DEF 14A: Definitive proxy statements

Published on October 8, 2009

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to § 240.14A-12 |

RESMED INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

|

Dear Stockholder:

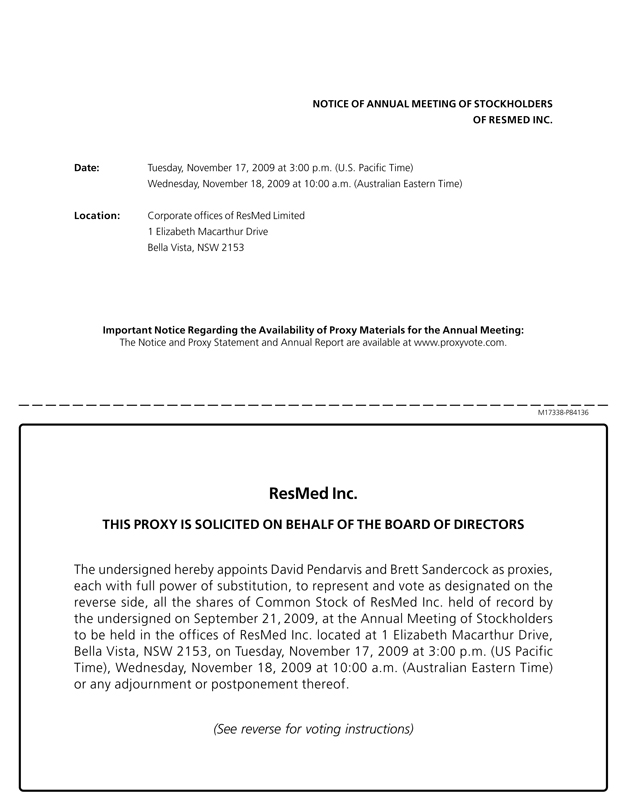

We cordially invite you to attend the Annual Meeting of Stockholders of ResMed Inc. on Wednesday, November 18, 2009, at 10:00 a.m. Australian Eastern Time (Tuesday, November 17, 2009, at 3:00 p.m. US Pacific Time) in the corporate offices of ResMed Limited, located at 1 Elizabeth Macarthur Drive, Bella Vista NSW 2153.

The attached Notice of Meeting and Proxy Statement contain information about the business of the meeting, the nominees for election as directors and the other proposals. This year we ask you to elect three directors of the Company, approve amendments to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan, approve amendments to the ResMed Inc. Employee Stock Purchase Plan, and ratify the selection of our independent auditors for fiscal year 2010.

Your vote is important. If you cannot attend the Annual Meeting in person, you may vote your shares by Internet, or, if this proxy statement was mailed to you, by completing and signing the accompanying proxy card and promptly returning it in the envelope provided.

Very truly yours,

Peter C. Farrell

Executive Chairman of the Board

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF RESMED INC.

| Date: | Wednesday, November 18, 2009, at 10:00 a.m. (Australian Eastern Time) |

Tuesday, November 17, 2009, at 3:00 p.m. (US Pacific Time)

| Location: | Corporate offices of ResMed Limited |

1 Elizabeth Macarthur Drive

Bella Vista NSW 2153.

At the 2009 Annual Meeting, stockholders will act on the following matters:

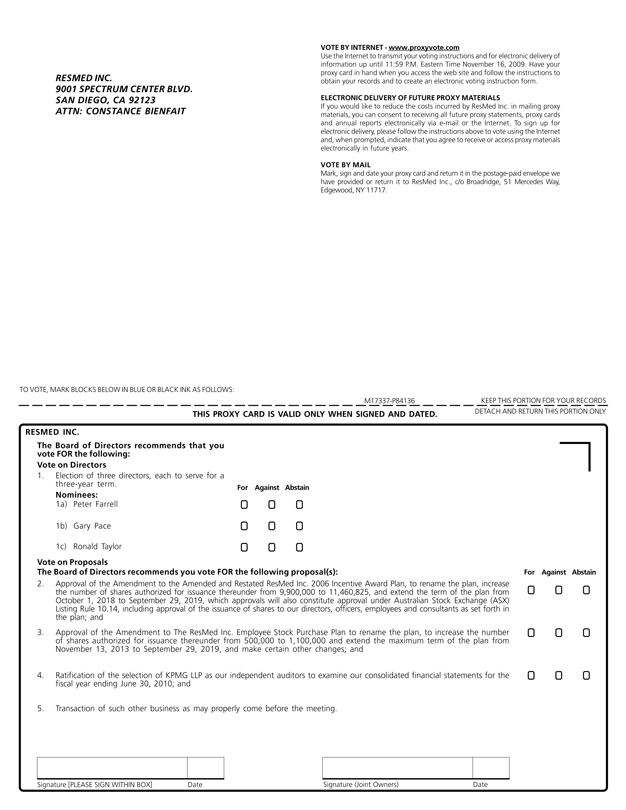

| 1. | Election of three directors, each to serve for a three-year term. The nominees for election as directors at the 2009 Annual Meeting are Peter Farrell, Gary Pace and Ronald Taylor; and |

| 2. | Approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan, to rename the plan, increase the number of shares authorized for issuance thereunder from 9,900,000 to 11,460,825, and extend the term of the plan from October 1, 2018 to September 29, 2019, which approvals will also constitute approval under Australian Stock Exchange (ASX) Listing Rule 10.14, including approval of the issuance of shares to our directors, officers, employees and consultants as set forth in the plan; and |

| 3. | Approval of the Amendment to The ResMed Inc. Employee Stock Purchase Plan to rename the plan, increase the number of shares authorized for issuance thereunder from 500,000 to 1,100,000, extend the maximum term of the plan from November 13, 2013 to September 29, 2019, make certain other changes; and |

| 4. | Ratification of the selection of KPMG LLP as our independent auditors to examine our consolidated financial statements for the fiscal year ending June 30, 2010; and |

| 5. | Transaction of such other business as may properly come before the meeting. |

Please refer to the accompanying proxy statement for a more complete description of the matters to be considered at the Annual Meeting. In addition, stockholders are advised that there are special voting and other requirements under the Australian Securities Exchange Listing Rules relating to the approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan. Please see Matter To Be Acted On Proposal 2: Approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan.

Stockholders of record of our common stock at the close of business on September 21, 2009 (US), will be entitled to vote at the Annual Meeting and at any adjournments or postponements of the meeting.

Only individuals with proof of share ownership are entitled to be admitted to the Annual Meeting. If you are a stockholder of record, you will need to bring proof of share ownership with you to the Annual Meeting, together with photo identification. If your shares are not registered in your name, you must bring proof of share ownership (such as a recent bank or brokerage firm account statement, together with proper identification) in order to be admitted to the Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting whether or not you plan to attend the Annual Meeting in person. If you are viewing the proxy statement on the Internet, you may grant your proxy electronically via the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials previously mailed to you and the instructions listed on the Internet site. If you are receiving a paper copy of the proxy statement, you may vote by completing and mailing the proxy card enclosed with the proxy statement, or you may grant your proxy electronically via the Internet by following the instructions on the proxy card. Submitting your proxy, in any permitted form, will ensure your shares are represented at the Annual Meeting.

By order of the Board of Directors,

David Pendarvis

Secretary

Dated: October 8, 2009

Table of Contents

| 1 | ||

| 1 | ||

| 1 | ||

| COMMON STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT |

4 | |

| 7 | ||

| 7 | ||

| 17 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| 22 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 27 | ||

| 27 | ||

| 27 | ||

| 27 | ||

| 29 | ||

| 32 | ||

| 32 | ||

| 32 | ||

| 32 | ||

| 35 | ||

| 35 | ||

| 35 | ||

| 39 | ||

| MATTER TO BE ACTED ON PROPOSAL 2: APPROVAL OF THE AMENDMENT TO THE 2006 PLAN |

40 | |

| 50 | ||

| MATTER TO BE ACTED ON PROPOSAL 4: RATIFICATION OF SELECTION OF AUDITORS |

55 | |

| 55 | ||

| 55 | ||

| APPENDIX 1: AMENDMENT TO THE AMENDED AND RESTATED RESMED INC. 2006 INCENTIVE AWARD PLAN |

57 | |

| APPENDIX 2: AMENDMENT TO THE RESMED INC. EMPLOYEE STOCK PURCHASE PLAN |

59 | |

Table of Contents

PROXY STATEMENT

The Board of Directors of ResMed Inc. (ResMed, we, us, or our) is providing this proxy statement in connection with our 2009 Annual Meeting of Stockholders to be held on Wednesday, November 18, 2009, at 10:00 a.m. Australian Eastern Time (Tuesday, November 17, 2009 at 3:00 p.m. US Pacific Time), in the corporate offices of ResMed Limited, located at 1 Elizabeth Macarthur Drive, Bella Vista NSW 2153, or at any continuation, postponement or adjournment of the Annual Meeting, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting and any business properly brought before the Annual Meeting.

DELIVERY OF AND ACCESS TO PROXY MATERIALS

We expect to first make available this proxy statement and the Annual Report to our stockholders and our holders of CHESS Units of Foreign Securities (CUFS) on the internet, and to mail notice and access materials on or about October 8, 2009.

Under rules recently adopted by the U.S. Securities and Exchange Commission (SEC), we are furnishing proxy materials to our stockholders via the Internet, instead of mailing printed copies of proxy materials to each stockholder. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the Notice) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice if your shares are listed on the NYSE. If you hold our CHESS units of Foreign Securities (CUFS) listed on the Australian Stock Exchange (ASX), you will receive your Notice of Internet Availability of Proxy Materials from Computershare. If you received the Notice by mail, you will not automatically receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review this proxy statement, our Annual Report, and proxy voting card. The Notice also instructs you on how you may submit your proxy via the Internet.

You can, however, still receive a hard copy of our proxy materials by following the instructions contained in the Notice on how you may request to receive your materials in printed form on a one-time or on-going basis. There will also be instructions on how you may request to receive your materials electronically on a permanent basis.

Stockholders are cordially invited to attend the Meeting in person. However, please vote by internet or by completing and signing a proxy card and returning it promptly in the postage paid envelope provided. If you choose, you may still vote in person at the Meeting even though you previously voted by submitting a proxy card or through the internet.

VOTING INSTRUCTIONS AND INFORMATION

Who can vote?

You are entitled to vote or direct the voting of your ResMed Inc. shares if you were a stockholder on September 21, 2009 (US Time), the record date for the Annual Meeting.

How do I vote?

Your vote is important. The shares represented by proxies (in the forms solicited by the Board of Directors) received by us before, or, if submitted in person, at the Annual Meeting, will be voted at the Annual Meeting. If a choice is specified on the proxy with respect to a matter to be voted on, the shares represented by the proxy will be voted in accordance with that specification. If no choice is specified, the shares represented by a properly executed proxy will be voted: (i) FOR each of the three nominees to our board listed in this proxy statement; (ii) FOR approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan, which approval will also constitute approval under ASX Listing Rule 10.14 as described further below; (iii) FOR approval of the Amendment to the ResMed Inc. Employee Stock Purchase Plan, and (iv) FOR ratification of the selection of KPMG LLP as our independent auditors to examine our consolidated financial statements for the fiscal year ending June 30, 2010. You may vote by attending the Annual Meeting and voting in person or you may vote by submitting your proxy. We encourage you to vote promptly.

1

Table of Contents

Holders of Common Stock Listed on the New York Stock Exchange (NYSE)

You may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy, and (2) for shares held as a record holder and shares held in street name. If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the Internet, you may vote by submitting a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage paid envelope provided to you, or by submitting a proxy over the Internet by following the instructions on the proxy card.

If you hold your shares of common stock in street name, which means your shares are held of record by a broker, bank or nominee, you will receive a Notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the Internet. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the Notice provided by your broker. If your broker holds your common stock in street name and you have not provided your broker with voting instructions, your broker will vote your shares in its discretion on proposals considered routine under NYSE rules. The election of directors and ratification of auditor selection are both considered routine proposals. Approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan and approval of the Amendment to the ResMed Inc. Employee Stock Purchase Plan are not considered routine proposals, and brokers do not have discretionary authority to vote on these proposals without your direction.

Internet voting closes at 11:59 p.m. (US Eastern Time) on November 16, 2009.

Holders of CHESS Units of Foreign Securities Listed on the ASX

If you hold our CHESS Units of Foreign Securities (CUFS), you will receive a Notice from Computershare, which will allow you to deliver your voting instructions over the Internet. In addition, you may request paper copies of the proxy statement and voting instruction from Computershare by following the instructions on the Notice provided by Computershare.

Voting By Attending the Annual Meeting

If you attend the Annual Meeting and wish to vote in person, you may vote your shares in person by requesting a ballot at the Annual Meeting. You will need to have proof of ownership and valid photo identification with you for admission to the Annual Meeting. Please note, however, that if your shares are held in street name, which means your shares are held of record by a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record holder of the shares, which is the broker or other nominee, authorizing you to vote at the Annual Meeting

Your vote is important. We encourage you to submit your proxy, or provide instructions to your brokerage firm, bank or the CHESS nominee, as applicable. This will ensure that your shares are voted at the Annual Meeting.

Solicitation of Proxies. The cost of soliciting proxies will be borne by us. After the original delivery of the Notice and other proxy soliciting material, further solicitation of proxies may be made by mail, telephone, facsimile, electronic mail, and personal interview by our regular employees, who will not receive additional compensation for such solicitation. We will also request that brokerage firms and other nominees or fiduciaries deliver the notice and proxy soliciting material to beneficial owners of the stock held in their names, and we will reimburse them for reasonable out-of-pocket expenses incurred in doing so. We have engaged Morrow & Co., LLC to act as a proxy solicitor to assist in the solicitation of proxies and provide related advice and informational support, and will pay approximately $15,000 in fees (plus reimbursement of expenses) for these services in US and Australia.

List of Stockholders. In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available at the meeting at the corporate offices of ResMed Limited, 1 Elizabeth Macarthur Drive, Bella Vista NSW 2153, and for 10 days before the Annual Meeting at the corporate offices of ResMed Inc., located at 9001 Spectrum Center Blvd., San Diego, California, 92123 USA, between the hours of 9:00 a.m. and 4:00 p.m. local time.

2

Table of Contents

How many votes are required?

Only record holders of our common stock as of the close of business on September 21, 2009 (the record date), are entitled to receive notice of and to vote at the Annual Meeting. At the record date we had 75,295,707 outstanding shares of common stock (excluding treasury shares), the holders of which are entitled to one vote per share. Accordingly, an aggregate of 75,295,707 votes may be cast on each matter to be considered at the Annual Meeting.

To constitute a quorum to conduct business, a majority of the outstanding shares entitled to vote must be represented at the Annual Meeting. Shares represented by proxies that reflect abstentions or broker non-votes (street name shares held by a broker or nominee which are represented at the meeting, but with respect to which the broker or nominee is not empowered to vote on a particular proposal and has not been instructed to vote on the proposal by the beneficial owner of such shares) will be counted as shares represented at the Annual Meeting for purposes of determining a quorum.

For Proposal 1, directors will be elected by a plurality of the votes cast. Thus, the three nominees receiving the largest number of votes will be elected. As a result, abstentions will not be counted in determining which nominees received the largest number of votes cast. Brokers generally have discretionary authority to vote on the election of directors and thus we do not expect broker non-votes to result from the vote on election of directors. Any broker non-votes that may result will not affect the outcome of the election.

For Proposals 2 and 3, the approval of the Amendment to the Amended and Restated ResMed Inc. 2006 Incentive Award Plan (the 2006 Plan), and the approval of the Amendment to the ResMed Inc. Employee Stock Purchase Plan (the ESPP), the affirmative vote of a majority of shares cast in person or by proxy is required for each proposal, provided that the total votes cast on the proposal represent over 50% of the outstanding shares of common stock entitled to vote on the proposal. Votes for and against and abstentions count as votes cast, while broker non-votes do not count as votes cast. All outstanding shares, including broker non-votes, count as shares entitled to vote. Thus, the total sum of votes for, plus votes against, plus abstentions, which are referred to as the NYSE Votes Cast, must be greater than 50% of the total outstanding shares of our common stock. Once this requirement is met, the number of votes for the proposal must be greater than 50% of the NYSE Votes Cast. The approval of an equity plan is a matter on which brokers or other nominees are not empowered to vote without direction from the beneficial owner. Thus, broker non-votes can result from these proposals and make it difficult to satisfy the NYSE Votes Cast requirement. Abstentions have the effect of a vote against each proposal. There are special voting and other requirements under the ASX Listing Rules relating to the approval of the Amendment to the 2006 Plan. Please see Matter To Be Acted On Proposal 2: Approval of the Amendment to the 2006 Incentive Plan for a description of these requirements.

For Proposal 4, the affirmative vote of a majority of the shares cast in person or by proxy is required for the ratification of the selection of KPMG LLP as our independent auditors. Abstentions will not affect the outcome of this proposal. Brokers generally have discretionary authority to vote on the ratification of our independent auditors, thus we do not expect broker non-votes to result from the vote on Proposal 4. Any broker non-votes that may result will not affect the outcome of this proposal.

How can I revoke my proxy or change my vote?

You may revoke your proxy and change your vote at any time before the proxy is exercised by any of the following methods:

Holders of Record

| | Delivering written notice of revocation to our Secretary at our principal executive offices located at 9001 Spectrum Center Blvd., San Diego, California, 92123 USA; |

| | Delivering another timely and later dated proxy to us at our principal executive offices located at 9001 Spectrum Center Blvd., San Diego, California 92123 USA; |

| | Revoking by Internet before 11:59 p.m. (US Eastern Time) on November 16, 2009; or |

| | Attending the 2009 Annual Meeting and voting in person by written ballot. Please note that your attendance at the meeting will not revoke your proxy unless you actually vote at the meeting. |

Stock Held by Brokers, Banks and Nominees and CUFS

| | You must contact your broker, bank or other nominee to obtain instructions on how to revoke your proxy or change your vote. You may also obtain a legal Proxy from your broker, bank or other nominee to attend the Annual Meeting and vote in person by written ballot. |

3

Table of Contents

COMMON STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS AND MANAGEMENT

The following table shows the number of shares of our common stock that, according to information supplied to us, are beneficially owned as of the record date by: (1) each person who, to our knowledge based on Schedule 13G filed with the SEC and Substantial Stockholder Notices filed with the ASX, is the beneficial owner of more than five percent of our outstanding common stock; (2) each person who is currently a director, three of whom are also nominees for election as directors; (3) each of the named executive officers; and (4) all current directors and executive officers as a group. In this proxy statement, beneficial ownership means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (that is, the power to dispose of, or to direct the disposition of, a security). All of the following calculations are based on 75,295,707 shares of common stock outstanding (excluding treasury shares) on September 21, 2009, the record date.

| Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership(1) |

Percent of Outstanding Common Stock |

||||

| T. Rowe Price Associates, Inc. 100 E. Pratt Street Baltimore, MD 21202 |

1,738,200 | (2) | 2.3 | % | ||

| Capital Research Global Investor 333 South Hope Street, 55/F Los Angeles, CA 90071-1406 |

4,807,310 | (3) | 6.4 | % | ||

| Peter Farrell |

1,631,810 | (4) | 2.2 | % | ||

| Christopher Roberts |

436,300 | (5) | * | |||

| Michael Quinn |

362,300 | (6) | * | |||

| Gary Pace |

377,500 | (7) | * | |||

| Kieran Gallahue |

443,974 | (8) | * | |||

| David Pendarvis |

156,527 | (9) | * | |||

| Brett Sandercock |

128,185 | (10) | * | |||

| Richard Sulpizio |

106,000 | (11) | * | |||

| Ronald Taylor |

104,000 | (12) | * | |||

| John Wareham |

102,000 | (13) | * | |||

| Robert Douglas |

111,620 | (14) | * | |||

| All current executive officers and directors as a group (12 persons) |

3,951,466 | (15) | 5.2 | % | ||

| * | Less than one percent (1%) |

| (1) | Beneficial ownership is stated as of September 21, 2009, and includes shares subject to options exercisable within 60 days after September 21, 2009. Shares have been rounded to the nearest whole number. Shares subject to options are deemed beneficially owned by the person holding the options for the purpose of computing the percentage of ownership of that person but are not treated as outstanding for the purpose of computing the percentage of any other person. |

| (2) | Based on information provided in a Schedule 13G/A filed with the SEC on February 13, 2009, by T. Rowe Associates, Inc., that reports sole voting power over 480,900 of these shares and sole dispositive power over all of these shares. |

| (3) | Based on information provided in a Schedule 13G filed with the SEC on February 13, 2009, by Capital Research Global Investors that reports sole voting power over 3,516,810 of these shares and sole dispositive power over all of these shares. |

| (4) | Includes 817,582 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (5) | Includes 11,600 shares held by his wife, 178,700 shares held of record by Cabbit Pty Ltd and 68,000 shares held by Acemed Pty Ltd, two Australian corporations controlled by Dr. Roberts and his wife. Includes 178,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (6) | Includes 188,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009; also includes 3300 shares held by Kaylara ATF Straflo Pension Fund, an entity controlled by Mr. Quinn. |

| (7) | Includes 220,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

4

Table of Contents

| (8) | Includes 440,750 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (9) | Includes 153,309 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (10) | Includes 113,750 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (11) | Includes 96,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (12) | Includes 102,000 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (13) | Comprised of options exercisable within 60 days after September 21, 2009. |

| (14) | Includes 101,250 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

| (15) | Includes an aggregate of 2,410,641 shares of common stock that may be acquired on the exercise of options exercisable within 60 days after September 21, 2009. |

Executive Officers

As of the record date, September 21, 2009, our executive officers were:

| Executive Officer |

Age | Position | ||

| Robert Douglas |

49 | Chief Operating Officer Asia Pacific | ||

| Peter Farrell |

67 | Executive Chairman of the Board of Directors | ||

| Kieran Gallahue |

46 | Chief Executive Officer, President and Director | ||

| Stein Jacobsen |

44 | Chief Operating Officer Europe | ||

| David Pendarvis |

50 | Sr. Vice President, Organizational Development and General Counsel | ||

| Brett Sandercock |

42 | Chief Financial Officer |

Effective as of January 1, 2009, Lasse Beijer resigned from his position as our Chief Operating Officer Europe. Mr. Beijer continues to be employed by us in a non-executive officer capacity, as Senior Advisor to the Chief Operating Officer Europe. Our Current Report on Form 8-K filed on December 15, 2008 provides additional details regarding his resignation.

ROBERT DOUGLAS

Chief Operating Officer, Asia Pacific

Robert Douglas has been Chief Operating Officer Asia Pacific since July 2008. Prior to this Mr. Douglas was Chief Operating Officer, Sydney. From April 2001 to November 2005, Mr. Douglas was Vice President of Operations and responsible for ResMeds Australian manufacturing, and was Vice President of Corporate Marketing. Before joining ResMed in 2001, and beginning in 1995, Mr. Douglas was the General Manager, Strategy and New Business for Keycorp Ltd., an Australian electronic commerce company providing services to major banks and telecommunications companies around the world. Before Keycorp, he held senior R & D and operational roles in Telectronics Pty Ltd., mainly working on the development of an implantable defibrillator. Mr. Douglas sits on the Board of Directors of Continence Control Systems International Pty Ltd, a private startup medical device company unrelated to ResMed. Mr. Douglas also sits on the Board of Directors of the Australian Science Media Centre (AusSMC) a nonprofit organization that facilitates media reporting of science. ResMed is a sponsor of AusSMC. Mr. Douglas has an M.B.A. from Macquarie University and a B.S. in Electrical Engineering and Computer Sciences from New South Wales University, Sydney.

STEIN JACOBSEN

Chief Operating Officer, Europe

Stein Jacobsen has served as ResMeds Chief Operating Officer Europe since January 1, 2009. He joined ResMed in 2005 as Chief Operating Officer Nordics, after the companys acquisition of PolarMed Holding AS, a Scandinavian medical equipment distributor that Mr. Jacobsen founded in 1993. Mr. Jacobsen served as COO Nordics until July 2007, when he became Senior

5

Table of Contents

Vice President of ResMeds Ventilation Strategic Business Unit. He continues to lead the Ventilation Strategic Business Unit in addition to his responsibilities as COO Europe. With over 20 years experience in the respiratory business, Mr. Jacobsen has founded and directed eight successful medical equipment distributors in the Scandinavian respiratory market. Mr. Jacobsen holds the equivalent of a B.Sc. in Clinical Engineering from the University of Stavanger, Norway.

DAVID PENDARVIS

Sr. Vice President, Organizational Development and General Counsel

David Pendarvis has been Sr. Vice President, Organizational Development since February 2005. Mr. Pendarvis has been Global General Counsel since he joined ResMed in September 2002, and from February 2003, has been Corporate Secretary. From September 2000 until September 2002, Mr. Pendarvis was a partner in the law firm of Gray Cary Ware & Freidenrich LLP, where he specialized in intellectual property and general business litigation. Until September 2000 he was a partner with Gibson, Dunn & Crutcher LLP, where he began working in 1986. From 1984 until 1986 he was a law clerk to the Hon. J. Lawrence Irving, US District Judge, Southern District of California. Mr. Pendarvis holds a B.A. from Rice University; a J.D., cum laude, from the University of Texas School of Law; and a Masters of Science in Executive Leadership from the University of San Diego.

BRETT SANDERCOCK

Chief Financial Officer

Brett Sandercock has been Chief Financial Officer since January 1, 2006. From November 2004 until December 31, 2005, Mr. Sandercock was Vice President, Treasury and Finance. Before that, from 1998 to November 2004, Mr. Sandercock was Group Accountant and then Controller. From March 1996 to August 1998 he was Manager, Financial Accounting and Group Reporting at Norton Abrasives, a division of the French multi-national, Saint Gobain. Mr. Sandercock also held finance and accounting roles from November 1994 to March 1996 at Health Care of Australia, a large private hospital operator in Australia. From 1989 to 1994, Mr. Sandercock worked at PricewaterhouseCoopers in Sydney, specializing in audits of clients predominantly focused on distribution and manufacturing, financial services and technology. Mr. Sandercock holds a B.Ec. from Macquarie University and is a Certified Chartered Accountant.

For a description of the business background of Dr. Farrell and Mr. Gallahue, see Matters to be Acted On/Election of Directors.

6

Table of Contents

Compensation Discussion and Analysis (CD&A)

Introduction

This Compensation Discussion and Analysis section discusses the compensation policies and programs for our named executive officers. During fiscal year 2009, our named executive officers were the Chief Executive Officer, our Chief Financial Officer and our three next most highly paid executive officers. This section also discusses the Compensation Committees role in the design and administration of these programs and policies and in making compensation decisions for our executive officers.

The Compensation Committee is a subcommittee of our Board of Directors. It decides matters regarding compensation of our executive officers. Compensation Committee members are independent directors who meet the standards for independence set by the US Securities and Exchange Commission, the New York Stock Exchange, and the Australian Securities Exchange. The Committee operates under a written charter adopted by our Board of Directors. We have posted a copy of the charter of the Compensation Committee on our Website, at www.resmed.com. During fiscal year 2009, Donagh McCarthy, Gary Pace, Richard Sulpizio and Ronald Taylor served as members of the Compensation Committee. Mr. Taylor served as Chair of the Compensation Committee during the entire fiscal year. Mr. McCarthy resigned from the board effective November 20, 2008, and as a result did not serve as a member of the Compensation Committee after that date.

General Philosophy and Objectives

We desire to attract, motivate and retain high quality employees who will enable us to achieve our short- and long-term strategic goals and values. We participate in a high-growth environment where substantial competition exists for skilled employees. Our ability to attract, motivate and retain high caliber individuals depends in large part on the compensation packages we offer.

We believe that our executive compensation programs should reflect our financial and operating performance. In addition, individual contribution to our success should be supported and rewarded. The objectives of our compensation programs are to:

| | align the interests of our executives with those of our stockholders through equity-based incentive awards, primarily in the form of stock options, that require stock price appreciation before any compensation is delivered to the executive; |

| | subject a significant portion of our executives compensation to the achievement of pre-established short-term corporate financial performance objectives or pre-established individual objectives thorough our annual cash incentive programs; and |

| | provide a total compensation program that is competitive with similarly-sized companies in the medical device and medical technology industries with which we compete for executive talent. |

Each element of our compensation program is designed to satisfy one or more of these compensation objectives and each element is an integral part of and supports our overall compensation objectives. Our executive compensation program primarily consists of:

| | a base salary; |

| | a potential cash bonus potential based on our short-term financial performance; and |

| | the opportunity to earn equity compensation linking the employees long-term financial success to the stockholders long-term financial success. |

The Compensation Committee considers each of these components individually, considers total cash compensation (salary plus on-target bonus amounts), and considers total direct remuneration (total cash compensation plus equity compensation) as a whole in making its decisions. During fiscal year 2009, the Committee determined that total cash compensation (assuming on target cash bonus) for its executive officers should be targeted between the 60th and 70th percentile; and that total cash compensation should be adjusted so that executives have comparatively modest salaries and a higher percentage of pay at risk in the form of annual cash incentive compensation. For fiscal year 2010, the Committee is reviewing the use of restricted stock units in order to provide a mix of awards that increases the capability of the Compensation Committee to manage more effectively our use of shares under our stock option plan, balance the leverage and risk provided by various equity vehicles, more closely conform with practices at our peer companies, and provide more tax-effective equity awards (particularly for our Australian-based executives).

7

Table of Contents

We are committed to a philosophy of total pay (the sum of cash compensation, equity compensation and benefits programs) being competitive within relevant markets when our performance meets target performance criteria set forth in our bonus programs. Total pay will typically lag the market when our performance is below the target performance criteria set forth in the bonus programs and may significantly exceed competitive levels when our performance is above the target performance criteria set forth in the bonus program.

Compensation Process

The Compensation Committee reviews and approves salaries, bonuses, equity-based compensation, and all other elements of the compensation packages offered to our executive officers, including the named executive officers, and establishes our general compensation policies.

In making its decisions, the Committee reviews data obtained from peer group companies and considers the recommendations of management and the advice of its independent compensation consultants regarding each element of compensation. Since fiscal 2007, the Compensation Committee has retained Frederic W. Cook & Co., Inc., an independent compensation consultant, to advise the Committee with respect to executive compensation matters for US executive officers. During fiscal 2009 the Committee also engaged the services of Hewitt Associates to advise regarding the compensation paid in Australia to the positions of Chief Financial Officer and Chief Operating Officer. The Committee reviewed the market practices and benchmarking data from the consultants and considered the Companys and the executive relative performance and the recommendations of the consultants when setting compensation. The Committee also considered the experience and knowledge of committee members regarding compensation practices for comparable positions. Although the Committee considers various sources of information and recommendations, ultimately, of course, the Committee relies on its own independent judgment.

Our Chief Executive Officer, our Executive Chairman, our Sr. Vice President Organizational Development, and other members of management provide input and recommendations to the Committee for their review and approval. In particular, all three officers make recommendations regarding the compensation to be paid to the other members of management. While the Compensation Committee gives consideration to these recommendations, it exercises independent judgments. Management provides to the compensation consultants and to the Committee historical and prospective breakdowns of total compensation components for each executive officer. Management also provides recommendations that include financial goals and criteria for our annual and long-term incentive plans. Management gathers the information it provides from consultants, the market and internal resources, allowing designs and strategies to be tied directly to our business needs. While management typically attends Compensation Committee meetings, the Committee Chairman excuses individual management members when deemed necessary for independent review or decision-making.

2009 In Review

During fiscal year 2009, the philosophy and objectives of the Compensation Committee relating to performance-based pay were reflected in overall executive compensation. At the outset of the year, the Committee increased the bonus amounts payable, as expressed as a percentage of salary, for named executive officers, reflecting a desire to base more of their compensation on performance and put more at risk, with a goal of paying above peer comparables if we achieved our targets. The Compensation Committee increased the bonus payable at target to 120% (from 100%) of salary for the CEO and the Executive Chairmen and to 70% of salary (from 65%) for the other executive officers.

During fiscal 2009, we exceeded our performance targets, despite challenging overall economic conditions. Bonus payments to our executive officers and other executive officers reflected this over-performance and were paid at amounts ranging from 111% to 126% of target bonus opportunity. Bonus payments exceeded target payments, were higher than lower-performing peer companies, and resulted in above median total cash compensation when compared to our peers. In contrast, although ResMeds stock price on the NYSE increased during the year (up 14% from June 30, 2008 through June 30, 2009), our stock price declined when measured on a 2- and 3- year basis (down 1% and down 13%, respectively). Thus, despite some short-term gains, at the end of the fiscal year our named executive officers had significant portions of their stock option portfolios out-of-the-money, aligning them with long-term shareholders. Together, this situation reflected our balanced pay-for-performance model where short-term cash incentives can be earned for goal achievement while there is no compensation delivered under the long-term plan because the stock price did not increase.

8

Table of Contents

Equity Ownership Guidelines for Officers and Directors

We believe that our officers and directors should be stockholders and have a financial stake in us, and we encourage them to own shares of our stock. In addition, our officers who are not board members are eligible (on the same basis as all other employees) to participate in our Employee Stock Purchase Plan, which provides them with the opportunity to purchase our stock at a discount through payroll deductions. Nevertheless, the number of shares of our stock any officer or director owns is a personal decision and, at this time, the board has chosen not to adopt a policy requiring ownership by officers or directors of a minimum number of shares.

Perquisites and Other Benefits

We provide certain of our named executive officers with perquisites and other personal benefits that the Compensation Committee believes are reasonable and consistent with our overall compensation programs and philosophy. These benefits are intended to be part of a competitive overall compensation program that will enable us to attract and retain these executives. These benefits are also intended to provide job satisfaction and enhance productivity, address healthcare needs, and provide stability of benefits. They are not tied to any formal individual or company performance criteria. The type and amount of these benefits is reviewed annually by our Compensation Committee. In reviewing these benefits, the Committee considers information from its independent compensation consultant on an annual basis regarding the prevalence and aggregate costs of benefits and perquisites at our peer companies.

Timing of Decisions

Generally, our executive officers compensation is adjusted each year effective as of October 1, the beginning of our second fiscal quarter. Accordingly, the Compensation Committee generally makes decisions on the principal components of executive officer compensation base salary, bonus potential, stock options, and perquisites during the first or second quarter. Specific performance bonus targets for executive officers are generally determined before or during the first month of the fiscal year for that year. Determination of actual performance versus targets and calculation of bonus payouts generally occur in the first two months following the end of our fiscal year. Bonus payments to our officers are made after the fiscal year-end audit is complete. If other executive compensation issues arise during the course of the year, the Compensation Committee takes those issues up on a case by case basis. Determinations regarding promotions are made contemporaneous with the promotions.

Peer Group Comparisons

In making its decisions on executive compensation, the Compensation Committee generally uses industry compensation surveys prepared by outside consultants. In August 2008, Frederic W. Cook & Co. Inc., the Committees independent compensation consultants, performed an executive compensation review based on current U.S. market compensation data from a peer group of 19 publicly traded medical device and medical technology companies. The companies comprising the peer group for the fiscal year 2009 review of executive compensation were:

| Advanced Medical Optics |

Intuitive Surgical | |

| Affymetrix |

Invitrogen Corp. |

|

| Applera |

Kinetic Concepts |

|

| Beckman Coulter |

Mentor Corp. |

|

| Charles River |

Perkinelmer |

|

| Dentsply International |

Respironics |

|

| Edwards Lifesciences |

STERIS Corporation |

|

| Gen-Probe |

Techne Corp. |

|

| Hologic |

Varian Medical Systems |

|

| Illumina |

The Compensation Committee believes that this peer group reflected a reasonable cross-section of our labor market for talent and included companies that our investors might consider in trying to determine the reasonableness of our pay and alignment of our pay with our performance. The Compensation Committee periodically reviews the composition of the peer group and the criteria

9

Table of Contents

and data used in compiling the list and considers modifications to the group. We select peer companies primarily on the basis of their being medical device or medical technology companies with a market capitalization, stockholder return, profitability, revenue and employee population roughly comparable to ours. In approving this peer group for fiscal year 2009, the Committee approved replacing two companies, Cytyc and Ventana, with Advanced Medical Optics and STERIS Corporation, as these companies appeared to be better aligned with the peer group.

The Compensation Committee also considered compensation survey data prepared by Hewitt Associates in August 2008. This report provided remuneration data for our Chief Financial Officer and our Chief Operating Officer-Sydney. In its analysis, Hewitt Associates compared these roles to approximately sixty large size Australian-based companies with annual revenues ranging from 500 million to 1 billion dollars, staff ranging from 10,001 to 25,000 employees and assets ranging from 2.5 billion to 10 billion in value.

The Committee determined that there was not an adequate comparable for Dr. Farrells position. As a founder and former Chief Executive Officer, it is not possible to develop meaningful market benchmarks; therefore, compensation is tailored to his role and time commitment.

Components of Compensation for 2009

Base Salary

Base salaries provide our executives with a degree of financial certainty and stability by guaranteeing a minimum amount of compensation for the role. In order to attract and retain highly qualified executives, we pay within salary ranges that are generally based on similar positions in companies of comparable size and complexity to us. The Compensation Committee begins its analysis by assessing each element of compensation (base salary, cash bonus and equity incentives) against peer company comparables. The peer group is comprised of companies in specific industry sectors that relate to our business. They are matched based on market capitalization, number of employees, net profit and numerous other factors to validate that the data is relevant in comparison to our executive positions. Using the peer group data, the Committee assesses base salaries at the 50th and the 60th percentiles with the goal of positioning base salary around the 60th percentile. Adjustments are made based on the final Committee assessment.

Salary adjustments are generally made annually in October, at the start of the second quarter of our fiscal year. In fiscal year 2009, the Committee approved the following base salaries based on competitive information provided by the consultants. The Committee authorized various percentage increases in order to bring each individual position closer to the median salary of like positions within the peer group. For Mr. Sandercock and Mr. Douglas, the amounts represent the US dollar equivalent of their Australian dollar-denominated salaries, based on exchange rates at the time of the approval and compared to region-specific comparative data. Mr. Douglass compensation includes a retroactive adjustment effective since January 1, 2009, to reflect his promotion from Chief Operating Officer Sydney, to Chief Operating Officer Asia Pacific. In addition, the impact of the currency conversions account for approximately 10% of the increased amounts of approved base salary pay for Mr. Sandercock and Mr. Douglas in 2009.

| Named Executive Officer/Position |

2009 Base Salary Approved by the Committee |

% Variance to Annualized Peer Target (60th Percentile) |

2008 Base Salary |

||||||||

| Peter Farrell Executive Chairman of the Board |

$ | 450,000 | (b) | $ | 450,000 | ||||||

| Kieran Gallahue President and Chief Executive Officer |

$ | 710,000 | -14 | % | $ | 675,000 | |||||

| Brett Sandercock Chief Financial Officer |

$ | 373,519 | (a) | -5 | % | $ | 309,375 | (c) | |||

| David Pendarvis Sr. Vice President, Organizational Development and General Counsel |

$ | 390,500 | -13 | % | $ | 355,000 | |||||

| Rob Douglas Chief Operating Officer Asia Pacific |

$ | 338,431 | (a) | -4 | % | $ | 268,125 | (c) | |||

10

Table of Contents

| (a) | These amounts were approved based on the average annual exchange rate used by the Company in setting its budget for fiscal year 2009. The AUD:USD exchange rate used was 0.9055. |

| (b) | Insufficient data for comparing this position, based in part on consideration of prior roles, to peer group. |

| (c) | These amounts were approved based on the average annual exchange rate used by the Company in setting its budget for fiscal year 2008. The AUD:USD exchange rate used was 0.8250. |

Annual Performance-Based Bonuses

The second compensation component is a cash bonus under our annual bonus program. The primary purpose of our annual bonus program is to motivate our executives to meet or exceed our company-wide and regional short-term operating performance objectives. The program is intended to share our success with eligible executives to the extent warranted by our performance and their individual performance, and to provide competitive compensation to eligible executives in a manner consistent with our philosophy of paying for performance. The bonus program is designed to qualify as a performance-based award under our 2006 Amended and Restated ResMed Inc. 2006 Incentive Award Plan as well as performance-based compensation for purposes of section 162(m) of the US Internal Revenue Code.

In setting appropriate bonus target amounts, the Compensation Committee reviewed the 50th, 60th, and 75th percentiles of peer comparables (both in terms of target amounts and amounts actually earned). The Committee also considers the potential effect of bonus targets on total cash compensation. The Committee reviews total cash compensation at peer comparables at those percentiles.

During fiscal year 2009, the Committee approved target bonus percentages for named executive officers, other than the Chief Executive Officer and the Executive Chairman of the Board, at 70% of base salary, and at 120% of base salary for the Chief Executive Officer and the Executive Chairman of the Board, representing increases from 65% and 100% respectively. These increases reflected the Committees assessment that the performance targets have historically and for fiscal 2009 represented stretch goals. Increases in the bonus target percentages from fiscal year 2008 also reflected the Compensation Committees preference to place a higher proportion of total cash compensation for these individuals at risk. The increased bonus percentages were designed to deliver total cash compensation at roughly the 60th percentile of comparable peers if those performance goals were achieved, while increasing the percentage of our officers cash compensation at risk and based on performance.

For fiscal year 2009, all of our named executive officers participated in a bonus compensation program based on overall corporate financial performance as measured against pre-established performance measures. The performance measures, weighting and percentage payout based on performance are substantially similar to those in effect for fiscal 2008. The bonus program structure is described in the following table with linear interpolation between and above the payout milestones listed below.

| Bonus Component |

Weighting | No payout |

50% payout |

100% payout |

150% payout |

Greater than 150% of payout |

||||||

| Global Revenue net sales |

50% | < 85% of target |

85% of target |

100% of target |

115% of target |

>115% of target |

||||||

| Profit net profit after tax as a % of revenue (proforma) |

50% | < 85% of target |

85% of target |

100% of target |

115% of target |

>115% of target |

||||||

Bonus payments for Dr. Farrell and Mr. Gallahue were based on a combination of global metrics as noted above, as well as specific target metrics. The company performance measures described above represented 80% of their total target bonus opportunity, or 96% of their salary at target. The additional specific performance targets represented 20% of their total target bonus opportunity, or 24% of their salary at target. The additional specific performance targets were as follows:

| | 5% of the 20% (6% of salary at target) based on growth in sales to specific customers; |

| | 5% of the 20% (6% of salary at target) based on executing certain pilot studies; and |

| | 10% of the 20% (12% of salary) based on launching new products. |

11

Table of Contents

The Compensation Committee approves the actual bonus amounts for executive officers before they are paid. For fiscal year 2009, applying the pre-determined bonus payment formula, the Committee approved a total global bonus percentage of 126% calculated with the following data:

| Bonus Component |

Target | Actual Performance |

Percentage Payout for the Metric |

Resulting Bonus Earned after Weighting |

||||||||||

| Global Revenue net sales |

$ | 961,188,000 | $ | 966,397,000 | 102 | % | 51 | % | ||||||

| Profit net profit after tax as a % of revenue (proforma) |

16.73 | % | 19.22 | % | 150 | % | 75 | % | ||||||

In addition, the Committee determined that Dr. Farrell and Mr. Gallahue achieved the targets in their additional performance measures related to customer sales and pilot studies; but that they did not achieve the targets related to product launches. Accordingly, they earned 10% of their target bonus, or 12% of their salary, based on these additional performance measures, resulting in payout of 111% of target bonus opportunity based on 126% performance of financial goals, weighted at 80%, and 50% performance of other goals, weighted at 20%.

The following table sets forth the 2009 target and actual bonus payments. The bonus targets for our Australian-based officers are based on the estimated US dollar equivalent described in the Base salary section above. The actual bonus amounts are based on the US dollar equivalent based on applicable average annual exchange rates.

| Named Executive Officer |

Annual Bonus Target % |

Annual Bonus Target $ |

Actual Bonus Pay |

Actual Bonus as a % of Target |

||||||||

| Peter Farrell Executive Chairman of the Board |

120 | % | $ | 540,000 | $ | 597,499 | 111 | % | ||||

| Kieran Gallahue President and Chief Executive Officer |

120 | % | $ | 852,000 | $ | 942,721 | 111 | % | ||||

| Brett Sandercock Chief Financial Officer |

70 | % | $ | 261,463 | $ | 270,773 | 126 | % | ||||

| David Pendarvis Sr. VP, Organizational Development and General Counsel |

70 | % | $ | 273,350 | $ | 343,902 | 126 | % | ||||

| Rob Douglas Chief Operating Officer Asia Pacific |

70 | % | $ | 236,901 | $ | 245,337 | 126 | % | ||||

Stock Options

The third major component of the named executive officers compensation provides a long-term incentive through equity participation. During fiscal year 2009, we provided this opportunity by granting our executive officers stock options. The primary purpose of granting stock options is to link the officers financial success to that of our stockholders, with the value of the options increasing only as the stock price increases.

We have generally provided annual option grants to our named executive officers each fiscal year. Initially, the Committee reviews the option grant history, historical burn rates, dilution overhang, and costs, and similar statistics among our peer groups. The Compensation Committee, after consulting as it deem appropriate with other board members, then sets an annual pool of options available for grants to employees at that years annual grant, as well as available for new-hire, promotional, and special situations until the next years annual grant.

During fiscal year 2009, the Committee approved a pool of 2.5 million options for company-wide use, the same number it had approved during fiscal year 2008. The net share usage after forfeitures during fiscal year 2009 was 2.7% as a percentage of shares outstanding, consistent with its 3-year average of 2.7%. Gross share usage during the fiscal year was 3.3% slightly above the 3-year average of 3.2%. The fair value of all options granted is fiscal year 2009 was $26.4 million compared to $31.8 million for

12

Table of Contents

fiscal year 2008. As a percentage of market capitalization, gross expense was 1.1% slightly above the 3-year average of 1.0%, while the net expense was 0.8% of market capitalization for both fiscal year 20098 and the 3-year average.

In determining the number of options granted to specific named executive officers, the Compensation Committee reviews company performance, the number of outstanding options available and the percentage of the pool represented by the proposed grant, the present value of the proposed grant, the existing option ownership, the number of options granted in the prior year and the three prior years, the carried interest ownership, and the grant practices of our peer group companies. The Compensation Committee reviewed Frederic W. Cooks August 2008 report concerning our historic equity grants and practices relative to those of our peer companies.

The consultant reported that our fiscal year 2008 and three-year average award levels were in a median range for the Chief Executive Officer and most other named executive officers. In fiscal year 2008, which is the data reviewed when making fiscal 2009 equity award determinations, the named executive officers option grants were below the market-cap adjusted median value in aggregate, and only the Chief Executive Officer was above the median, if his promotion award upon becoming CEO was compared to the regular annual awards provided to CEOs with ongoing service in the position.

The Committee considers adjustments to each of these elements of compensation based on market analysis, individual performance, the perceived value of the individual to the Company and other factors it deems relevant. The Committee also considers regional variation. For example, the base salaries for certain positions in other countries, when translated to US dollars, may reflect a different percentile when compared to US market peers than when compared to market peers in the executives home country. There are similar variations by region in the use of short-term and long-term incentives. The Committee attempts to balance the goal of paying consistent with the local market, with the goal of maintaining internal consistency in compensating executives in different regions.

Policies with Respect to Equity Compensation Awards

During fiscal year 2009, the Compensation Committee continued its preexisting policy to have its annual stock option grants to named executive officers and non-executive management effective on or about the annual stockholder meeting date. In setting this policy the Compensation Committee considered many factors, including the alignment of this date with the election of directors and the traditional October 1 salary adjustment date. This enables management and the Compensation Committee to combine the salary review process with the option grant process for consistency and administrative convenience and to make awards only after performance in the previous year is known. Also, given our traditional earnings release date in late October or early November, the stockholder meeting is likely to occur in an open window period. In addition, the stockholder meeting date is set and announced several months in advance, which provides transparency to the process. Based on these reasons, the Compensation Committee has set the Annual Meeting date as the target for our annual stock option grants, although the actual grant date (i.e., the date on which the Committee takes the formal action to make the grants) may vary by a few days from the Annual Meeting date due to administrative or other factors. The exercise price for such grants, however, will equal the closing price of our common stock on the actual grant date. In addition, the actual annual stockholder meeting date will be selected based on all relevant circumstances at the time.

The Compensation Committees policy with regard to granting stock options for promotions, new hire and other special situations is that such option grants must be properly approved in advance of or on the grant date and the grant date is to occur on the first business day of the month following the promotion, new hire or other special situation; unless the event occurs on the first business day of the month, in which case the grant may be made as of that day. The Compensation Committee has delegated authority to the Senior Vice President, Organizational Development to make grants to employees in connection with new hires, provided that the grants are not to executive officers, are within pre-determined guidelines approved by the Compensation Committee, and are consistent with the other practices relating to our stock option program. In fiscal year 2009, the Senior Vice President, Organizational Development made grants of an aggregate amount of 22,500 stock options, to individuals under this delegation.

Fiscal Year 2009 Equity Grants

For fiscal year 2009, the Committee reviewed survey data with median equity allocations for each officers position, except Dr. Farrell. The Committee determined there was not an adequate comparable for Dr. Farrells position. The Committee based Dr. Farrells grant on its perception of his level of contribution and effort, and the comparison to our other named executive

13

Table of Contents

officers. Mr. Gallahues grant was below median compared to ongoing CEOs, reflecting his short tenure in his current CEO role and the fact that his fiscal year 2008 grant was substantially above-median as a result of his promotion. The allocations for all other officers diverged from their individual market median comparables, but were equal to the median when measured in the aggregate. The Committee determined that setting grants at the median for all positions, inclusive of named executives and all other officers, was a more appropriate benchmark. The following table sets forth option grants provided to our named executive officers in fiscal year 2009 with comparisons to the relevant peer data.

| Named Executive Officer/Position |

2009 Option Grant |

Median Grant to Peer Group |

Variance of Grant to Peer Group Median |

|||||

| Peter Farrell Executive Chairman of the Board |

100,000 | (a) | (a) | |||||

| Kieran Gallahue Chief Executive Officer |

200,000 | 250,000 | -20 | % | ||||

| Brett Sandercock Chief Financial Officer |

70,000 | 95,000 | -26 | % | ||||

| David Pendarvis Sr. Vice President, Organizational Development and General Counsel |

70,000 | 95,000 | -26 | % | ||||

| Rob Douglas Chief Operating Officer Asia Pacific(b) |

70,000 | 50,000 | 40 | % | ||||

| (a) | Insufficient data for comparing this position to peer group. |

| (b) | Grant is in addition to a 20,000 promotional grant Mr. Douglas received in August 2008. |

Terms of Stock Options

Stock options were issued to our named executive officers during fiscal year 2009 in accordance with the 2006 Plan. The 2006 Plan requires that the exercise price of options equal the fair market value on the day of the grant, as measured by the closing price of our common stock on the NYSE on the grant date. Options are generally exercisable 25% per year on each anniversary of the grant date starting on the first anniversary of the grant date. In addition, as discussed below, vesting is automatically accelerated on a change of control. After vesting, options are exercisable for a maximum period of the earlier of: (1) seven years after the date of grant; or (2) one year after termination, retirement, death or disability.

Change of Control and Termination Arrangements

None of our named executive officers has an employment contract providing a right to continued employment. None has a contractual right to receive severance payments if employment is terminated (except in the event of certain change of control events, described below).

Our form of option award agreement for named executive officers provides:

| | an extended option exercise period of one year after termination of employment of the executive for any reason; and |

| | accelerated option vesting on a change of control. |

These extended exercise provisions are intended to facilitate financial planning after employment terminates and to ensure that the executive would be able to exercise options and sell the underlying shares when not in possession of material public information about us. In addition, the accelerated vesting provisions are intended to protect the expected economic benefit of the executives equity participation in the event of certain change of control transactions, and to make it easier to attract, retain, and motivate our key executives.

We have change in control agreements with each of our named executive officers and certain other members of our senior management team. These agreements provide certain change of control payments and benefits, including accelerated option vesting on a change of control. These agreements also provide for certain additional compensation and benefits, including severance

14

Table of Contents

payments based on a multiplier (based on position) of salary, bonus and other benefits, and limited tax-gross up payments, to be made to the named executive officers if their employment is terminated under specified circumstances within six months before or one year after a change of control. A description of the material terms of our change of control arrangements can be found beginning on page 28 of this proxy statement under Potential Payments on Termination or Change of Control Change of Control Agreements. These agreements are maintained in order to recruit and retain new executives, as well as to foster best efforts of management in the deliberation of a potential transaction. The Committee believes that such agreements may continue to attract senior level candidates to the Company in light of the relatively specialized nature of our product offerings and the continued potential for merger and acquisition activity in the medical technology market sector. Also, the Committee believes that the agreements assure appropriate motivation by senior management to evaluate potential transactions that may involve the Company. These agreements were reviewed and updated in immaterial ways to ensure compliance with section 162(m) and 409A of the US Internal Revenue Code during fiscal year 2009. These changes included slightly refined definitions for bonus compensation and good reason.

We also have stock option agreements for all employees that provide for accelerated option vesting on a change of control. We provide these vesting terms for employees who are not executive officers for reasons similar to those described above for our named executive officers. In addition, we believe it is consistent with our culture to provide similar benefits to all employees holding options.

Perquisites and Other Benefits

After review of Frederic W. Cooks report on August 18, 2009, the Committee did not make any material changes in the perquisites and other benefits we provided to our named executive officers. We provided the benefits described below. The incremental cost to us of these benefits is described in the Summary Compensation Table:

| | We provided comprehensive medical examinations to all of our named executive officers to promote their personal health and work/life balance. We believe this benefits us as well as the individuals through improved health, productivity and longevity. |

| | We provided certain named executive officers with access to corporate club memberships they may use for personal and business use, to promote work/life balance, enable business entertainment, and enhance community affiliations. |

| | We participate in a fractional aircraft interest program to provide for more efficient use of our executives time and to provide a more confidential and secure travel environment in which to conduct company business. The aircraft are primarily used for business purposes by our Executive Chairman of the Board, Chief Executive Officer and, to a lesser extent, other named executive officers, subject to Chief Executive Officer approval. We also make the aircraft available to the Executive Chairman of the Board for his personal use. Other named executive officers may travel for personal use together with the Executive Chairman of the Board. We reflect all personal use as a perquisite valued at our incremental costs as set forth in our Summary Compensation Table. The aggregate incremental cost to us for any personal use is reviewed at least annually by the Compensation Committee. Named executive officers may invite their spouses or guests to accompany them on the aircraft during specified business trips subject to space availability. Our Chief Executive Officer is authorized to make limited exceptions to this policy, if viewed as essential or appropriate under the circumstances. Aircraft use by a named executive officer, spouse or guest that does not constitute business use based on IRS guidance is treated as imputed income to the executive based on the IRS Standard Industry Fare Level. We do not reimburse the officers for taxes on the imputed income. In view of the increased productivity and security, we believe that these policies are appropriate to provide a comprehensive and competitive compensation package, particularly to our Executive Chairman of the Board and Chief Executive Officer. |

| | We provided certain of our named executive officers with benefits in connection with a sales incentive award travel program. This program is primarily targeted for sales personnel and other key management who regularly interact with our customers and to recognize their contributions to us. The Compensation Committee believes that participation by executive officers in this program enhances the overall sales incentive program and requires their attendance, to the extent determined by the appropriate operating officer. We provide these benefits on the same general basis as we provide to non-executives who qualify to participate in the program, including a tax gross-up, which is provided to all executive and non-executive participants so that they are not discouraged from participating by tax expenses attributable to this program. |

15

Table of Contents

| Our policy reflects the Compensation Committees belief that the named executive officers attendance at this program is a part of their general business duties. |

| | We also offer paid time off, medical plans, dental plans, vision plans, tax qualified defined contribution retirement plans (including matching contributions and government-mandated contributions), and disability and life insurance plans. Named executive officers generally are eligible to participate in these benefit programs on the same basis as other similarly-situated employees in their respective locations. |

Tax Considerations

Section 162(m) of the US Internal Revenue Code limits the US federal income tax deductions of publicly-traded companies to the extent total compensation for certain named executive officers exceeds $1 million in any one year. Under Section 162(m) the deduction limit does not apply to payments that constitute qualified performance-based compensation. Generally, objectively determinable performance bonus payments and option grants to our named executive officers are intended to constitute qualified performance-based compensation under Section 162(m) and not be subject to the Section 162(m) limit. However, in certain circumstances, the Committee may provide bonus payments, option grants, and other payments and awards that do not constitute qualified performance-based compensation if the Committee determines such payments and awards would be in the best interest of the Company. If compensation to certain named executive officers does not constitute qualified performance-based compensation, the Companys deduction for US federal income tax purposes for such compensation may be wholly or partially disallowed under Section 162(m). Payments under our bonus program for fiscal 2009 and our stock options grants are each intended to qualify as performance-based compensation for purposes of section 162(m) of the US Internal Revenue Code.

Sections 280G and 4999 of the Internal Revenue Code impose certain adverse tax consequences on excess parachute payments, which are compensatory payments or benefits that are contingent on a change in the control and exceed in the aggregate three times the executives base amount. Excess parachute payments are subject to a 20% excise tax and our compensation deduction in respect of the excess parachute payments is disallowed. If we were to be subject to a change of control, certain amounts received by our executives (for example, amounts attributable to the accelerated vesting of stock options and certain of the severance payments) could be excess parachute payments. The change of control agreements generally provide that tax gross up payments will be made only if the aggregate payments and distributions to the executive are 10% or greater than 2.99 times the executives base amount, as calculated under relevant US Internal Revenue Code provisions. These agreements were amended in fiscal year 2009 to ensure compliance with Section 409A and Section 162(m) of the Internal Revenue Code; the amendments were not material.

16

Table of Contents

The following table sets forth summary information concerning the compensation awarded, paid to, or earned by each of our named executive officers for all services rendered in all capacities to us for the fiscal years ended June 30, 2009, and fiscal year ended June 30, 2008, and June 30, 2007. We compensate our executive officers in their residences local currency. The compensation amounts for Australian-based named executive officers are presented in US dollars based on an average annual conversion rate determined on June 30, 2009. Mr. Gallahue assumed the role of Chief Executive Officer January 1, 2008, the same date Dr. Farrell ceased serving this role.

| Named Executive Officer and Principal Position |

Year | Salary(a) | Bonus | Option Awards(b) |

Non-Equity Incentive Plan Compensation(d) |

All Other Compensation(e) |

Total | |||||||||||||

| Peter Farrell |

2009 | $ | 450,000 | $ | 0 | $ | 1,622,856 | $ | 597,499 | $ | 140,656 | $ | 2,811,011 | |||||||

| Executive Chairman | 2008 | $ | 557,500 | $ | 40,000 | $ | 1,418,274 | $ | 294,179 | $ | 526,808 | $ | 2,836,761 | |||||||

| 2007 | $ | 613,958 | $ | 56,126 | $ | 1,153,669 | $ | 413,583 | $ | 171,483 | $ | 2,408,819 | ||||||||

| Kieran Gallahue |

2009 | $ | 701,250 | $ | 0 | $ | 1,746,025 | $ | 942,721 | $ | 47,723 | $ | 3,437,719 | |||||||

| President & Chief Executive Officer | 2008 | $ | 547,500 | $ | 0 | $ | 1,105,179 | $ | 495,336 | $ | 204,868 | $ | 2,352,883 | |||||||

| 2007 | $ | 400,000 | $ | 33,826 | $ | 445,211 | $ | 211,288 | $ | 138,014 | $ | 1,228,339 | ||||||||

| Brett Sandercock |

2009 | $ | 300,473 | $ | 0 | $ | 636,550 | $ | 270,773 | $ | 29,634 | $ | 1,237,430 | |||||||

| Chief Financial Officer | 2008 | $ | 325,286 | $ | 0 | $ | 463,222 | $ | 160,508 | $ | 31,627 | $ | 980,643 | |||||||

| 2007 | $ | 247,999 | $ | 17,096 | $ | 296,579 | $ | 106,791 | $ | 3,228 | $ | 671,693 | ||||||||

| David Pendarvis |

2009 | $ | 381,625 | $ | 0 | $ | 589,127 | $ | 343,902 | $ | 39,873 | $ | 1,354,527 | |||||||

| Sr. Vice President, Organizational Development and General Counsel | 2008 | $ | 347,500 | $ | 0 | $ | 426,687 | $ | 169,331 | $ | 26,923 | $ | 970,441 | |||||||

| 2007 | $ | 315,000 | $ | 21,715 | $ | 305,807 | $ | 135,642 | $ | 48,833 | $ | 826,997 | ||||||||

| Rob Douglas |

2009 | $ | 278,578 | $ | 0 | $ | 572,125 | $ | 245,337 | $ | 27,663 | $ | 1,123,703 | |||||||