a printed copy of the proxy materials in the mail. Instead, the notice tells you how to use the internet to access and review this proxy statement, our annual report on Form 10-K, and proxy voting card. The notice also tells you how you may submit your proxy via the internet.

Our proxy materials explain how you may request to receive your materials in printed form on a one-time or ongoing basis. Certain stockholders who have previously given us a permanent request to receive a paper copy of our proxy materials will be sent paper copies in the mail.

6

PROPOSALS

| ||

PROPOSAL 1: ELECTION OF DIRECTORS

| ||

Our bylaws authorize a board of directors with between one and thirteen members, with the exact number to be specified by the board from time to time. Our board currently authorizes ten directors.

As of our last stockholders meeting in November 2022, our board completed its transition to annual elections for all directors.

All of our current directors’ terms expire at this annual meeting. On the nominating and governance committee’s recommendation, our board has nominated each of our current directors for re-election at this annual meeting. The directors to be elected at this annual meeting will hold office until the 2024 annual meeting (and until their successors are elected and qualified) or until the director’s earlier death, disability, resignation, or removal.

We are soliciting proxies in favor of these ten nominees and proxies will be voted for them unless the proxy otherwise specifies. If any nominee becomes unable or unwilling to serve as a director, the proxies will be voted for the election of another person, if any, that the board designates.

Information about the ten nominees for director is set forth below:

| Director | Age as of September 20, 2023 |

Position | ||||||

| Carol Burt | 65 | Director | ||||||

| Jan De Witte | 59 | Director | ||||||

| Karen Drexler | 63 | Director | ||||||

| Michael Farrell | 51 | Chair of the board and chief executive officer | ||||||

| Peter Farrell | 81 |

Founder, chair emeritus and non-executive employee

|

||||||

| Harjit Gill | 58 | Director | ||||||

| John Hernandez | 56 | Director | ||||||

| Richard Sulpizio | 73 | Director | ||||||

| Desney Tan | 47 | Director | ||||||

| Ronald Taylor | 75 | Independent lead director | ||||||

The following biographical information is furnished with regard to our directors as of September 20, 2023.

Nominees for election at our annual meeting to serve for a one-year term expiring at the 2024 annual meeting:

7

|

Carol Burt has served as a ResMed director since November 2013 and is chair of the audit and compliance oversight committees. She is also a member of the nominating and governance committee.

Ms. Burt, principal of Burt-Hilliard Investments since 2008, is a private investor with more than 35 years of experience in corporate governance, operations, strategy, finance, mergers and acquisitions, and investment banking. Since 2013, Ms. Burt has served as a senior advisor and a member of the operating council of Consonance Capital Partners, a New York-based private equity firm focused on investments in the healthcare industry. Ms. Burt serves on the boards of IQVIA Holdings Inc. (NYSE: IQV), a leading global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry, where she chairs the leadership development and compensation committee and is a member of the audit committee; and two private companies, Global Medical Response and WellDyne.

Prior to their sale, Ms. Burt served on the public boards of four NYSE companies: Envision Healthcare, Transitional Hospitals, Vanguard Health Systems, WellCare Health Plans, and private equity-backed KEPRO. Through her public board service, Ms. Burt has served, or currently serves, as chair of audit, compensation, compliance and nominating and governance committees.

Ms. Burt was formerly senior vice president corporate finance and development of WellPoint, Inc. (now Elevance Health, NYSE: ELV) where she was part of the executive team that built WellPoint from a single state health plan to one of the leading health benefits companies in the U.S., at the time ranking in the top 35 Fortune 500 companies. Ms. Burt was responsible for, among other things, corporate strategic planning and execution, mergers and acquisitions, strategic and venture investments, financial planning and analysis, budgeting and forecasting, administrative accounting, treasury and chief investment officer, business information services and corporate real estate management. In addition, WellPoint’s financial services and international insurance business units reported to her.

Before WellPoint, Ms. Burt was senior vice president and treasurer of American Medical Response. Previously, she spent 16 years at Chase Securities, Inc., now JP Morgan Chase & Co (NYSE: JPM), most recently as founder, managing director and head of the Health Care Banking Group.

Ms. Burt is Co-Chair of the Emeritus Trustee program for the Colorado Chapter of The Nature Conservancy. Ms. Burt is a member of Women Corporate Directors, and the International Women’s Forum. Her philanthropic activities focus on mentoring women for leadership positions and environmental causes.

Ms. Burt graduated magna cum laude from the University of Houston, earning a Bachelor of Business Administration.

Ms. Burt’s extensive executive management and board leadership experience in the health insurance, healthcare services, medical technology and financial services industries led the board to the conclusion that she should serve as a director.

|

|||||||

8

|

Jan De Witte has served as a ResMed director since May 2019, and is a member of the audit and compliance oversight committees.

Mr. De Witte has served in a variety of operational and business leadership roles over the past 30 years. Since October 2021, Mr. De Witte has served as president, chief executive officer, and a director of Integra Life Sciences (NASDQ: IART), a global leader in regenerative tissue technologies and neurological solutions. From 2016 to 2021, he served as CEO and, from 2016 through 2021, a member of the board of directors of Barco (EBR: BAR), a global leader in advanced visualization solutions for healthcare, entertainment, and enterprise, with headquarters in Belgium. Before joining Barco in October 2016, Mr. De Witte was an officer of the General Electric Company (NYSE: GE), and CEO of its healthcare division’s software and solutions business. During his 17-year tenure with GE, he worked in management and CEO roles in manufacturing, supply chain, quality/lean six sigma, services, and software solutions, covering business responsibilities across Europe, Middle East, China, Asia-Pacific, and the Americas. While at GE, he and his family lived in Belgium, London, Chicago, Milwaukee, and Paris.

Before GE, Mr. De Witte held operational management positions in supply chain and manufacturing at Procter & Gamble (NYSE: PG) in Europe. He also served as senior consultant with McKinsey & Company serving clients in the airline, process, and high-tech industries across Europe.

Mr. De Witte has served on the board of directors of the Advanced Medical Technology Association (AdvaMed) since March 2022. From 2018 until 2021, Mr. De Witte served as chair of the board of Hangar K, a non-profit innovation and co-creation hub bringing together start-ups, young growth companies and established companies in the Flanders (Belgium) region with the aim to accelerate innovation and growth, with a focus on digital technologies in EdTech and GameTech. Mr. De Witte also served as a board member of the Ghent University (Belgium) from 2018 to 2021.

Mr. De Witte holds a Master of Science degree in electromechanical engineering with Greatest Distinction from the KU Leuven in Belgium, and an MBA from Harvard Business School.

Mr. De Witte’s skills and experience, particularly his 20-plus years of experience in executive management, operations, and software operations; his experience as an operating CEO in the field of medical technology; and his international business experience led the board to the conclusion that he should serve as a director.

|

|||||||

9

|

Karen Drexler has served as a ResMed director since November 2017, and is a member of our compensation and nominating and governance committees.

Ms. Drexler is a serial entrepreneur with expertise in the fields of digital health, medical devices, and diagnostics. Currently, she serves on the boards of Outset Medical (NASDAQ: OM), a medtech company innovating dialysis treatment, where she is a member of both the compensation and nomination and governance committees; Tivic Health, (NASDAQ: TIVC), a bioelectric medicine company focused on relief of congestion and sinus pain, where she chairs the compensation and nomination and corporate governance committees and serves on the audit committee; and EBR Systems, Inc. (ASX: EBR), maker of a wireless cardiac pacing system for people with heart failure, where she chairs the remuneration and governance committee.

Ms. Drexler is also on the board of two private companies: VIDA Diagnostics, the leading company in AI-powered lung intelligence solutions; and Huma.ai, a company using natural language queries to extract unique insights from complex medical data.

From 2016 to 2020, Ms. Drexler was the CEO and a board member of Sandstone Diagnostics, Inc., a private company developing instruments and consumables for point-of-care medical testing. From 2011 to 2017, she served as board chair of Hygieia, Inc., a digital insulin therapy company, and remains an advisor to the CEO. She also acts as a senior strategic advisor for other early-stage companies, and spent 11 years on the board of the Keller Center for Innovation in Engineering Education at Princeton University.

Ms. Drexler is an active mentor and advisor with Astia, a global nonprofit that supports high-potential female founders. She is a founding member of Astia Angels, a network of individual investors who fund such founders, and a lead mentor with StartX, the Stanford University incubator. She is also on the Life Science and Women’s Health Councils for Springboard, an accelerator for women-led technology-oriented companies. Through her work with Astia, Springboard, and StartX, she interacts with many promising young medtech companies.

Ms. Drexler was founder, president, and CEO of Amira Medical Inc., a private company focused on minimally invasive glucose monitoring technology, from 1996 until it was sold to Roche Holding AG in 2001. Before Amira Medical, she held management roles at LifeScan and played a key role in its sale to Johnson & Johnson (NYSE: JNJ).

Ms. Drexler graduated magna cum laude with a B.S.E. in chemical engineering from Princeton University, and earned an M.B.A. with honors from the Stanford University Graduate School of Business.

Ms. Drexler’s executive and board experience in the medical diagnostics and medical device industries, particularly her experience in digital health, technology, and data security, and out-of-hospital care models, led our board to conclude she should serve as a director.

|

|||||||

10

|

Michael “Mick” Farrell has served as ResMed’s CEO and as a ResMed director since March 2013. He was appointed as chair of the board in January 2023. Mr. Farrell joined the company in 2000, serving as president of the Americas region from 2011 to 2013, senior vice president of the global sleep apnea diagnostic and therapeutic business from 2007 to 2011, and various senior roles in marketing and business development.

Before joining ResMed, Mr. Farrell worked in management consulting, biotechnology, chemicals and metals manufacturing at companies including Arthur D. Little, Sanofi Genzyme, Dow, and BHP.

Mr. Farrell has served on the board of directors of the Advanced Medical Technology Association (AdvaMed), an American medical device trade association since April 2015. He joined the board of Zimmer Biomet (NYSE: ZBH), a global provider of implantable musculoskeletal medical devices, and associated robotics and digital health technology in December 2014. Mr. Farrell is a member of two committees at Zimmer Biomet: the quality, technology and regulatory committee, and the compensation and management development committee, of which he is chair. Mr. Farrell also volunteers as a trustee for non-profit organizations: UC San Diego Foundation, Rady Children’s Hospital, and Father Joe’s Villages’ project for the homeless in San Diego, California.

Mr. Farrell holds a Bachelor of Engineering with first-class honors from the University of New South Wales, a Master of Science in chemical engineering from the Massachusetts Institute of Technology (MIT), and an M.B.A. from the MIT Sloan School of Management.

Mr. Farrell's skills, over 23 years of experience with ResMed and over 27 years of experience with healthcare and technology industries provides him with a unique and deep understanding of our operations, technology, and market, and led the board to the conclusion that he should serve as a director. As outlined in the board leadership structure discussion below, the board also believes it is appropriate for Mr. Farrell, as the chief executive officer, to serve as chair of the board of directors.

|

|||||||

11

|

Peter Farrell is ResMed’s founder. He has been a director since ResMed’s inception in June 1989. Dr. Farrell served as CEO from July 1990 until December 2007, and from February 2011 until March 2013. He served as executive board chair from December 2007 until February 2011, and from March 2013 through December 2013. Since January 1, 2014, he has been a non-officer employee of ResMed. Dr. Farrell served as board chair until January 2023, when he became chair emeritus.

Before founding ResMed, Dr. Farrell served as vice president of research and development at various subsidiaries of Baxter International, Inc. (NYSE: BAX), from July 1984 to June 1989, and managing director of the Baxter Center for Medical Research Pty Ltd. from August 1985 to June 1989. From January 1978 to December 1989, he was foundation director of the Graduate School for Biomedical Engineering at the University of New South Wales where he currently serves as a visiting professor and as chair of the UNSW Centre for Innovation and Entrepreneurship. He served on the Visiting Committee of the Harvard/MIT Health Sciences & Technology Program from 1998 through 2018, and currently serves on the MIT Dean of Engineering’s Advisory Council.

Dr. Farrell serves as independent board chair at Arcturus Therapeutics Holdings Inc. (NASDAQ: ARCT)where he is a member of the compensation and nominating and corporate governance committees. He is currently on the board of Evolus, Inc. (NASDAQ:EOLS) where he is a member of the audit and the nominating and governance committees. He currently sits on two faculty advisory boards at the University of California, San Diego: the Rady Business School and the Jacobs Engineering School. He is also chair of WaveGuide, a startup leveraging nuclear magnetic resonance technology. He is on the Board of Trustees of Scripps Research and an active board member of both ProtoStar and Mikroscan. Dr. Farrell’s past board appointments also include director of NuVasive, Inc. (NASDAQ: NUVA) from 2005 through 2018.

Dr. Farrell is a fellow or honorary fellow of several professional bodies. In 2012, he became an elected member of the US National Academy of Engineering and joined the board of trustees of Scripps Research. He was named 2005 U.S. National Entrepreneur of the Year for Health Sciences, 2001 Australian Entrepreneur of the Year, and 1998 San Diego Entrepreneur of the Year for Health Sciences. He has served on the Executive Council of the Division of Sleep Medicine at Harvard Medical School since 1998.

Dr. Farrell has a B.E. in chemical engineering with honors from the University of Sydney, an S.M. in chemical engineering from MIT, a Ph.D. in chemical engineering and bioengineering from the University of Washington, Seattle, and a D.Sc. from the University of New South Wales.

Dr. Farrell’s son, Michael Farrell, is ResMed’s chief executive officer and chair of its board of directors.

Dr. Farrell’s role as our founder and chief executive officer for more than 20 years provides him with a unique and deep understanding of our operations, technology, and industry. In addition, his background reflects significant executive experience with other publicly-held medical technology companies and public company governance experience. These experiences and skills led our board to conclude that he should serve as a director.

|

|||||||

12

|

Harjit Gill has served as a ResMed director since November 2018, and is a member of the audit and compensation committees.

Since February 2019, Ms. Gill has served as CEO of the Asia Pacific Medical Technology Association (APACMed), the first and only regional association to provide a unified voice for the medical device, equipment, and in-vitro diagnostics industry in Asia Pacific.

Since January 2022, Ms. Gill has been a director of Alticor Inc., a private holding company for Amway, a global leader in home, health, and beauty products. Since 2019 she has also been a member of the Innovation Board of Directors at MAS Holdings, one of the largest apparel tech companies in South Asia with over 115,000 people and a presence in 17 countries.

From 2015 to 2016, Ms. Gill served as chief operations and marketing officer for HTC, Taiwan (OTCMKTS: HTCKF). From 1990 to 2015, she worked for Royal Philips (NYSE: PHG) in various roles. From 2012 to 2015, she was executive vice president and chief executive officer for Philips ASEAN & Pacific, based in Singapore, responsible for Healthcare/Lighting and Consumer Lifestyle. From 2009 to 2012, she was senior vice president of International Sales, and from 2006 to 2009, was vice president of Asia for Philips Consumer Lifestyle Products. Before 2006, she held progressive roles in the Netherlands, Hong Kong, Dubai, and Singapore for Consumer Electronics. From 2012 to January 2018, Ms. Gill served as a board member of the National University of Singapore, Entrepreneurship Committee.

From 2012 to 2015, she was a board member of the Singapore International Chamber of Commerce. From 2017 to 2019 she was a member of the board of directors of Apollo Education and Training, a company providing English teaching in Vietnam. From 2014 to 2015 she was a member of the World Economic Forum South East Asia Council and in 2018 she was the Chapter Chair Gold of the YPO Singapore Chapter. From 2016 to 2019, she was an advisor to Delmedica Investments, a Singapore-based company focused on respiratory healthcare and inventors of the X-Halo breath thermometer.

Ms. Gill has a Bachelor of Arts (honors) in combined studies from the University of Manchester.

Ms. Gill’s executive and operational experience and skills led our board to the conclusion that she should serve as a director, particularly her background in consumer healthcare, her international experience, and her broad experience in sales, marketing and operations.

|

|||||||

13

|

John Hernandez has served as a ResMed director since November 2021, and is a member of the compliance oversight committee.

Since 2018, Dr. Hernandez has served as head of health impact at Google (NASDAQ: GOOGL), where he oversees clinical research, health economics and outcomes research. He joined Alphabet in 2016 where he has built and led teams at Verily and Google leveraging artificial intelligence to assist in promoting healthy lifestyles, diagnosing cancer, preventing blindness, among other things.

Since May 2021, Dr. Hernandez has served as a director of Carmat, SA (ALCAR.PA), a French artificial heart company, publicly traded on the Euronext Paris exchange. He is a member of the audit and research and development committees.

Before joining Verily in 2016, Dr. Hernandez was vice president of global health economics and outcomes research at Abbott Laboratories, a medical devices and healthcare company, from 2010 to 2016, and vice president of clinical research and health economics at Boston Scientific Corporation from 2001 to 2010. He has served in research and consulting roles at the RAND Corporation, Quintiles (now IQVIA), PwC and the American Society of Internal Medicine (now ACP).

Dr. Hernandez held teaching and advisory positions with Stanford University from 2015 to 2019, University of Southern California from 2017 to 2019, and University of Washington from 2015 to 2018.

Dr. Hernandez is widely published in scientific journals and lectures frequently on diverse topics including digital health strategy, health policy, health economics, healthcare technology assessment, value-based payments and real-world evidence strategies.

Dr. Hernandez obtained his Bachelor of Arts from the University of North Carolina at Chapel Hill. He received a Master’s degree in health policy and a Doctorate of Philosophy at the RAND Graduate School in Santa Monica, CA.

Dr. Hernandez’ experience in health economics and outcomes research in the medical device and digital health technologies industries led the board to conclude he should serve as a director.

|

|||||||

14

|

Richard “Rich” Sulpizio has served as a ResMed director since August 2005. He is chair of the compensation committee and a member of the audit and nominating and governance committees.

Mr. Sulpizio retired as president and chief operating officer of Qualcomm, Inc. (NASDAQ: QCOM) in 2001. He served on Qualcomm’s board of directors from 2000 until 2007. Mr. Sulpizio joined Qualcomm in 1991 and in 1994, was appointed president of Qualcomm Wireless Business Solutions. Four years later, he became Qualcomm’s president and COO. In 2002, he rejoined Qualcomm to serve as interim president of Qualcomm China and then took the helm of Qualcomm Europe in 2004. He was appointed as president in 2005 of MediaFLO USA, Inc. a wholly-owned subsidiary of Qualcomm, and was chartered with overseeing the development and deployment of MediaFLO technology and bringing multimedia services to the wireless industry. His last assignment, from December 2009 to November 2013, was president and CEO of Qualcomm Enterprise Services (QES), which was sold to a private equity firm.

Before joining Qualcomm, Mr. Sulpizio worked at Unisys Corporation (NYSE: UIS) and Fluor Corporation (NYSE: FLR).

From 2009 through 2018, Mr. Sulpizio served as a director of CA, Inc. (NASDAQ: CA), an information technology management software company. He currently serves as an honorary board member of the advisory board of the University of California San Diego’s Sulpizio Family Cardiovascular Center.

He holds a Bachelor of Arts from California State University, Los Angeles, and a Master of Science in systems management from the University of Southern California.

Mr. Sulpizio’s experience and skills, particularly his experience with high growth technology companies, executive and board experience with software businesses, and international business experience led the board to the conclusion that he should serve as a director.

|

|||||||

15

|

Desney Tan has served as a ResMed director since November 2021. He is a member of the compensation committee.

Since 2021, Dr. Tan has served as vice president and managing director for Health and Life Science R&D at Microsoft (NASDAQ: MSFT). From 2015 to 2021, he was managing director, Microsoft Healthcare, and has worked in various leading research roles since joining Microsoft in 2004.

Since 2007, he has been an affiliate professor of computer science and engineering at the University of Washington Seattle, where he cofounded the National Science Foundation Center for Sensorimotor Neural Engineering and chaired its industry advisory board.

Dr. Tan is a seasoned executive who has built and run multidisciplinary global innovation teams – leveraging expertise in hardware and devices, software development, applied machine learning and artificial intelligence, human-computer interaction, and applied science to make impact in areas such as autonomous navigation, entertainment and consumer products, as well as health and life sciences.

Dr. Tan is the named inventor on more than 100 granted patents, and author of numerous academic publications, on topics relevant to ResMed's long-term strategy, such as artificial intelligence, machine learning, and human-computer interaction. He serves on the board of two private companies: 1910 Genetics, a biotechnology company integrating artificial intelligence, computation, and biological automation to improve drug development; and Artificial, a lab automation company focused on accelerating the pace of life science discoveries. He also serves on the Washington Research Foundation's board of directors: as senior advisor and chief technologist to IntuitiveX, a medical device and life sciences innovation partner and catalyst; and as advisor to Proprio, which is developing an advanced surgical navigation platform.

Dr. Tan is a veteran of the Singapore Armed Forces and achieved the rank of Lieutenant while on active duty from 1996 to 1998, and will continue to serve in the reserves through 2026. He served as battalion security/intelligence officer and platoon commander.

Dr. Tan graduated summa cum laude with a Bachelor of Science in computer engineering from the University of Notre Dame, and earned a Doctorate of Philosophy in computer science form Carnegie Mellon University.

Dr. Tan’s experience in digital health technologies and artificial intelligence, and his current executive position led our board to conclude he should serve as a director.

|

|||||||

16

|

Ronald “Ron” Taylor has served as a ResMed director since January 2005 and as independent lead director since July 2013. He is chair of the nominating and governance committee and a member of the audit and compliance oversight committees.

In 1987, Mr. Taylor founded Pyxis Corporation, a manufacturer of automated drug dispensers for hospitals, where he served as chair, president, and CEO until its purchase by Cardinal Health, Inc., in 1996. For six years before founding Pyxis, Mr. Taylor was responsible for operations and international sales at Hybritech, Inc., a biotechnology company. Before joining Hybritech, he served for 10 years in management roles at Allergan plc (NYSE: AGN), a pharmaceutical company. From 1998 to 2001, he was a general partner at Enterprise Partners Venture Capital.

Mr. Taylor’s past public company board experience includes serving as a director at Allergan from 1994 through 2018. From 1998 through 2014, he served as a member of the Red Lion Hotels governance, compensation, and audit committees. From 2002 until his appointment to the ResMed board in 2005, he served as chair of the ResMed Foundation.

Mr. Taylor has a Bachelor of Arts from the University of Saskatchewan and a Master of Arts from the University of California, Irvine.

Mr. Taylor’s background reflects significant executive and operational experience with publicly-held medical technology and pharmaceutical companies, including experience in evaluating and investing in healthcare companies as a partner in a venture capital firm, and public company governance experience. He has been a director of approximately 20 publicly and privately held companies over the past 27 years. In addition, he has more than 15 years of experience as a member of the Red Lion Hotel’s governance, compensation, and audit committees, and more than 20 years of experience as a member of the Allergan (formerly Watson and Actavis) audit, compensation, and governance committees.

Mr. Taylor’s experience and skills as a public medical technology company CEO, venture capital experience, and board experience, led the board to the conclusion that he should serve as a director. As set forth below in the discussion of board leadership structure, Mr. Taylor also serves as our lead independent director, serving an important role advising our board and our chair of the board.

|

|||||||

| BOARD RECOMMENDATION | ||

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF THE TEN NOMINEES TO THE BOARD OF DIRECTORS. | ||

17

PROPOSAL 2: RATIFICATION OF SELECTION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR ENDING JUNE 30, 2024

| ||

The audit committee has appointed the firm of KPMG LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2024. KPMG has served as our independent registered public accounting firm since 1994. Neither the firm nor any of its members has any relationship with us or any of our affiliates except in the firm’s capacity as our independent registered public accounting firm.

Stockholder ratification of the selection of KPMG LLP as our independent registered public accounting firm is not required by our bylaws or otherwise. However, the board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain KPMG. Even if the selection is ratified, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the audit committee determines that the change would be in our and our stockholders’ best interests.

We expect representatives of KPMG LLP to be present at the meeting. They will be able to make statements if they so desire and to respond to appropriate questions from stockholders.

| BOARD RECOMMENDATION | ||

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE RATIFICATION OF THE SELECTION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2024. | ||

18

PROPOSAL 3: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION (“SAY-ON-PAY”)

| ||

Background

As required by Section 14A of the Securities Exchange Act of 1934, as amended (Exchange Act), we are asking our stockholders to approve, on a non-binding, advisory basis, the compensation of our named executive officers as described in the “Compensation Discussion and Analysis” and “Executive Compensation Tables” sections of this proxy statement. This proposal is commonly known as a “say-on-pay” proposal.

The board has adopted a policy of providing for annual say-on-pay advisory votes and our stockholders have twice (in 2011 and 2017) voted to prefer an annual frequency of these votes. As discussed in Proposal 4 below, the board is recommending that stockholders vote for “ONE YEAR” as the frequency of our future say-on-pay votes. Unless the board modifies its determination on the frequency of future say-on-pay advisory votes, the next say-on-pay advisory vote will be held at our 2024 annual meeting of stockholders.

Because the say-on-pay vote is advisory, it does not bind us. But the board’s compensation committee, which consists entirely of independent directors, values our stockholders’ opinions and considers voting results on the say-on-pay proposal when making its executive compensation decisions.

The board believes that the information in the “Compensation Discussion and Analysis” and “Executive Compensation Tables” sections of this proxy statement demonstrates that our executive compensation programs are designed appropriately, emphasize pay for performance, and are working to ensure that management’s interests are aligned with our stockholders’ interests to support long-term value creation. The board is asking our stockholders to approve the following advisory resolution at the annual meeting:

“RESOLVED, that the stockholders of ResMed approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in the Compensation Discussion and Analysis and Executive Compensation Tables sections of this proxy statement.”

| BOARD RECOMMENDATION | ||

| YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF RESMED’S NAMED EXECUTIVE OFFICERS. | ||

19

|

PROPOSAL 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE SAY-ON-PAY VOTES

| ||

Background

As required by Section 14A of the Exchange Act, we are asking our stockholders to vote, on an advisory basis, to hold an advisory stockholder vote on the compensation of our named executive officers every year. We are providing stockholders the option of selecting a frequency of one, two, or three years, or abstaining. At our 2017 stockholders' meeting, a majority of our stockholders elected to hold the say-on-pay vote every year.

The board currently plans to hold an advisory say-on-pay vote every year. We believe it is appropriate and important to provide our stockholders with the opportunity to have input in our executive compensation programs on a regular basis. As a result, the board believes that annual voting provides the greatest opportunity for review and accountability for our executive compensation program.

Although this “frequency” vote is advisory and not binding on the board, we appreciate and value the opinions of our stockholders and will evaluate the ultimate outcome of the advisory vote when establishing the actual frequency of future advisory votes by stockholders on executive compensation.

The board recommends that future say-on-pay votes occur every year until the next advisory vote on the frequency of future say-on-pay votes. Stockholders are not being asked to approve or disapprove the board’s recommendation, but rather to demonstrate their choice among the following frequency options: one year, two years, or three years, or to abstain from voting. If none of the frequency alternatives – one year, two years, or three years – receives a majority of the votes cast, we will consider the highest number of votes cast by stockholders to be the frequency that has been selected by stockholders.

After this year's vote, we expect to conduct another advisory vote on the frequency of say-on-pay votes in 2029.

|

BOARD RECOMMENDATION YOUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS SELECT “ONE YEAR” AS THE FREQUENCY OF FUTURE SAY-ON-PAY VOTES. | ||

20

COMPANY INFORMATION

| ||

CORPORATE GOVERNANCE

| ||

Board independence

Our board has determined that of our ten current directors, eight: Carol Burt, Jan De Witte, Karen Drexler, Harjit Gill, John Hernandez, Richard Sulpizio, Desney Tan, and Ronald Taylor, are independent members of our board under the listing standards of the NYSE, and they and their respective family members have no material relationship with us, commercial or otherwise, that would impair the director’s independence.

The board determined that each member of the audit, compliance oversight, nominating and governance, and compensation committees is independent under the NYSE’s listing standards, and that each member of the audit committee and compensation committee meets the additional standards for independence for audit committee and compensation committee members, as applicable, imposed by the SEC’s regulations and the NYSE's listing standards. The board determined that based on their employment with the company, Peter Farrell and Michael Farrell are not deemed independent: Michael Farrell is an executive officer; while Peter Farrell is a current non-executive employee and the father of Michael Farrell.

There were no specific relationships or transactions that required consideration by our board in making its independence decisions. However, the board did consider the tenure of individual directors, and concluded that none of them impaired independence.

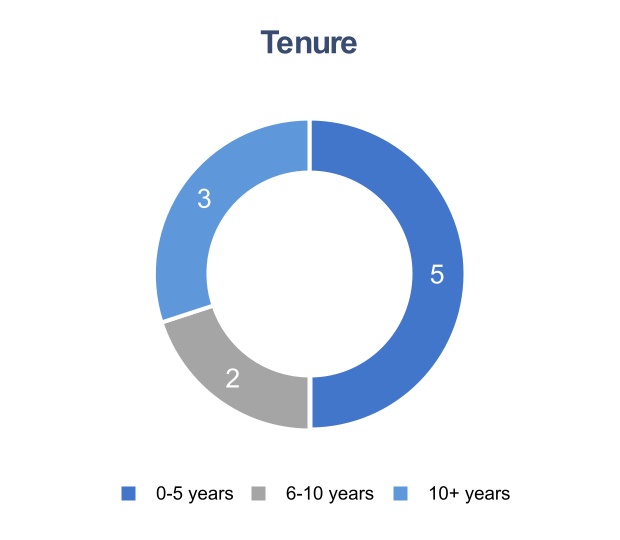

Tenure and board refreshment. The nominating and governance committee believes board composition and an appropriate balance of board refreshment and experience is important to effective governance.

The board believes the independent directors represent an appropriate balance of tenure. Six of our eight independent directors have been on the board for ten years or less. Two of our eight independent directors and nominees are long-tenured: Richard Sulpizio and Ronald Taylor each joined our board in 2005, and so have each served for about 18 years. The board considers that the length of their tenure has not compromised their independence; in fact, in the board’s view, the depth of their knowledge and insight with the company has strengthened their independence and contributions to our board. Moreover, their tenure and experience balance the relatively lower tenure and experience of the other independent directors. The average tenure of all our other independent directors is six years, and the average tenure of all our independent board members is only eight years.

The board follows a process of regularly reviewing board composition and board refreshment, with a long-term perspective. The nominating and governance committee reviews and regularly updates a matrix of directors’ skill sets, based on factors the board deems important to oversee management and our strategic goals. The committee makes recommendations to the board regarding plans for director succession. In each of fiscal years 2018, 2019, and 2020, a long-tenured board member left our board and was replaced. In fiscal year 2022, the board nominated, and shareholders elected, two new independent directors with uniquely valuable skill sets. During fiscal year 2023, Peter Farrell stepped down as board chair, and our board elected Michael Farrell to serve as chair of the board. The board also designated Peter Farrell as chair emeritus to recognize his distinguished contributions during his more than 33 years of service as chair since founding the company.

While refreshment is an important consideration in assessing board composition, the board does not make determinations based solely on tenure.

Board composition

Our board believes that its composition appropriately reflects the knowledge, experience, skills, diversity, and other characteristics required to fulfill its duties.

21

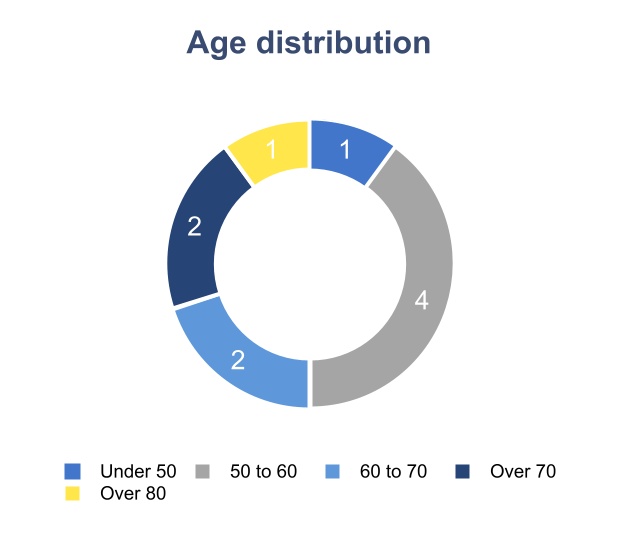

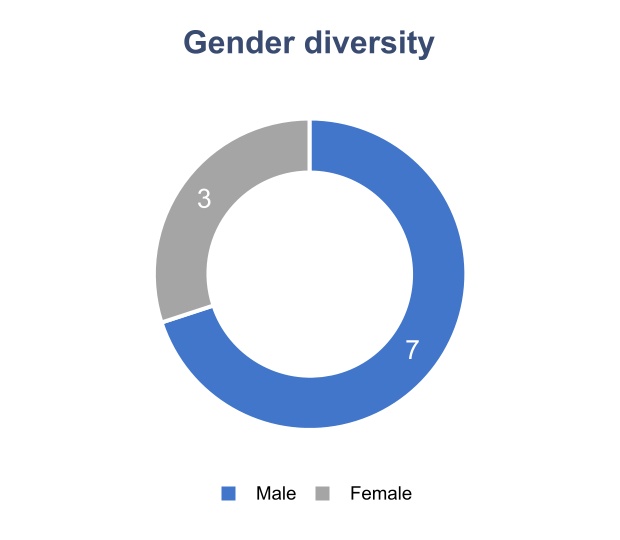

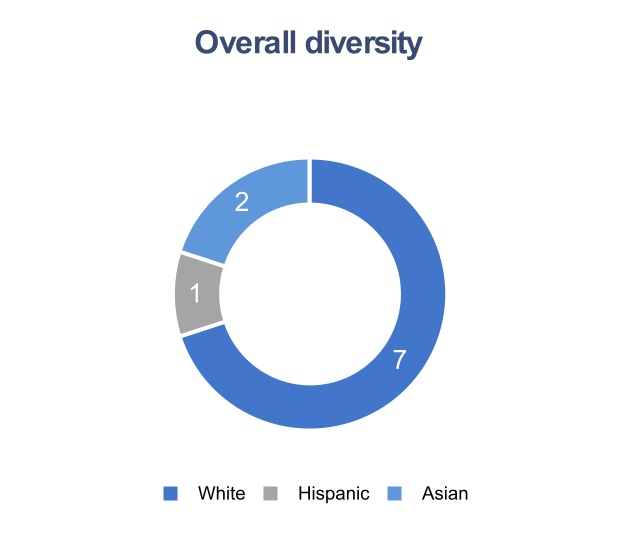

The following tables provide information regarding the age, gender, tenure and overall diversity of our nominees for election:

22

The nominees have diverse backgrounds and perspectives that enable them to provide valuable guidance on strategy and operations. They have extensive leadership experience, as well as corporate governance expertise arising from service on other boards of directors. Many have global business experience, including through service as CEO or in other senior corporate leadership positions involving management of complex operations, business challenges, risks, and growth. One currently resides and works outside the U.S., and several others have done so in the past, providing valuable perspectives on our global business environment. All have experience with medical device, technology or product innovation and development, entrepreneurship, and the dynamics of our industry. Our most recently elected directors have extensive expertise in digital health technology. All have demonstrated involvement in their communities, having contributed to social causes through nonprofit organizations or philanthropy.

Our board of directors benefits from these qualifications, as well as the perspectives of directors with in-depth knowledge of ResMed through their current or former service as executive officers.

Meetings and director attendance

During fiscal year 2023, each director attended more than 75% of the meetings of our board and of the committees on which the director served. Our board and standing committees met, as follows:

•Board: seven meetings;

•Compensation committee: five meetings;

•Audit committee: eight meetings;

•Compliance oversight committee: four meetings; and

•Nominating and governance committee: five meetings.

During each regular board meeting, our independent directors met alone, and our lead director chaired those sessions. In addition to meetings, the members of our board and its committees sometimes act by written consent in lieu of a meeting, as permitted under Delaware corporate law, or discuss company business without calling a formal meeting.

All our directors were present for our 2022 annual stockholders meeting. We encourage directors to attend our annual meetings and we generally schedule board meetings to coincide with the annual meeting to facilitate directors’ attendance.

Environmental social and governance matters

Information about our ESG initiatives can be found at https://investors.resmed.com/investor-relations/about-us/Corporate-Citizenship-at-ResMed/default.aspx, including our current report on environment, social, and corporate governance issues. The report highlights our commitment to ESG standards including:

•Our products

•Environment

•Our people

•Health and wellbeing; and

•Community.

Our Products:

Our core mission is to improve people’s health and wellbeing by providing innovative and high-quality products and services for sleep apnea, COPD, asthma, and other chronic conditions, as well as to help streamline the process of aiding and managing consumers of out-of-hospital care services such as skilled nursing, life plan care, or home health and hospice services. This focus on product quality and innovation is reflected not only in the high regard our customers have for our products and services but in our vigilance in meeting our safety and marketing obligations. We have a strong track record of quality, innovation and continuous improvement and our quality management system guides our employees’ and suppliers operations to ensure our products are designed, manufactured, and distributed to meet patient needs and performance requirements.

23

Environment:

We operate our business efficiently and responsibly while always striving to reduce our environmental footprint throughout our business operations and supply chain. We are committed to working with our employees, suppliers, and customers to eliminate unnecessary waste in all our systems and processes, minimize pollution, decarbonize our operations, design and develop innovative products with reduced impact on the environment throughout their lifecycle, monitor our environmental performance, continually make improvements, and fulfill our compliance obligations. Specifically, we are focused on energy efficiency, managing our electricity consumption, greenhouse gas emissions, sustainable design and packing, improving waste and recycling, water stewardship and the use of paper.

Our People:

We are committed to building and fostering an extraordinary culture of belonging, inclusion, and diversity, where every ResMedian does their best work to help millions of people live healthier and higher-quality lives. We are committed to diversity and inclusion, people development, recruitment excellence, employee engagement and listening, work-life balance and flexible working, fair, equitable and competitive compensation and benefits, and employee consultation.

Health and Wellbeing:

We recognize the benefits of a healthy workforce and adopt a holistic approach to the health and safety of our people. We provide onsite support for employee fitness when possible, for example at our major campuses in Sydney, San Diego, and Singapore. We offer employee health and wellbeing programs that may variously include on-site blood pressure, cholesterol, and heart testing. Programs may include seasonal flu vaccinations, subsidized quit-smoking programs, screening for sleep apnea, confidential third-party counseling and referrals on stress and mental health issues, support for a gym membership, and in some jurisdictions, company-sponsored private health insurance.

Community:

Our community contributions reflect our mission to improve millions of lives worldwide through the treatment of chronic diseases like sleep apnea, COPD, asthma, and other chronic diseases, plus improved management of consumers benefiting from out-of-hospital care. We work with “healthcare ecosystem” participants to create opportunities that enable access to the care, technology, and services needed for all people at the right time. This means we conduct relevant research, engage with and support communities as a trusted partner through unwavering commitment. Our contributions to our local communities are made in both monetary contributions and the time and championship of our employees.

Governance changes during fiscal year 2023

Our board of directors welcomes feedback from stockholders on our governance practices and policies, board composition, executive compensation framework, and other matters related to our strategy and performance. During fiscal year 2023, we continued discussions with our stockholders and received valuable feedback. Our board also routinely reviews developing best practices, considering input from stockholders, management, external legal and financial advisors, stockholder advisory firms, and other relevant sources. As part of that regular practice, we adopted changes in our governance practices, including:

•Annual director elections. We completed the declassification of our board during fiscal year 2023. At the November 2022 stockholders' meeting, all board members were elected to annual terms, and will continue to be elected annually going forward.

•Compensation recovery policy. In August 2023, after consulting with advisors, we adopted a new policy on recovering compensation paid to our executive officers in compliance with the new NYSE listing standards and SEC rules, as well as to reflect the ongoing development of best practices in this area. As required by SEC and NYSE rules, the new compensation recovery policy requires mandatory recovery of incentive compensation in the event of financial restatements to correct material errors in prior periods and also immaterial errors in previously reported periods to avoid a material error in the current period, regardless of fault. Our revised policy also provides for the

24

mandatory recovery of time-based equity awards, including stock options. The new policy replaces our 2017 compensation recovery policy and is effective October 2, 2023.

Board oversight of risk

The general risk oversight function, including with respect to ESG issues and cybersecurity, is retained by the full board; the standing committees of the board, comprised and chaired by our independent directors, retain primary responsibility for risk identification and analysis in the key areas further identified below. The committees periodically update the board about significant risk management issues and management’s response.

| Committee | Primary risk oversight responsibility | ||||

| Audit | Overseeing financial risk, capital risk, financial compliance risk, code of conduct, ethics and legal compliance, and internal controls over financial reporting. | ||||

| Compensation | Overseeing our compensation philosophy and practices and evaluating the balance between risk-taking and rewards to senior officers. | ||||

| Compliance oversight | Overseeing compliance with United States federal healthcare laws and regulations, and specifically obligations under the corporate integrity agreement we reached in 2019. | ||||

| Nominating and governance | Evaluating each director’s independence, evaluating the effectiveness of our corporate governance guidelines, and overseeing management’s succession planning. | ||||

Designated internal management, as well as certified professional accounting firms performing annual internal audits, regularly review and test functions, controls and processes to review, evaluate and recommend mitigation strategies, as may be warranted. Critical areas of focus include financial, operational, regulatory, compliance, economic, compensation, privacy, cybersecurity, and competition, among others.

ESG Oversight. The full board is responsible for general oversight of our environmental, social, governance, and sustainability strategy. We have designated a cross-functional management team to execute our ESG programs, and during fiscal year 2023, the board reviewed our ESG strategy and progress with members of this team, as well as independent outside advisors during multiple meetings. The nominating and governance committee specifically oversees our corporate governance programs.

Cybersecurity Oversight. The full board is responsible for general oversight of our cybersecurity program. Our full board meets regularly with our chief information security officer, chief privacy officer, and other executives responsible for strategy and execution of our cybersecurity and data privacy programs. At our August 2023 board meeting each of our independent directors attended a full day of cybersecurity training, including the new SEC disclosure requirements, and the use of AI in our products, from our chief information security officer, our chief privacy officer, and outside experts.

Information about our cybersecurity and privacy initiatives can be found at https://investors.resmed.com/investor-relations/about-us/Corporate-Citizenship-at-ResMed/default.aspx and in our 2022 Report on Environmental, Social & Corporate Governance (ESG) topics.

Board leadership structure

Our nominating and governance committee and board evaluates, considers, and discusses our board leadership structure annually. During fiscal year 2023, acting on the recommendation of our nominating and governance committee, our board decided to change the current board leadership structure such that one person will serve as board chair and chief executive officer. As a result, Peter Farrell ceased serving as our chair of the board, a role he had held since 1989, and was given the title of chair emeritus to recognize his distinguished service in that role.

In making its decision, the board concluded that having Michael Farrell serve as chair of the board and chief executive officer is the most appropriate leadership structure for us and in the best interests of our stockholders

25

at this time. Combining the two roles is more efficient, creates clear lines of authority, and is consistent with the prevailing practice among medical equipment companies in the S&P 500.