DEF 14A: Definitive proxy statements

Published on October 16, 2003

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

ResMed Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of ResMed Inc., at 3:00 p.m. local time, on Thursday, November 13, 2003, in the Lyceum Theatre of Wesley Conference Centre Compendium, located at 220 Pitt Street, Sydney NSW, Australia.

Information about the business of the meeting, the nominees for election as directors and other proposals is set forth in the Notice of Meeting and the Proxy Statement, which are attached. This year you are asked to elect two Directors of the Company, to approve the ResMed Inc. Employee Stock Purchase Plan, approve an increase in the maximum aggregate directors fees payable to the non-executive members of our Board of Directors, and to ratify the selection of our independent auditors for fiscal year 2004.

Very truly yours,

Peter C. Farrell

Chairman and Chief Executive Officer

RESMED INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOVEMBER 13, 2003

The 2003 Annual Meeting of Shareholders of ResMed Inc. will be held in the Lyceum Theatre of Wesley Conference Centre Compendium, located at 220 Pitt Street, Sydney NSW, Australia, on November 13, 2003, at 3:00 p.m. local time for the following purposes:

| 1. | To elect two directors, each to serve for a three-year term; |

| 2. | To approve the 2003 Employee Stock Purchase Plan, under which an aggregate of 3,250,000 shares would be available for issuance; |

| 3. | To approve an increase in the maximum aggregate amount of directors fees that may be paid in any fiscal year to all non-executive directors, as a group, from current payments of $50,000 to a maximum aggregate amount not to exceed $400,000 during any fiscal year; |

| 4. | To ratify the selection of KPMG LLP as our independent auditors to examine our consolidated financial statements for the fiscal year ending June 30, 2004; and |

| 5. | To transact such other business as may properly come before the meeting. |

Please refer to the accompanying proxy statement for a more complete description of the matters to be considered at the meeting. Only shareholders of record at the close of business on September 15, 2003, will be entitled to notice of, and to vote at, the 2003 Annual Meeting and any adjournment thereof.

In accordance with the Australian Stock Exchange, the Company will disregard any votes cast in resolution 3 by a director of the Company or an associate of a director of the Company. However, the Company need not disregard a vote if it is cast by a person as proxy for a person who is entitled to vote in accordance with the direction on the proxy form; or if it is cast by the person chairing the meeting as proxy for a person who is entitled to vote in accordance with a direction on the proxy form to vote as the proxy decides.

It is important that your shares be represented at the annual meeting. Even if you plan to attend the annual meeting in person, please sign, date and return your proxy form in the enclosed envelope as promptly as possible. This will not prevent you from voting your shares in person if you attend, but will make sure that your shares are represented in the event that you cannot attend.

Please sign, date and return the enclosed proxy promptly in the envelope provided, which requires no United States postage.

By Order of the Board of Directors,

David Pendarvis,

Secretary

Dated: October 13, 2003

RESMED INC.

PROXY STATEMENT

Annual Meeting of Shareholders to be held November 13, 2003

General

The enclosed proxy is solicited on behalf of the Board of Directors of ResMed Inc. for use at the 2003 Annual Meeting of Shareholders to be held at 3:00 p.m. on Thursday, November 13, 2003, in the Lyceum Theatre of Wesley Conference Centre Compendium, located at 220 Pitt Street, Sydney NSW, Australia, and at any and all adjournments and postponements thereof for the following purposes:

| 1. | To elect two directors, each to serve for a three-year term; |

| 2. | To approve the 2003 Employee Stock Purchase Plan, under which an aggregate of 3,250,000 shares would be available for issuance; |

| 3. | To approve an increase in the maximum aggregate amount of directors fees that may be paid in any fiscal year to all non-executive directors, as a group, from current payments of $50,000 to a maximum aggregate amount not to exceed $400,000 during any fiscal year; |

| 4. | To ratify the selection of KPMG LLP as our independent auditors to examine our consolidated financial statements for the fiscal year ending June 30, 2004; and |

| 5. | To transact such other business as may properly come before the meeting. |

The enclosed proxy may be revoked at any time before its exercise by giving written notice of revocation to our Secretary at our principal executive offices located at 14040 Danielson Street, Poway, CA 92064, U.S.A. You may also revoke your proxy and change your vote by voting in person at the meeting. Please note that your attendance at the meeting will not constitute a revocation of your proxy unless you actually vote at the meeting.

The shares represented by proxies (in the form solicited by the Board of Directors) received by us before or at the meeting will be voted at the meeting. If a choice is specified on the proxy with respect to a matter to be voted upon, the shares represented by the proxy will be voted in accordance with that specification. If no choice is specified, the shares will be voted as stated below in this proxy statement.

We expect to first mail this proxy statement and the accompanying form of proxy to our shareholders on or about October 14, 2003. Our Annual Report to Shareholders for Fiscal 2003 is enclosed with this proxy statement along with a copy of our Annual Report to the Securities and Exchange Commission on Form 10-K, but those reports do not form a part of the proxy soliciting material. The cost of soliciting proxies will be borne by us. Following the original mailing of the proxy soliciting material, further solicitation of proxies may be made by mail, telephone, facsimile and personal interview by our regular employees, who will not receive additional compensation for such solicitation. We will also request that brokerage firms and other nominees or fiduciaries forward copies of the proxy soliciting material, Form 10-K and the 2003 Annual Report to beneficial owners of the stock held in their names, and we will reimburse them for reasonable out-of-pocket expenses incurred in doing so.

Voting Securities and Voting Rights

Only recordholders of our common stock as of the close of business on September 15, 2003 (the record date) are entitled to receive notice of and to vote at the meeting. At the record date we had 33,847,386 outstanding shares of common stock, the holders of which are entitled to one vote per share. Accordingly, an aggregate of 33,847,386 votes may be cast on each matter to be considered at the meeting.

Holders of our Chess Units of Foreign Securities (CUFS) vote by directing the CHESS nominee how to vote the shares of our common stock underlying their CUFS holdings using the form of proxy provided to them by the CHESS nominee. If you hold your shares in street name you must use the legal proxy sent by your broker in order to vote at the meeting. Holding shares in street name means your ResMed shares are held in an account at a brokerage firm or bank or other nominee holder and the stock certificates and record ownership are not in your name. We encourage you to provide instructions to your brokerage firm or CHESS nominee, as applicable, by completing the proxy that it sends to you. This will ensure that your shares are voted at the meeting.

In order to constitute a quorum for the conduct of business at the meeting, a majority of the outstanding shares entitled to vote at the meeting must be represented at the meeting. Shares represented by proxies that reflect abstentions or broker non-votes (street name shares held by a broker or nominee which are represented at the meeting, but with respect to which such broker or nominee is not empowered to vote on a particular proposal) will be counted as shares represented at the meeting for purposes of determining a quorum.

Common Stock Ownership of Principal Shareholders and Management

The following table shows the number of shares of common stock which, according to information supplied to us, are beneficially owned as of the record date by (1) each person who, to our knowledge based on Schedules 13G filed with the SEC and substantial Shareholder Notices filed with the ASX, is the beneficial owner of more than five percent of our outstanding common stock, (2) each person who is currently a director, two of whom are also nominees for election as directors, (3) each of the Named Officers as defined on page 5 hereof, and (4) all current directors and executive officers as a group. As used herein, beneficial ownership means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (that is, the power to dispose of, or to direct the disposition of, a security). A person is deemed, as of any date, to have beneficial ownership of any security that the person has the right to acquire within 60 days after that date.

| Name of Beneficial Owner(1) |

Amount and Nature of Beneficial Ownership(2) |

Percent of Outstanding Common Stock |

|||

| William Blair & Company 222 West Adams Street Chicago, IL 60606 |

3,234,792 | (3) | 9.5 | ||

| Peter C. Farrell |

1,261,935 | (4) | 3.7 | ||

| Christopher G. Roberts |

378,334 | (5) | 1.1 | ||

| Gary W. Pace |

169,333 | (6) | 0.5 | ||

| Michael A. Quinn |

136,667 | (7) | 0.4 | ||

| Donagh McCarthy |

132,667 | (8) | 0.4 | ||

| Christopher Bartlett |

29,667 | (9) | 0.1 | ||

| Louis A. Simpson |

54,200 | (10) | 0.1 | ||

| Curt Kenyon |

17,054 | (11) | 0.0 | ||

| Adrian Smith |

63,334 | (12) | 0.1 | ||

| David Pendarvis |

6,000 | (13) | 0.0 | ||

| All current executive officers and directors as a group (11 persons) |

2,107,191 | (14) | 6.2 | ||

2

| (1) | The address of the directors, officers and ex-officers listed in this table is 14040 Danielson Street, Poway, California, 92064-6857. |

| (2) | Except for the information based on Schedules 13F or 13G as indicated in these footnotes, beneficial ownership is stated as of September 15, 2003, and includes shares subject to options exercisable within 60 days after September 15, 2003. Shares subject to options are deemed beneficially owned by the person holding the options for the purpose of computing the percentage of ownership of that person but are not treated as outstanding for the purpose of computing the percentage of any other person. |

| (3) | Based on information provided by William Blair & Company on the record date, William Blair & Company has shared dispositive power and shared voting power and beneficial ownership over these shares. |

| (4) | Includes 236,367 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (5) | Includes 5,800 shares held by his wife, 280,200 shares held of record by Cabbit Pty Ltd and 34,000 shares held by Acemed Pty Ltd, two Australian corporations controlled by Dr. Roberts and his wife. Includes 58,334 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (6) | Includes 47,500 shares that are indirectly held in a variable forward sales contract with Credit Suisse First Boston and 36,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (7) | Includes 48,367 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (8) | Includes 120,667 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (9) | Includes 28,667 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (10) | Includes 25,000 shares held in a trust, 4,000 shares owned by his wife and 7,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (11) | Includes 8,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (12) | Comprised solely of options exercisable within 60 days after September 15, 2003. |

| (13) | Includes 5,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 15, 2003. |

| (14) | Includes, in addition to the shares described in notes 4 through 13 above, 47,667 shares of common stock that may be acquired on the exercise of options by the executive officers not named in the table. |

The information presented is based on the knowledge of management and, in the case of the named individuals, on information furnished by them.

Executive Officers

Our executive officers, as of September 15, 2003 were:

| Name |

Age |

Position |

||

| Peter C. Farrell |

61 | Chief Executive Officer and Chairman of the Board of Directors | ||

| Christopher G. Roberts |

49 | Executive Vice President; Director | ||

| Kieran T. Gallahue |

40 | President and Chief Operations Officer, Americas | ||

| Adrian M. Smith |

39 | Vice President, Finance and Chief Financial Officer | ||

| Klaus Schindhelm |

50 | Senior Vice President, Operations | ||

| David Pendarvis |

44 | Vice President, Global General Counsel, and Secretary |

For a description of the business background of Drs. Farrell and Roberts, see Matters to be Acted on/Election of Directors.

Adrian Smith has been Chief Financial Officer since February 1995. From January 1986 through January 1995, Mr. Smith was employed by Price Waterhouse, specializing in the auditing of listed public companies in the medical and scientific field. Mr. Smith holds a B.Ec. from Macquarie University and is a Certified Chartered Accountant.

Klaus Schindhelm, Ph.D., has been Senior Vice President of Operations since October 2001. From January 2000 to October 2001 Dr. Schindhelm was our Vice President, Operations. Dr. Schindhelm

3

was Vice President, Product Development, from July 1998 to December 1999. From January 1995 to June 1998 Dr. Schindhelm was Professor and Head, Graduate School of Biomedical Engineering, University of New South Wales and from January 1990 to August 1994, Director, Centre for Biomedical Engineering, University of New South Wales. Before that Dr. Schindhelm held various academic positions in Biomedical Engineering at the University of New South Wales. Dr. Schindhelm received a B.E. and a Ph.D. in Chemical Engineering from the University of New South Wales.

David Pendarvis has been Vice President, Global General Counsel since September 2002 and Corporate Secretary from February 2003. From September 2000 until September 2002 Mr. Pendarvis was a partner in the law firm of Gray Cary Ware & Freidenrich LLP where he specialized in intellectual property and general business litigation. Until September 2000 he was a partner with Gibson, Dunn & Crutcher LLP, where he began working in 1986. From 1984 until 1986 he was a law clerk to the Hon. J. Lawrence Irving, U.S. District Judge, Southern District of California. Mr. Pendarvis holds a B.A. from Rice University, and a J.D., cum laude, from the University of Texas School of Law.

Kieran T. Gallahue has been President and Chief Operating Officer of the Americas since January 2003. Before joining ResMed Mr. Gallahue served as President of Nanogen, Inc., a San Diego-based DNA research and medical diagnostics company. Mr. Gallahue also held the roles of Chief Financial Officer and Vice President of Strategic Marketing for Nanogen. From 1995 to 1997 he served as Vice President of the Critical Care Business Unit for Instrumentation Laboratory, or IL, where he was responsible for worldwide strategic sales and marketing, and research and development efforts for this business unit. From 1992 to 1995 he held a variety of sales and marketing positions within IL. In addition, Mr. Gallahue held various marketing and financial positions within Procter & Gamble and the General Electric Company. Mr. Gallahue holds a B.A. from Rutgers University and an M.B.A. from Harvard Business School.

Curt Kenyon was Senior Vice President, Telemedicine and Informatics Services from August 2002 until February 2003. From 1999 to 2002 he was Senior Vice President, Sales and Marketing for the United States, Canada and Latin America. From 1997 to 1999 he held the position of Vice President, U.S. Sales. Between 1995 and 1997 he was the Director of U.S. Sales and between 1994 and 1995 he held the position of Eastern Region Sales Manager. Before his employment with us Mr. Kenyon was a Regional Sales Manager for EMPI Inc. and Medtronic, both of Minneapolis, MN. Mr. Kenyon holds a B.A. in Design and Planning with a concentration in Business Administration from State University of New York at Buffalo, where he was a cum laude graduate.

Recent Changes in Executive Officers

On August 21, 2002 Dana Voien was appointed Senior Vice President, New Business, Marketing and Clinical Education and Clinical Affairs and replaced Dr. Deirdre Stewart as an Executive Officer of the Company. In February 2003 Dana Voien moved to the new position of Senior Vice President, Telemedicine and Channel Management. He ceased to be an Executive Officer of the Company on May 17, 2003.

On September 1, 2002 David Pendarvis was appointed Vice President, Global General Counsel and an Executive Officer of the Company. Norman DeWitt, ResMeds former General Counsel and former Executive Officer, retired from full-time employment with ResMed in December 2002. On February 17, 2003 Mr. Pendarvis was also appointed Corporate Secretary of the Company replacing Mr. Walter Flicker. Mr. Flicker ceased to be an Executive Officer of the Company on August 11, 2003.

On January 13, 2003 Kieran Gallahue was appointed President and Chief Operating Officer of the Americas and an Executive Officer of the Company, reporting directly to Dr. Peter Farrell, Chairman and Chief Executive Officer.

4

On February 28, 2003, Curt Kenyon, named in the table below, ceased being an Executive Officer. Mr. Kenyon resigned from the company on July 15, 2003.

Executive Compensation

The following table sets forth certain information regarding the annual and long-term compensation paid for services rendered to us in all capacities for the fiscal years ended June 30, 2003, 2002 and 2001 of those persons who were at June 30, 2003 (1) the chief executive officer, (2) one of the four other most highly compensated executive officers whose annual salary and bonuses exceeded $100,000 or (3) any other executive officer who would have qualified under sections (1) or (2) of this paragraph but for the fact that the individual was not serving as an executive officer at the end of the 2003 fiscal year (collectively, the Named Officers).

Summary Compensation Table

| Name and Principal Position |

Fiscal Year |

Annual Compensation |

Long Term Compensation Awards |

|||||||||

| Salary ($) |

Bonus ($) |

Other Annual Compensation ($)(1) |

Securities Underlying Options |

All Other ($)(2) |

||||||||

| Peter C. Farrell President and Chief Executive Officer |

2003 2002 2001 |

392,375 365,000 330,000 |

244,935 213,399 228,055 |

0 0 18,375 |

60,000 80,000 80,000 |

8,272 11,000 5,100 |

||||||

| Christopher G. Roberts Executive Vice President |

2003 2002 2001 |

220,125 172,800 129,092 |

128,106 75,821 69,819 |

0 0 0 |

15,000 20,000 20,000 |

20,083 13,824 9,651 |

||||||

| Curt Kenyon Senior Vice President, Telemedicine and Informatics |

2003 2002 2001 |

168,750 165,000 150,000 |

68,947 83,217 78,083 |

5,400 7,200 7,200 |

5,000 12,000 13,500 |

5,848 10,390 5,100 |

||||||

| David Pendarvis(3) Vice President, General Counsel and Secretary |

2003 | 166,667 | 151,675 | 0 | 30,000 | 140 | ||||||

| Adrian Smith Vice President and Chief Financial Officer |

2003 2002 2001 |

161,425 106,532 73,263 |

98,477 45,848 40,838 |

0 3,527 13,851 |

10,000 15,000 12,000 |

14,800 8,777 6,111 |

||||||

| (1) | Represents cash value of company-provided vehicle. |

| (2) | For fiscal 2003, includes term life insurance premiums paid on behalf of Messrs. Roberts and Smith in the amounts of $272 each; $140 for Mr. Pendarvis; $2,772 for Peter Farrell; and $348 for Curt Kenyon; the remainder represents Company contributions to defined contribution plans. |

| (3) | Mr. Pendarvis joined the Company in September 2002. |

5

Stock Options

The following table sets forth certain information with respect to option grants made during the fiscal year ended June 30, 2003 to the Named Officers.

Option Grants in Last Fiscal Year

| Name |

Number of Securities Underlying Options Granted (1) |

Individual Grants |

Expiration Date |

Potential Realizable Value at Assumed Annual Rates of Share Price Appreciation for Option Term ($) (2) |

||||||||

|

% of Total Options Granted to Employees in Fiscal Year |

Exercise or ($/Sh) |

|||||||||||

|

5% |

10% |

|||||||||||

| Peter C. Farrell |

60,000 | 4.8 | 25.42 | July 10, 2012 | 840,886 | 2,071,142 | ||||||

| Christopher G. Roberts |

15,000 | 1.0 | 25.42 | July 10, 2012 | 210,221 | 517,786 | ||||||

| Curt Kenyon |

5,000 | 0.3 | 25.42 | July 10, 2012 | 70,074 | 172,595 | ||||||

| David Pendarvis |

15,000 | 1.0 | 27.63 | Sept 30, 2013 | 228,498 | 562,801 | ||||||

| David Pendarvis |

15,000 | 1.0 | 37.40 | May 26, 2013 | 309,295 | 761,809 | ||||||

| Adrian Smith |

10,000 | 0.7 | 25.42 | July 10, 2012 | 140,148 | 345,190 | ||||||

| (1) | Represents options granted under our 1997 Equity Participation Plan, which are exercisable 33% per year on the anniversary date of grant starting on the first anniversary of the grant date. Under the terms of the 1997 Plan, this exercise schedule may be accelerated in certain specific situations. In addition, we have the right to require the surrender of outstanding options on the grant of lower priced options to the same individual. |

| (2) | Assumed annual rates of share appreciation for illustrative purposes only. Actual share prices will vary from time to time based on market factors and our financial performance. No assurance can be given that such rates will be achieved. |

The following table sets forth information concerning the stock option exercises by our Named Officers during the fiscal year ended June 30, 2003 and the unexercised stock options held at June 30, 2003 by the Named Officers.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| Name |

Shares Acquired on Exercise |

Value Realized ($) |

Number of Securities Underlying Unexercised Options at FY-End |

Value of Unexercised In-the- Money Options at FY-End($)(1) |

||||||||

|

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

|||||||||

| Peter C. Farrell |

31,000 | 658,355 | 181,634 | 140,000 | 3,880,982 | 1,215,472 | ||||||

| Christopher G. Roberts |

60,000 | 1,963,440 | 40,000 | 35,000 | 711,453 | 303,872 | ||||||

| Curt Kenyon |

15,726 | 257,329 | 4,000 | 17,500 | 0 | 134,488 | ||||||

| David Pendarvis |

0 | N/A | 0 | 30,000 | 0 | 200,550 | ||||||

| Adrian Smith |

0 | N/A | 60,000 | 24,000 | 1,542,360 | 196,100 | ||||||

| (1) | Represents the amount by which the closing sales price of our common stock on the New York Stock Exchange on June 28, 2003 ($39.20 per share), multiplied by the number of shares to which the in-the-money options apply, exceeded the exercise price of those options. |

6

Equity Compensation Plan Information

The following table summarizes outstanding stock option plan balances as at June 30, 2003:

| Plan Category |

Number of securities to be issued on exercise of options |

Weighted average exercise price of outstanding option |

Number of securities remaining available for future issuance under equity compensation plans |

|||||

| Equity compensation plans approved by security holders |

4,745,178 | $ | 29.04 | 888,525 | (1) | |||

| Total |

4,745,178 | $ | 29.04 | 888,525 | (1) | |||

| (1) | The total number of authorized shares of common stock under the 1997 Equity Participation Plan was initially established at 1,000,000 and increases at the beginning of each fiscal year, commencing on July 1, 1998, by an amount equal to 4% of the outstanding common stock on the last day of the preceding fiscal year. The maximum number of shares of Common stock issuable on exercise of incentive stock options granted under the 1997 Plan, however, cannot exceed 8,000,000. The number reflected in the table includes the automatic share increase that occurred on July 1, 2003. |

Report of the Compensation Committee

Introduction

Decisions regarding compensation of the Companys officers are made based on recommendations by the Compensation Committee, which is composed of three independent Directors. The Compensation Committees decisions on compensation of the Companys executive officers are reviewed and approved by the full Board. Set forth below is a report submitted by Donagh McCarthy, Gary Pace and Christopher Bartlett in their capacity as members of the Boards Compensation Committee addressing the Companys compensation policies for fiscal year 2003 as they affected executive officers of the Company, including the Chief Executive Officer and the other Named Officers.

General Philosophy

The Compensation Committee reviews and determines salaries, bonuses and all other elements of the compensation packages offered to the executive officers of the Company, including its Chief Executive Officer, and establishes the general compensation policies of the Company.

The Company desires to attract, motivate and retain high quality employees who will enable the Company to achieve its short and long-term strategic goals and values. The Company participates in a high-growth environment where substantial competition exists for skilled employees. The ability of the Company to attract, motivate and retain high caliber individuals depends in large part upon the compensation packages it offers.

The Company believes that its executive compensation programs should reflect the Companys financial and operating performance. In addition, individual contribution to the Companys success should be supported and rewarded.

The 1993 Omnibus Budget Reconciliation Act (OBRA) became law in August 1993. Under the law, income tax deductions of publicly-traded companies in tax years beginning on or after January 1,

7

1994, may be limited to the extent total compensation (including base salary, annual bonus, stock option exercises, and non-qualified benefits) for certain executive officers exceeds $1 million (less the amount of any excess parachute-payments as defined in Section 280G of the Internal Revenue Code of 1986) in any one year. Under OBRA, the deduction limit does not apply to payments that qualify as performance-based. To qualify as performance-based, compensation payments must be based solely upon the achievement of objective performance goals and made under a plan that is administered by a committee of outside directors. In addition, the material terms of the plan must be disclosed to and approved by shareholders, and the Compensation Committee must certify that the performance goals were achieved before payments can be made. We do not have any cash payment plans that qualify as performance-based; however, option grants made under our 1997 Equity Participation Plan may qualify as performance-based compensation in part, so long as grants are made by the Committee at exercise prices that are equal to or greater than the fair market value of our common stock on the date of grant.

The Committee intends to design the Companys compensation programs to conform to the OBRA legislation and related regulations so that total compensation paid to any employee will not exceed $1 million in any one year, except for compensation payments that qualify as performance-based. The Company may, however, pay compensation that is not deductible in limited circumstances when sound management of the Company so requires.

The Companys executive and key employee compensation program consists of a base salary component, a component providing the potential for an annual bonus based on relevant Company performance and a component providing the opportunity to earn stock options linking the employees long-term financial success to that of the shareholders.

Compensation

Base Salary

Officers are compensated with salary ranges that are generally based on similar positions in companies of comparable size and complexity to the Company. In addition, the Compensation Committee uses industry compensation surveys, by outside consultants such as Mercer, Radford and Watson Wyatt, in determining compensation. The primary level of compensation is based on a combination of years of experience and performance. The salary of all officers is reviewed annually with the amount of the increases based on factors such as Company performance, general economic conditions, marketplace compensation trends and individual performance.

In fiscal year 2003, the Compensation Committee approved salary increases for the Named Officers as follows: Peter C. Farrell, 10%; Christopher G. Roberts, 17%; Curt Kenyon, 10%; Adrian Smith 37%.

The larger increase for Mr. Smith was based in part on survey data prepared by outside consultants concerning compensation payable to Chief Financial Officers within comparable companies and the desire of the Compensation Committee to bring Mr. Smiths salary more in line with market. Mr. Pendarvis was first hired in fiscal 2003.

Bonus

The second compensation component is a bonus program under the Companys Bonus Plan. Bonuses are primarily based on the Companys annual financial performance and secondarily on the performance of the individual. Target bonuses generally range from 40% to 60% of base salary. The measures of annual financial performance used in determining the amount of bonuses include sales, expenses, and profitability. For fiscal 2003, all three measures were used. The bonus plan allows for over-achievement of the target bonus based on a formula approved in advance by the Committee.

8

The formula is similar to that described below for the CEO, but with target criteria specific to the officers role.

Stock Options

The third major component of the officers compensation consists of stock options. The primary purpose of granting stock options is to link the officers financial success to that of the shareholders of the Company. The exercise price of stock options is determined by the Compensation Committee at the time the option is granted, but generally may not be less than the prevailing market price of the Companys common stock as of the date of grant. Options become exercisable beginning 12 months after the date of grant and are exercisable for a maximum period of 10 years after the date of grant, as determined by the Compensation Committee.

Stock options were issued to officers of the Company during fiscal year 2003 in accordance with the provisions of the Companys 1997 Equity Participation Plan. The number of options granted by the Compensation Committee was based on company performance, the number of outstanding options available, salary and individual performance.

Recently the Compensation Committee has been reviewing the continued advisability of the Companys historic option grant practices and has been consulting with compensation experts regarding competitive compensation programs. Based on this review and consultation the Compensation Committee has determined that it would be in the best interests of the Company and its shareholders to revise the long-term compensation program to provide less emphasis on stock options and to reduce the aggregate number of option grants made each year. In order to continue to provide proper incentives to the Companys employees and to further align the interests of the employees with the Companys shareholders, the Compensation Committee approved the adoption of an Employee Stock Purchase Plan, which is intended to qualify under Section 423 of the Internal Revenue Code of 1986, and which provides employees with the opportunity to purchase the Companys common stock at a discount through payroll deductions. These purchases will initially occur through successive six month offering periods under the plan. The Compensation Committee believes that this plan will provide an important incentive to employees to exert their best efforts on behalf of the Company.

Chief Executive Officer Compensation

The compensation of our CEO is based on the performance of the Company and the important role Dr. Farrell plays within the Company as its founder, President and Chief Executive Officer, as a member of the boards of the Companys principal subsidiaries and as an active participant in new product and corporate development.

The CEOs target bonus during fiscal year 2003 was 60% of his base salary. Fifty percent of the CEOs target bonus is based on achieving budgeted revenue targets and 50% is based on achieving budgeted group profitability, excluding non-recurring items such as gains from debt repurchases. Budget targets are determined by the Board of Directors at the beginning of each fiscal year. The linear bonus formula allows for receiving 50% of the target bonus at 75% of the budget target, 100% of the target bonus at 100% of budget, 150% of the target bonus at 125% of budget, and so on. There is no bonus paid for achievement of less than 75% of budget.

COMPENSATION COMMITTEE OF THE COMPANYS BOARD OF DIRECTORS:

Christopher Bartlett (Chairman)

Donagh McCarthy

Gary Pace

Dated: October 9, 2003

9

The above report of the Compensation Committee will not be deemed to be incorporated by reference to any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference.

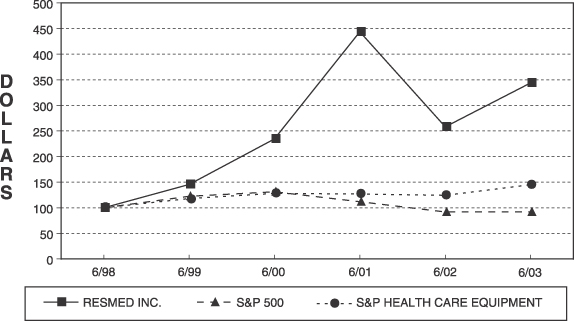

Performance Graph

Set forth below is a line graph comparing the cumulative shareholder return on our common stock against the cumulative total return of the S&P 500 Index and the S&P Health Care Equipment and Supplies Index for the period commencing June 30, 1998, assuming an investment of $100 on June 30, 1998.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG RESMED INC., THE S & P 500 INDEX

AND THE S & P HEALTH CARE EQUIPMENT INDEX

| * | $100 invested on 6/30/98 in stock or index-including reinvestment of dividends. Fiscal year ending June 30. |

| Copyright © 2002, Standard & Poors, a division of The McGraw-Hill Companies, Inc. All rights reserved. |

|

June 30, 1998 |

June 30, 1999 |

June 30, 2000 |

June 30, 2001 |

June 30, 2002 |

June 30, 2003 |

|||||||||||||

| ResMed Inc. |

$ | 100.00 | $ | 145.68 | $ | 234.84 | $ | 443.79 | $ | 258.11 | $ | 344.14 | ||||||

| S&P 500 |

$ | 100.00 | $ | 122.76 | $ | 131.66 | $ | 112.13 | $ | 91.96 | $ | 92.19 | ||||||

| S&P Health Care Equipment |

$ | 100.00 | $ | 118.03 | $ | 128.36 | $ | 127.26 | $ | 124.46 | $ | 145.00 | ||||||

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the Securities and Exchange Commission initial reports of ownership and reports of change in ownership of our common stock and other equity securities. Executive officers, directors and greater than ten-percent shareholders who are affiliates of the Company are required by the SEC regulation to furnish us with copies of all Section 16(a) forms they file.

10

Based solely on our review of copies of such forms the Company received, or written representations from certain reporting persons, we believe that during fiscal 2003 all of our directors and executive officers and persons who own more than 10% of our common stock have complied with the reporting requirements of Section 16(a).

Compensation Committee Interlocks and Insider Participation

During fiscal year 2003, the Compensation Committee consisted of Dr. Christopher Bartlett (Chairman), Mr. Donagh McCarthy and Dr. Gary Pace. None of them is an officer or employee of us or any of our subsidiaries. During fiscal 2003, none of our executive officers served as a director or member of a compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served as a director or member of our Compensation Committee.

Audit Fees

The following table presents fees for professional audit services by KPMG LLP for the audit of our annual financial statements for fiscal 2003 and 2002, and fees billed for other services rendered by KPMG LLP.

| Fees |

2003 |

2002 |

||||

| Audit Fees |

$ | 272,241 | $ | 204,961 | ||

| Audit Related Fees(1) |

26,058 | | ||||

| Total Audit and audit related fees |

298,299 | 204,961 | ||||

| Tax Fees(2) |

| 10,000 | ||||

| Total Fees |

$ | 298,299 | $ | 214,961 | ||

| (1) | Audit related fees consisted principally of fees for services related to SEC filings, responses, and related research. |

| (2) | Tax fees consisted of fees for income tax consulting and tax compliance. |

Audit Committee Report

The Audit Committee of the Companys Board of Directors is comprised of independent directors as required by the listing standards of the New York Stock Exchange. The members of the Audit Committee are Michael A. Quinn, Donagh McCarthy and Louis Simpson. The Audit Committee operates under a written charter adopted by the Board of Directors.

The role of the Audit Committee is to oversee the Companys financial reporting process on behalf of the Board of Directors. Management of the Company has the primary responsibility for the Companys financial statements as well as the Companys financial reporting process, principles and internal controls. The independent auditors are responsible for performing an audit of the Companys financial statements and expressing an opinion as to the conformity of such financial statements with generally accepted accounting principles.

In this context, the Audit Committee has reviewed and discussed the audited financial statements of the Company as of and for the year ended June 30, 2003 with management and the independent auditors. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as currently in effect. In addition the Audit Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as currently in effect, and it has discussed with the auditors their independence from the Company.

11

The members of the Audit Committee are not engaged in the accounting or auditing profession and are not involved in day-to-day operations of the Company. In the performance of their oversight function, the members of the Audit Committee necessarily relied upon the information, opinion, reports and statements presented to them by management of the Company and by the independent auditors. As a result, the Audit Committees oversight and the review and discussions referred to above do not assure that management has maintained adequate financial reporting processes, principles and internal controls, that the Companys financial statements are accurate, that the audit of such financial statements has been conducted in accordance with generally accepted auditing standards or that the Companys auditors meet the applicable standards for auditor independence.

Based on the reports and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Companys Annual Report on Form 10-K for the fiscal year ended June 30, 2003, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Michael A. Quinn (Chairman)

Donagh McCarthy

Louis Simpson

The above report of the Audit Committee will not be deemed to be incorporated by reference to any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference.

MATTERS TO BE ACTED ON

| Proposal 1. | Election of Directors |

Our bylaws authorize a Board of Directors with between 1 and 13 members, with the exact number to be specified by the Board of Directors from time to time. The Board of Directors has determined that the number of directors constituting the full Board of Directors will be seven at the present time.

The Board is divided into three classes. One class is elected every year at the Annual Meeting of Shareholders for a term of three years. The class of directors whose term expires in 2003 has two members, Peter C. Farrell and Gary W. Pace. Accordingly, two directors are to be elected at the 2003 Annual Meeting of Shareholders, who will hold office until the 2006 Annual Meeting of Shareholders or until the directors prior death, disability, resignation or removal.

On recommendation of the Nominating and Governance Committee, the Board of Directors has nominated Peter C. Farrell and Gary W. Pace for re-election as a director. Proxies are solicited in favor of these nominees and will be voted for them unless otherwise specified. If Peter C. Farrell or Gary W. Pace becomes unable or unwilling to serve as directors, it is intended that the proxies will be voted for the election of such other person, if any, as the Board of Directors shall designate.

Information concerning the nominees for director and the other directors who will continue in office after the meeting is set forth below:

12

| Name |

Term Expiration |

Age |

Position with the Company |

|||

| Peter C. Farrell |

2003 | 61 | President, Chief Executive Officer and Chairman of the Board of Directors |

|||

| Christopher G. Roberts |

2005 | 49 | Executive Vice President and Director | |||

| Donagh McCarthy (1) (2) (3) |

2005 | 56 | Director | |||

| Gary W. Pace(2)(3) |

2003 | 55 | Director | |||

| Michael A. Quinn (1)(3) |

2004 | 55 | Director | |||

| Christopher Bartlett(2)(3) |

2004 | 59 | Director | |||

| Louis A. Simpson(1)(3) |

2005 | 66 | Director |

| (1) | Member of Audit Committee |

| (2) | Member of Compensation Committee |

| (3) | Member of the Nominating and Governance Committee |

Peter C. Farrell, Ph.D., has been President and a director since ResMeds inception in June 1989 and Chief Executive Officer since July 1990. From July 1984 to June 1989, Dr. Farrell served as Vice President, Research and Development at various subsidiaries of Baxter International, Inc. (Baxter) and from August 1985 to June 1989, he also served as Managing Director of the Baxter Center for Medical Research Pty Ltd., a subsidiary of Baxter. From January 1978 to December 1989, he was Foundation Director of the Center for Biomedical Engineering at the University of New South Wales where he currently serves as a Visiting Professor. He holds a B.E. in chemical engineering with honors from the University of Sydney, an S.M. in chemical engineering from the Massachusetts Institute of Technology, a Ph.D. in chemical engineering and bioengineering from the University of Washington, Seattle and a D.Sc. from the University of New South Wales. Dr. Farrell was named 1998 San Diego Entrepreneur of the Year for Health Sciences and Australian Entrepreneur of the Year in 2001. In August 2000, he was named Vice Chairman of the Executive Council of the Harvard Medical School Division of Sleep Medicine. In addition to his responsibilities with ResMed, Dr. Farrell is a director of Cardiodynamics Inc. (NASDAQ ticker: CDIC), and a director of Medcare Flaga hf. (Medcare develops and manufactures sleep diagnostic equipment. ResMed owns a minority equity interest in Medcare and has a strategic alliance with it.)

Christopher G. Roberts, Ph.D., joined ResMed in August 1992 as Executive Vice President. He has been a director since September 1992. He also served as a director from August 1989 to November 1990. In addition to his responsibilities with ResMed, Dr. Roberts is a non-executive director of Portland Orthopaedics Pty Limited, a medical device company commercializing innovative technology for hip replacement. From February 1989 to June 1992, Dr. Roberts served in various positions, most recently as Vice President-Clinical and Regulatory Affairs, with medical device subsidiaries of Pacific Dunlop Limited, a large multinational manufacturing company. From January 1984 to December 1988, he served as President of BGS Medical Corporation, a medical device company that was acquired in September 1987 by Electro Biology Inc. (EBI), at which time he became Vice President-Clinical and Regulatory Affairs of EBI. Dr. Roberts holds a B.E. in chemical engineering with honors from the University of New South Wales, an M.B.A. from Macquarie University and a Ph.D. in biomedical engineering from the University of New South Wales. He is a Fellow of the Australian Academy of Technological Sciences and Engineering.

Donagh McCarthy has served as a director since November 1994. Mr. McCarthy is currently a consultant to Pharmediun Healthcare Inc., a privately held pharmacy service company. From 2000 to 2003 Mr. McCarthy was the President and CEO of Protiveris Inc., a Maryland based biotechnical startup company. From September 1996 to January 2000, he was President of RMS Inc., an affiliate of Baxter Healthcare. From June 1993 until September 1996, he was the President of the North America Renal Division of Baxter. Before that, Mr. McCarthy was General Manager and Director of Baxter Japan KK from March 1988. Mr. McCarthy held various positions at Baxter since 1982, including Vice President-Global Marketing, Strategy and Product Development. Mr. McCarthy received a bachelors degree in engineering from the National University of Ireland and an M.B.A. from the Wharton School, University of Pennsylvania.

13

Gary W. Pace, Ph.D., has served as a director since July 1994. Dr. Pace is currently Chairman and CEO of QRxPharma Pty Ltd, a Visiting Scientist at the Massachusetts Institute of Technology (MIT), an Adjunct Professor at the University of Queensland, a Director of Transition Therapeutics, a Director of Celsion Corp. and a Director of Protiveris Inc. From 1995 to 2001 Dr. Pace was President and CEO of RTP Pharma. From 2000 to 2002 Dr. Pace was Chairman and CEO of Waratah Pharmaceuticals Inc., a spin-off company from RTP Pharma. From 1993 to 1994, he was the founding President and Chief Executive Officer of Transcend Therapeutics Inc. (formerly Free Radical Sciences Inc.), a biopharmaceutical company. From 1989 to 1993, he was Senior Vice President of Clintec International, Inc., a Baxter/Nestle joint venture and manufacturer of clinical nutritional products. Dr. Pace holds a B.Sc. with honors from the University of New South Wales and a Ph.D. from MIT.

Michael A. Quinn has served as a director since September 1992. Since April 1999, Mr. Quinn has been the Chief Executive Officer of Innovation Capital, an Australian/U.S. venture capital fund. From February 1992 to April 1999, he was a management and financial consultant. From July 1988 to January 1992, he served as Executive Chairman of Phoenix Scientific Industries Limited, a manufacturer of health care and scientific products. Mr. Quinn holds a B.Sc. in physics and applied mathematics, a B.Ec. from the University of Western Australia and an M.B.A. from Harvard University.

Christopher Bartlett, Ph.D., has served as a director since October 2000. He is a Professor of Business Administration at Harvard Business School where he currently teaches courses in global strategy, organization and management and holds the Thomas D. Casserly Chair. Professor Bartlett has both masters and doctorate degrees in business administration from Harvard University. Before joining the faculty of Harvard Business School, Dr. Bartlett was a marketing manager with Alcoa in Australia, a management consultant in McKinseys London office, and general manager at Baxter Laboratories subsidiary company in France. He is also a graduate of the University of Queensland. Dr Bartlett is currently a director of Flowserve (NYSE:FLS), a global supplier of equipment to the process industries.

Louis A. Simpson has served as a director since May 2002. Since May 1993, Mr. Simpson has been President and Chief Executive Officer, Capital Operations of GEICO Corporation. From 1985 to 1993 he served as Vice Chairman of the Board of GEICO Corporation. Mr. Simpson joined GEICO Corporation and Government Employees Insurance Company (GEICO) in September 1979 as Senior Vice President and Chief Investment Officer. Before joining GEICO, Mr. Simpson was President and Chief Executive Officer of Western Asset Management, a subsidiary of the Los Angeles-based Western Bancorporation. Previously he was a partner at Stein Roe and Farnham, a Chicago investment firm, and an instructor of economics at Princeton University. A graduate of Ohio Wesleyan University, Mr. Simpson subsequently received a masters degree in economics from Princeton University. He is a director of Comcast, Western Asset Funds, Inc., Pacific American Income Shares Inc., and a trustee of Western Asset Premier Bond Fund. Mr. Simpson presently serves as a trustee for the Cate School, the University of California San Diego Foundation, the Urban Institute and the Woodrow Wilson National Fellowship Foundation. He is also chair of the Scripps Institution of Oceanography Council.

Committees of the Board of Directors

The Board of Directors has three committees to assist in the management of our affairs: Compensation, Nominating and Governance, and the Audit Committees.

14

The Compensation Committee currently consists of Dr. Christopher Bartlett (Chairman) and Messrs. Gary Pace and Donagh McCarthy. The Committee assists the Board in evaluating and approving the policies governing compensation of ResMeds executive officers, its incentive compensation programs, and director compensation. It also assists the Board in evaluating and developing candidates for executive positions.

The Nominating and Governance Committee consists of Gary W. Pace (Chairman), Donagh McCarthy, Michael Quinn, Louis Simpson, and Christopher Bartlett. This committee provides assistance to the Board and to the Chairman and CEO in the areas of membership selection, committee selection and rotation practices, evaluation of the overall effectiveness of the Board, and review and consideration of developments in corporate governance practices. The Nominating and Governance Committee will consider shareholder suggestions for nominees for director (other than self-nomination). Suggestions should be submitted to the Chairman of the Nominating and Governance Committee, c/o Secretary, ResMed Inc., 14040 Danielson Street, Poway, CA 92064, U.S.A.

The Audit Committee currently consists of Messrs. Michael A. Quinn (Chairman), Donagh McCarthy and Louis Simpson. This committee assists the Board in fulfilling its oversight responsibilities for managements conduct of ResMeds financial reporting processes. The Committee reviews the annual and quarterly financial statements with management and the companys independent auditor. It also reviews quarterly earnings announcements and discusses them with management and the auditor before they are released. It is directly responsible for the appointment, compensation and review of the work of the independent auditor, and reviews any major changes to accounting principles and practices.

The Compensation Committee met four times, the Nominating and Governance Committee met twice and the Audit Committee met four times during fiscal year 2003. These committees also met informally by telephone during the fiscal year as the need arose.

Board Meetings and Compensation

The Board of Directors held four meetings during fiscal year 2003. During that period, each director attended 100% of the aggregate of the total number of meetings of the Board of Directors and of the committees of the Board of Directors on which that director served.

Each director who is not an employee of ResMed received an annual fee of $10,000 for his service as a director during fiscal 2003. In addition, each director is reimbursed for his travel expenses for attendance at all such meetings. Directors who are not employees also hold and receive stock options under our 1995 Option Plan and 1997 Equity Participation Plan. During fiscal year 2003, the non-executive directors received 12,000 stock options each at an exercise price of $27.22. These levels of stock option award are below the automatic grant levels in the 1997 Equity Participation Plan approved by shareholders, as the directors waived their entitlement to the full automatic grant of 20,000 shares. The options vest one third at a time annually after grant.

The shareholders are being asked to approve an increase in the maximum aggregate amount of directors fees that may be paid to all non-executive directors, as a group, during any fiscal year, from the current aggregate payments of $50,000 to a maximum of aggregate payments not to exceed $400,000 during any fiscal year. See Proposal 3 To Approve an Increase in the Maximum Aggregate Non-Executive Director Fees. If the proposal is approved by the shareholders (approval is required by the ASX rules) the Board has approved the following revisions to the compensation payable to our five non-executive directors for fiscal 2004: (1) the annual retainer payable to non-executive directors will increase from $10,000 to $15,000 for non-Committee Chairpersons and to $17,000 for Committee Chairpersons, (2) the non-executive directors will be paid a fee of $1,500 per Board meeting, and $1,000 per Committee meeting, attended in person or by teleconference, and (3) the non-executive

15

directors will waive additional option shares above the level of 12,000 options. If Proposal 3 is approved by the shareholders, these revisions will be effective for fiscal 2004 and the non-executive directors would waive an additional 4,000 option shares that were granted on July 7, 2003, resulting in a total option grant on July 7, 2003 of 12,000 options.

Medical Advisory Board

In addition to the committees of the Board of Directors, we have an independent Medical Advisory Board. The Medical Advisory Board comprises leading physicians in sleep medicine who advise the board with respect to reviewing our current and proposed product lines from a medical perspective.

Required Vote and Board Recommendation

Assuming a quorum is present, directors will be elected by a favorable vote of a plurality of the aggregate votes cast, in person or by proxy, at the meeting. Accordingly, abstentions and broker non-votes (shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not empowered to vote on a particular proposal) will have no effect on the outcome of the election of candidates for director. In addition, a simple majority of the shares voting may elect all of the directors.

Unless instructed to the contrary, the shares represented by the proxies will be voted FOR the election of the two nominees named above. Although it is anticipated that the nominees will be able to serve as directors, should a nominee become unavailable to serve, the proxies will be voted for such other person or persons as may be designated by our Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH NOMINEE TO THE BOARD OF DIRECTORS.

| Proposal 2. | To Approve the Companys Employee Stock Purchase Plan |

The Compensation Committee and Board is submitting for approval by our shareholders the ResMed Inc. Employee Stock Purchase Plan (the ESPP). The ESPP is designed to provide employees with the opportunity to purchase our common stock at a discount through accumulated payroll deductions during successive offering periods. The Compensation Committee and Board, after consultation with compensation experts, have determined that it is in our best interests and the best interests of our shareholders to revise our long-term compensation program to provide less emphasis on option grants and to encourage direct stock ownership. The ESPP is intended to replace option grants for many employees and to supplement smaller option grants for management. As a compensation tool, the ESPP will assist us in (1) retaining the services of our employees, (2) securing the services of new employees, (3) providing incentives for our employees to exert maximum efforts for our success, and (4) aligning the interests of our employees with the interests of our shareholders.

A summary of the ESPP appears below. This summary is qualified in its entirety by the text of the ESPP, which is included as Appendix A to this proxy statement.

The ESPP is intended to qualify under Section 423 of the Internal Revenue Code of 1986, as amended (the U.S. Tax Code), which affords certain tax benefits under U.S. law to participants.

PLAN ADMINISTRATION

The Compensation Committee administers the ESPP. The Compensation Committee will have the discretionary authority to administer and interpret the ESPP, including the authority to (1) determine when rights to purchase our common stock are granted and the terms and conditions of each offering period, (2) designate from time to time which of the Companys subsidiaries are participating

16

subsidiaries, and thus employees of such participating subsidiaries may be eligible to participate in the ESPP, (3) construe and interpret the ESPP and the rights offered under the ESPP, (4) establish, amend and revoke rules and regulations for the administration of the ESPP, (5) amend the ESPP as explained below, and (6) exercise other powers and perform other acts deemed necessary to carry out the intent of the ESPP. Our Board, in its sole discretion, may at any time and from time to time assume the responsibilities and duties of the Compensation Committee under the ESPP.

SHARES AVAILABLE UNDER ESPP

There is a maximum of 3,250,000 shares of our common stock authorized for sale under the ESPP. This number of shares is equal to approximately 9.6% of the total number of our shares of common stock outstanding on September 15, 2003. The common stock available for sale under the ESPP may be authorized but unissued shares, treasury shares or shares purchased in the open market or in private transactions.

ELIGIBLE EMPLOYEES

Employees eligible to participate in the ESPP generally include our employees and employees of our subsidiaries that have been designated from time to time by the Compensation Committee as participating subsidiaries in the ESPP. At this time, none of our subsidiaries has been designated as a participating subsidiary, but the Company expects to designate each of its principal subsidiaries as a participating subsidiary. The Compensation Committee may, in its sole discretion, require that an employee be continuously employed by us or by a designated subsidiary for up to 2 years in order to be eligible to participate in an offering period under the ESPP. In addition, the Compensation Committee may, in its sole discretion, limit participation in an offering period to those employees who customarily work at least 5 months in a calendar year or are customarily scheduled to work at least 20 hours per week. An employee who owns (or is deemed to own through attribution) 5% or more of the combined voting power or value of all of our classes of stock or of one of our subsidiaries is not allowed to participate in the ESPP.

SUB-PLANS

The ESPP grants the Compensation Committee the authority to adopt sub-plans in order to ensure that the terms of the ESPP, as applicable to non-U.S. subsidiaries designated as participating subsidiaries, comply with applicable foreign laws. A sub-plan may be adopted for each non-U.S. subsidiary designated as a participating subsidiary by the Compensation Committee. Sub-plans adopted under the ESPP will not be intended to qualify under Section 423 of the U.S. Tax Code. At this time, none of our non-U.S. subsidiaries has been designated as a participating subsidiary, but the Company expects to designate each of its principal subsidiaries as a participating subsidiary.

OFFERING

Under the ESPP, participants are offered the right to purchase shares of our common stock at a discount during successive offering periods. Each offering period under the ESPP will be for a period of time determined by the Compensation Committee of no less than 3 months and no more than 27 months. Initially, the ESPP will have successive six-month offering periods. The first trading day of an offering period is referred to as the date of grant. On the date of grant participants are granted the right to acquire shares of our common stock on the last trading day of the offering period. The last trading day during an offering period is thus referred to as the date of purchase. Unless a participant has previously canceled his or her participation in the ESPP, the participant will be deemed to have exercised his or her right to purchase shares in full as of each date of purchase. At exercise the participant will purchase the number of shares of common stock that his or her accumulated payroll deductions during that offering will buy at the purchase price for that offering period. The purchase price for our common stock under the ESPP will be the lower of 85 percent of the fair market value of our common stock on the date of grant or 85 percent of the fair market value of our common stock on the date of purchase. The fair market value of our common stock on September 15, 2003, was $43.10.

17

The initial six-month offering period under the ESPP is expected to begin in early 2004, after all required approvals have been obtained and all registrations made. Subsequent offering periods are expected to commence on the conclusion of the prior offering period and continue for a period of 6 months, unless otherwise determined by the Compensation Committee.

PARTICIPATION

Eligible employees can enroll under the ESPP by completing a participation agreement within the time specified by the Compensation Committee. Each participation agreement must authorize the deduction of at least 1% but not more than an initial maximum percentage of 50% of the eligible employees compensation towards the purchase of our common stock. The Compensation Committee has the authority under the ESPP to set the maximum percentage to less than 50% of the eligible employees compensation. A participants authorized payroll deduction will be deducted on each payday during an offering period. Any amounts that are insufficient to purchase whole shares of our common stock on a date of purchase, and thus, are unused, will be carried over to the next offering period unless the participant withdraws from the ESPP, or is no longer eligible to participate in the ESPP, in which case, those unused amounts will be distributed to him or her in cash, without interest.

In no case may a participant subscribe for more than $25,000 in common stock during any calendar year. Based on our common stock price on September 15, 2003, of $43.10, no participant could purchase more than 508 shares in any calendar year. In addition, the Compensation Committee will place a limit on the maximum number of shares any participant can acquire in a single offering period (the limit is expected to be 5,000 shares and will also be subject to the annual $25,000 limit discussed above). If the aggregate subscriptions by all participants exceed the number of authorized shares of common stock available for purchase under the ESPP, all subscriptions will be reduced on a pro rata basis.

Except as otherwise provided by the Compensation Committee in the terms of an offering period, a participant may cancel his or her payroll deduction authorization at any time before the end of the offering period. Upon cancellation, the balance of the participants account will be refunded in cash, without interest. The Compensation Committee may provide that a participant can increase, decrease, or suspend his or her payroll deduction authorization during an offering period. Additionally, if a participant ceases to be an eligible employee during an offering period, that persons participation in the ESPP will cease and the balance of that participants account will be refunded to him or her in cash, without interest.

ADJUSTMENTS UPON CHANGES IN CAPITALIZATION, DISSOLUTION, LIQUIDATION, MERGER OR ASSET SALE

In the event of any dividend or other distribution, recapitalization, reclassification, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase, liquidation, dissolution, or sale, transfer, exchange or other disposition of all or substantially all of our assets, or exchange of shares of our common stock or other securities, issuance of warrants or other rights to purchase shares of our common stock or other securities, or other similar corporate transactions or events, or any unusual or nonrecurring transactions or events affecting us, any of our affiliates, or our financial statements or those of any of our affiliates, or of changes in applicable laws, regulations, or accounting principles, the Compensation Committee may take any one or more of the following actions whenever the Compensation Committee determines that such action is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan or with respect to any right under the Plan, to facilitate such transactions or events or to give effect to such changes in laws, regulations or principles:

| | provide that all rights then outstanding under the ESPP will terminate without being exercised on such date as the Compensation Committee determines in its sole discretion; |

18

| | provide that all then outstanding rights under the ESPP will be exercised and terminate immediately after such exercise; |

| | provide for either the purchase of any then outstanding right under the ESPP for an amount of cash equal to the amount that could have been obtained on the exercise of such right had the right been currently exercisable, or the replacement of the right with other rights or property selected by the Compensation Committee in its sole discretion; |

| | provide that then outstanding rights under the ESPP will be assumed by the successor or survivor corporation, or a parent or subsidiary of the successor or survivor corporation, or will be substituted for by similar rights for the stock of the successor or survivor corporation, or a parent or subsidiary of the successor or survivor corporation, with appropriate adjustments as to the number and kind of shares and prices; and |

| | make adjustments in the number and type of shares of common stock (or other securities or property) subject to outstanding rights, or in the terms and conditions of outstanding rights, or rights which may be granted in the future. |

AMENDMENT AND TERMINATION

The Compensation Committee may at any time, and from time to time, amend, suspend or terminate the ESPP. However, without obtaining shareholder approval within 12 months before or after the action, the Compensation Committee may not amend the ESPP to either increase the number of shares that may be purchased under the ESPP or to amend the ESPP in a way that requires shareholder approval under the U.S. Tax Code. Without shareholder consent and without regard to whether any Participant rights may be considered to have been adversely affected, the Board or the Compensation Committee, as applicable, may change the Offering Periods, limit the frequency and number of changes in the amount withheld during an Offering Period, establish the exchange ratio applicable to amounts withheld in a currency other than U.S. dollars, permit payroll withholding in excess of the amount designated by a Participant to adjust for delays or mistakes in the Companys processing of properly completed withholding elections, establish reasonable waiting and adjustment periods and accounting and crediting procedures to ensure that amounts applied toward the purchase of stock for each participant properly correspond with amounts withheld from the Participants Compensation, and establish such other limitations or procedures as the Board or the Compensation Committee, as applicable, determines in its sole discretion advisable which are consistent with the ESPP and Section 423 of the U.S. Tax Code. Unless sooner terminated the ESPP will be in effect until September 29, 2013, the tenth anniversary of its adoption by our Board.

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE EMPLOYEE STOCK PURCHASE PLAN

The following discussion is required by rules of the Securities and Exchange Commission, and summarizes the U.S. Federal income tax consequences of an employees participation in the ESPP. It does not summarize tax consequences for any employees who are not United States taxpayers. This summary does not address federal employment taxes, state and local income taxes and other taxes that may be applicable and is not intended to be a complete description of the tax consequences of participation in the ESPP.

The ESPP is intended to be an employee stock purchase plan within the meaning of Section 423 of the U.S. Tax Code. Under a plan that so qualifies, no taxable income is recognized by a participant, and no deductions are allowed to the Company, in connection with the grant of the option under the plan that occurs on the date of grant (first trading day) for an offering period or the automatic exercise of such option and acquisition of shares under the plan that occurs on the last trading day for an offering period.

Taxable income will not be recognized until there is a sale or other disposition of the shares acquired under the ESPP or in the event the participant should die while still owning the purchased shares.

19

If a participant sells or otherwise disposes of the purchased shares less than two years after the date of grant, or within one year after the date of purchase for those shares, then the participant will recognize ordinary income equal to the amount by which the fair market value of the shares on the date of purchase exceeds the purchase price paid for those shares, and the Company will be entitled to an income tax deduction equal in amount to such excess. The income is recognized by the participant, and the deduction taken by the Company, for the taxable year in which such sale or disposition occurs. For purposes of the U.S. Tax Code, the date of purchase means the date the shares are issued on automatic exercise of the option on the last trading day of the offering period.

If the participant sells or disposes of the purchased shares more than two years after the date of grant and more than one year after the date of purchase for those shares, then the participant will recognize ordinary income equal to the lesser of (1) the amount by which the fair market value of the shares on the sale or disposition exceeds the purchase price paid for those shares or (2) 15% of the fair market value of the shares on the date of grant for the offering period in which the shares were acquired, and any additional gain upon the disposition will be taxed as a long-term capital gain. The income is recognized by the participant for the taxable year in which such sale or disposition occurs. The Company will not be entitled to any income tax deduction with respect to such sale or disposition.

If the participant still owns the purchased shares at the time of death, the lesser of (1) the amount by which the fair market value of the shares on the date of death exceeds the purchase price or (2) 15% of the fair market value of the shares on the date of grant for the offering period in which those shares were acquired, will constitute ordinary income in the year of death.

NEW PLAN BENEFITS

Directors who are not employees will not receive any benefits under the ESPP and may not participate in the ESPP. Peter Farrell, the President and a director of the Company, and Christopher Roberts, an Executive Vice President and director of the Company, are the only directors who would be eligible to participate in the ESPP. Both Dr. Farrell and Dr. Roberts have irrevocably elected not to participate in the ESPP. Under the requirements of the ASX, in the event either of Dr. Farrell or Dr. Roberts elects to participate in the ESPP, shareholder approval will be required. The Company will not issue any shares to Drs. Farrell or Roberts under the ESPP without first obtaining any such required shareholder approval. The benefits that will be received under the ESPP by our current executive officers and by all eligible employees are not currently determinable.

VOTE REQUIRED AND BOARD RECOMMENDATION

In order for our Employee Stock Purchase Plan to be approved by our shareholders:

| | The New York Stock Exchange (the NYSE) requires that: (1) greater than 50% in interest of all securities entitled to vote on the proposal cast a vote on the proposal, and (2) a majority of the votes cast must vote for the proposal. For purposes of the first requirement: votes for and against and abstentions count as votes cast (while broker non-votes do not count as votes cast); and all outstanding shares, including broker non-votes, count as entitled to vote. (Broker non-votes are shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not empowered to vote on a particular proposal.) Thus, under requirement (1) above, the total sum of votes for, plus votes against plus abstentions (the NYSE Votes Cast) must be greater than 50% of the total outstanding shares of our common stock. In order to satisfy requirement (2) above, the number of votes for the proposal must be greater than 50% of the NYSE Votes Cast. |

| | Our bylaws require the affirmative vote of a majority of the aggregate votes cast, in person or by proxy. Under this standard, abstentions and broker non-votes have no effect on the outcome of this proposal. |

The voting standard under our bylaws is less than that required by the NYSE. We expect that brokers and other nominees will not have discretionary voting authority on this proposal and thus broker non-votes will result on this proposal. As a result the NYSE standard will be determinative. Accordingly, so long as the NYSE Votes Cast represent greater than 50% of the total outstanding shares, broker non-votes will have no effect on the outcome of this proposal.

20

Unless instructed to the contrary, the shares represented by the proxies will be voted FOR approval of the Employee Stock Purchase Plan.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR APPROVAL OF THE EMPLOYEE STOCK PURCHASE PLAN.

| Proposal 3. | To Approve an Increase in the Maximum Aggregate |

| Non-Executive Director Fees |