DEF 14A: Definitive proxy statements

Published on October 2, 2013

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||

| x |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to § 240.14A-12 |

RESMED INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

|||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) |

Title of each class of securities to which transaction applies:

|

|||

|

|

||||

| (2) |

Aggregate number of securities to which transaction applies:

|

|||

|

|

||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

|

|

||||

| (4) |

Proposed maximum aggregate value of transaction:

|

|||

|

|

||||

| (5) |

Total fee paid:

|

|||

|

|

||||

| ¨ |

Fee paid previously with preliminary materials. |

|||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

| (1) |

Amount Previously Paid:

|

|||

|

|

||||

| (2) |

Form, Schedule or Registration Statement No.:

|

|||

|

|

||||

| (3) |

Filing Party:

|

|||

|

|

||||

| (4) |

Date Filed:

|

|||

|

|

||||

Table of Contents

Dear Stockholder,

We cordially invite you to attend the ResMed Inc. annual stockholders meeting on Thursday, November 14, 2013, at 10:00 a.m. Australian Eastern Daylight Time (Wednesday, November 13, 2013, at 3:00 p.m. US Pacific Time) in ResMeds Australian corporate office located at 1 Elizabeth Macarthur Drive, Bella Vista New South Wales 2153.

Your vote is important. We are again promoting the use of the internet to provide proxy materials to stockholders, as we believe this is an efficient, cost-effective and environmentally responsible method for facilitating our annual meeting. Please read VOTING INSTRUCTIONS AND GENERAL INFORMATION Voting by Attending our Annual Meeting in the proxy statement.

Very truly yours,

Peter C. Farrell

Executive Chairman of the Board

Table of Contents

Notice of Annual Meeting of Stockholders of ResMed Inc.

| Date: |

Thursday, November 14, 2013, at 10:00 a.m. Australian Eastern Daylight Time Wednesday, November 13, 2013, at 3:00 p.m. US Pacific Time |

|

| Location: |

ResMeds Australian corporate office 1 Elizabeth Macarthur Drive Bella Vista New South Wales 2153 Australia |

|

| Items of business: |

1. Elect two directors, each to serve a three-year term. The nominees for election as directors at the 2013 annual meeting are Carol Burt and Richard Sulpizio.

2. Ratify our selection of KPMG LLP as our independent auditors for the fiscal year ending June 30, 2014.

3. Approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in this proxy statement.

4. Approve an amendment to the ResMed Inc. 2009 Incentive Award Plan, which, among other things, increases the plan reserve by 8,345,000 shares, and which serves as approval for purposes of section 162(m) of the US Internal Revenue Code.

5. Transact other business that may properly come before the meeting. |

|

| Record date: |

You are entitled to vote only if you were a ResMed stockholder at the close of business on September 16, 2013, at 4:00 p.m., US Eastern Daylight Time. |

|

| Meeting admission: |

Stockholders are cordially invited to attend the annual meeting. If you plan to attend the meeting, you will need proof of share ownership as of 4:00 p.m. (US Eastern Daylight Time) on Monday, September 16, 2013, together with photo identification. If your shares are not registered in your name, you must bring proof of share ownership (such as a recent bank or brokerage firm account statement, together with proper identification) in order to be admitted to our annual meeting. Please also note that if your shares are not registered in your name and you wish to vote at our annual meeting, you must bring to our annual meeting a legal proxy from the record holder of the shares, which is the broker or other nominee, authorizing you to vote at our annual meeting.

If you cannot attend the meeting in person, you may vote your shares by toll-free number, by internet, or, if this proxy statement was mailed to you, by completing and signing the accompanying proxy card and promptly returning it in the envelope provided. Please read VOTING INSTRUCTIONS AND GENERAL INFORMATION in the proxy statement. |

|

By order of the board of directors,

David Pendarvis

Secretary

Table of Contents

| 1 | ||||

| 9 | ||||

| 16 | ||||

| Proposal 3: Advisory vote to approve named executive officer compensation |

17 | |||

| Proposal 4: Approval of the Amendment to the ResMed Inc. 2009 Incentive Award Plan |

21 | |||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 50 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| Philosophy and objectives of our executive compensation program |

57 | |||

| 59 | ||||

| 61 | ||||

| 63 | ||||

| 67 | ||||

| Terms of stock options, performance-based stock units, and restricted stock units |

70 | |||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 73 | ||||

| 74 | ||||

| 75 | ||||

| 75 | ||||

| 78 | ||||

| 80 | ||||

| 82 | ||||

| 82 | ||||

| 84 | ||||

| 86 | ||||

| 86 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 89 | ||||

| Common Stock Ownership of Principal Stockholders and Management |

90 | |||

| 92 | ||||

| 92 | ||||

| 92 | ||||

| Transaction of other business that may properly come before the meeting |

94 | |||

| 94 | ||||

| Appendix A: Amendment No. 2 to the ResMed Inc. 2009 Incentive Award Plan |

A-1 | |||

Table of Contents

Voting Instructions and General Information

Why am I receiving these materials?

You are receiving this proxy statement because the board of directors of ResMed Inc. is soliciting your proxy to vote at our 2013 annual meeting of stockholders and any continuation, postponement or adjournment of the meeting. The meeting is scheduled for Thursday, November 14, 2013, at 10:00 a.m. (Australian Eastern Daylight Time) in our Australian corporate office, located at 1 Elizabeth Macarthur Drive, Bella Vista New South Wales 2153 Australia. If you held shares of our stock on September 16, 2013, we invite you to attend the annual meeting and vote on the proposals described below under the heading What am I voting on? But you do not need to attend the annual meeting to vote your shares. Instead, you may vote over the internet, by telephone, or complete, sign, date, and return the enclosed proxy card by mail.

When and where are proxy materials available?

We expect to first make this proxy statement available to our stockholders and our holders of CHESS Units of Foreign Securities on the internet, and to mail notice and access materials on or about October 3, 2013. Our annual report on Form 10-K was filed with the US Securities and Exchange Commission (SEC) on August 13, 2013. You can review it on our website, at www.resmed.com, and at the website where our proxy materials are posted, at www.proxyvote.com and www.investorvote.com.au.

We encourage you to access and review all of the important information contained in the proxy materials before voting.

Voting Instructions

What am I voting on?

There are four proposals scheduled to be voted on at the annual meeting:

| 1. | Elect two directors specified in this proxy statement to serve until our 2016 annual meeting and until their successors are elected and qualified; |

| 2. | Ratify our appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending June 30, 2014; |

| 3. | Approve, on an advisory basis, the vote on the compensation we paid to our named executive officers, as described in this proxy statement; and |

| 4. | Approve an amendment to the ResMed Inc. 2009 Incentive Award Plan, which, among other things, increases the number of shares authorized for issue under the plan by 8,345,000 shares, and which serves as approval for purposes of section 162(m) of the US Internal Revenue Code. |

How does the board recommend that I vote?

Our board recommends that you vote:

| 1. | FOR electing each of the two directors; |

| 2. | FOR ratifying our appointment of KPMG as accountants; |

1

Table of Contents

| 3. | FOR, on an advisory basis, approving the compensation we paid to our named executive officers; and |

| 4. | FOR amending our 2009 Incentive Award Plan. |

Who can vote at the annual meeting?

You are entitled to vote or direct the voting of your ResMed shares if you were a stockholder of record, a beneficial owner of shares held in street name, or a holder of Clearing House Electronic Subregister System (CHESS) Units of Foreign Securities, as of 4:00 p.m. (US Eastern Daylight Time), on September 16, 2013, the record date for our annual meeting. As of the record date, there were 141,659,275 shares of ResMed common stock outstanding, excluding treasury shares. Treasury shares will not be voted. Each stockholder has one vote for each share of common stock held as of the record date. As summarized below, there are some distinctions between shares held of record, those owned beneficially in street name, and those held through CHESS Units of Foreign Securities.

What does it mean to be a stockholder of record?

If, on the record date, your shares of common stock were registered directly in your name with our transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the annual meeting or vote by proxy. Whether or not you plan to attend the annual meeting, we urge you to vote by the internet, by telephone, or to fill out and return the enclosed proxy card, to ensure your vote is counted.

What does it mean to beneficially own shares in street name?

If, on the record date, your shares of common stock were held in an account at a broker, bank, or other financial institution (we will refer to those organizations collectively as a broker), then you are the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker. The broker holding your account is considered the stockholder of record for purposes of voting at our annual meeting. As the beneficial owner, you have the right to direct your broker on how to vote the shares in your account. As a beneficial owner, you are invited to attend the annual meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your broker giving you the legal right to vote the shares at the annual meeting, as well as satisfy the annual meeting admission criteria described below.

Under the rules governing brokers, your broker is not permitted to vote on your behalf on any matter to be considered at the annual meeting (other than ratifying our appointment of KPMG) unless you provide specific instructions to the broker as to how to vote. As a result, we encourage you to communicate your voting decisions to your broker before the annual meeting date to ensure that your vote will be counted.

What does it mean to be a holder of CHESS Units of Foreign Securities?

CHESS Units of Foreign Securities are depositary interests issued by ResMed through CHESS, and traded on the Australian Securities Exchange (ASX). The depositary interests are frequently called CUFS, or CDIs. If you own ResMed CUFS or CDIs, then you are the beneficial owner of one ResMed common share for every ten CUFS or CDIs you own. Legal title is held by CHESS Depositary Nominees Pty Limited. CHESS Depositary Nominees are considered the stockholder of record for purposes of voting at our annual meeting. As the beneficial owner, you have the right to direct CHESS Depositary Nominees on how to vote the shares in your account. As a beneficial owner, you are invited

2

Table of Contents

to attend the annual meeting. However, since you are not a stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from CHESS Depositary Nominees giving you the legal right to vote the shares at the annual meeting, as well as satisfy the annual meeting admission criteria described below.

You will receive a notice from Computershare that will allow you to deliver your voting instructions over the internet. In addition, you may request paper copies of the proxy statement and voting instructions from Computershare by following the instructions on the notice provided by Computershare.

Under the rules governing CUFS and CDIs, CHESS Depositary Nominees are not permitted to vote on your behalf on any matter to be considered at the annual meeting unless you provide specific instructions to CHESS Depositary Nominees as to how to vote. As a result, we encourage you to communicate your voting decisions to CHESS Depositary Nominees before the annual meeting date to ensure that your vote will be counted.

How do I vote my shares before the annual meeting?

Holders of common stock listed on the New York Stock Exchange (NYSE). If you are a holder of common stock listed on the NYSE, you may vote before the meeting by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the internet or receiving a paper copy, and (2) for shares held as a record holder and shares held in street name. You may request paper copies of the proxy statement and proxy card by following the instructions on the Notice.

| | Holders of record. If you hold your shares of common stock as a record holder and you are viewing this proxy statement on the internet, you may vote by submitting a proxy over the internet by following the instructions on the website referred to in the Notice previously mailed to you. If you hold your shares of common stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the pre-addressed, postage-paid envelope provided to you, or by using the toll-free number, or by submitting a proxy over the internet using the instructions on the proxy card. |

| | Shares held in street name. If you hold your shares of common stock in street name, which means your shares are held on record by a broker, bank or nominee, you will receive the Notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the internet. |

Holders of CHESS Units of Foreign Securities listed on the ASX. If you hold our CHESS Units of Foreign Securities, you will receive a notice from Computershare, which will allow you to make your voting instructions over the internet. In addition, you may request paper copies of the proxy statement and voting instructions from Computershare by following the instructions on the notice provided by Computershare.

Internet voting closes in the US at 11:59 p.m. (US Eastern Time) on November 12, 2013, for shares traded on the NYSE and 10:00 a.m. (Australian Eastern Daylight Time) on November 13, 2013, for holders of CHESS Units of Foreign Securities listed on the ASX.

How do I vote at the annual meeting?

If you attend our annual meeting and wish to vote in person, you may vote your shares in person by requesting a ballot at our annual meeting. You will need to have proof of ownership and valid photo

3

Table of Contents

identification with you for admission to our annual meeting. Please note, however, that if your shares are held in street name, or if you hold CUFS or CDIs and you wish to vote in person, you must bring a legal proxy from the record holder of the shares, which is the broker or other nominee, or CHESS nominee, as applicable, authorizing you to vote at our annual meeting.

How can I revoke my proxy or change my vote?

You may revoke your proxy and change your vote at any time before the proxy is exercised by any of the following methods:

Holders of record

| | Delivering written notice of revocation to our secretary at our principal executive office located at 9001 Spectrum Center Boulevard, San Diego, California 92123 USA; |

| | Delivering another timely and later dated proxy to our secretary at our principal executive office located at 9001 Spectrum Center Boulevard, San Diego, California 92123 USA; |

| | Revoking by internet or by telephone before 11:59 p.m. (US Eastern Standard Time) on November 12, 2013, for shares traded on the NYSE and 10:00 a.m. (Australian Eastern Daylight Time) on November 13, 2013, for holders of CHESS Units of Foreign Securities listed on the ASX; or |

| | Attending the 2013 annual meeting and voting in person by written ballot. Please note that your attendance at the meeting will not revoke your proxy unless you actually vote at the meeting. |

Stock held by brokers, banks and nominees; and CHESS Units of Foreign Securities

| | You must contact your broker, bank or other nominee to obtain instructions on how to revoke your proxy or change your vote. You may also obtain a legal proxy from your broker, bank or other nominee to attend our annual meeting and vote in person by written ballot. |

What happens if I return the proxy card to ResMed but do not make specific choices?

If you return a signed, dated proxy card to us with a choice specified on a voting matter, we will vote your shares according to your choice. If you return a signed, dated proxy card to us but do not make specific choices, we will vote your shares as follows: (1) FOR each of the two nominees to our board; (2) FOR ratifying our selection of KPMG; (3) FOR approving, on a non-binding, advisory basis, the compensation we paid our named executive officers; and (4) FOR approval of the amendment to the ResMed Inc. 2009 Incentive Award Plan.

What does it mean if I received more than one proxy card?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

4

Table of Contents

GENERAL INFORMATION

What are broker non-votes and how are they counted?

If your broker holds your common stock in street name and you have not provided your broker with voting instructions, your broker may vote your shares in its discretion on proposals considered routine under NYSE rules. The only proposal considered routine is the proposal to ratify our auditor selection. If you do not provide direction to your broker with respect to this proposal, your broker may continue to exercise its discretion to vote your shares. The election of directors, the amendment to the ResMed Inc. 2009 Incentive Award Plan, and the advisory vote on executive compensation are not considered routine, and brokers do not have discretionary authority to vote on these matters without your direction. You must indicate to your broker how you wish to vote on any non-routine matter with respect to any shares you hold in street name or they will be considered a broker non-vote.

Broker non-votes will not affect the outcome of the election of our directors or the advisory vote regarding our executive compensation, as these matters are generally determined based on the number of votes cast and broker non-votes are not considered votes cast. Broker non-votes may have an effect on the proposal relating to the amendment of the incentive plan, since broker non-votes do not count as votes cast and this proposal requires at least 50% of the outstanding shares of common stock entitled to vote to be cast.

Your vote is important. We encourage you to submit your proxy, or provide instructions to your brokerage firm, bank or the CHESS nominee, as applicable. This will ensure that your shares are voted at our annual meeting.

How many shares must be present or represented to conduct business at the annual meeting?

A quorum of stockholders is necessary to hold a valid annual meeting. A quorum will be present if a majority of the outstanding shares entitled to vote are represented at our annual meeting. Shares represented by proxies that reflect abstentions or broker non-votes will be counted as shares represented at our annual meeting for purposes of determining a quorum. If there are insufficient votes to constitute a quorum at the time of the annual meeting, we may adjourn the annual meeting to solicit additional proxies.

On the record date we had outstanding 141,659,275 shares of common stock (excluding treasury shares), the holders of which are entitled to one vote per share. Accordingly, an aggregate of 141,659,275 votes may be cast on each matter to be considered at our annual meeting, and at least 70,829,638 shares must be represented at the meeting to have a quorum.

What is the voting requirement to approve each of the proposals?

Proposal 1 Directors will be elected by a majority of the votes cast in person or by proxy, which means that the number of votes cast for a candidate for director must exceed the number of votes cast against that candidate. Abstentions and broker non-votes do not count as a vote cast either for or against and will not affect the outcome of the election.

Under our boards policy, in uncontested elections, an incumbent director nominee who does not receive the required votes for re-election will continue to serve, but is expected to tender a resignation to the board. The nominating and governance committee, or another duly authorized committee of the board, will decide whether to accept or reject the tendered resignation, generally within 90 days after

5

Table of Contents

certification of the election results. We will publicly disclose the boards decision on the tendered resignation and the rationale behind the decision.

Proposal 2 The proposal to ratify our selection of KPMG LLP as our independent auditors for the fiscal year ending June 30, 2014, requires the affirmative vote of a majority of the aggregate votes cast in person or by proxy. Abstentions will not affect the outcome of this proposal. Brokers generally have discretionary authority to vote on the ratification of our independent auditors, so we do not expect broker non-votes to result from the vote on proposal 2. Any broker non-votes that may result will not affect the outcome of this proposal.

Proposal 3 The advisory vote to approve our executive compensation (say on pay vote) requires the affirmative vote of a majority of shares cast in person or by proxy. Abstentions and broker non-votes will not affect the outcome of this proposal. As an advisory vote, the results of this vote will not be binding on the board or the company. However, the board values the opinions of our stockholders and will consider the outcome of the vote when making future decisions on the compensation of our named executive officers and our executive compensation principles, policies and procedures.

Proposal 4 Approval of the proposed amendment to the ResMed Inc. 2009 Incentive Award Plan, requires the affirmative vote of a majority of shares cast in person or by proxy, provided that the total votes cast on the proposal represent over 50% of the outstanding shares of common stock entitled to vote on the proposal. Votes for and against and abstentions count as votes cast, while broker non-votes do not count as votes cast. All outstanding shares, including broker non-votes, count as shares entitled to vote. Thus, the total sum of votes for, plus votes against, plus abstentions, which are referred to as the NYSE Votes Cast, must be greater than 50% of the total outstanding shares of our common stock. Once this requirement is met, the number of votes for the proposal must be greater than 50% of the NYSE Votes Cast. The approval of an amendment to an equity plan is a matter on which brokers or other nominees are not empowered to vote without direction from the beneficial owner. Thus, broker non-votes can result from this proposal and make it difficult to satisfy the NYSE Votes Cast requirement. Abstentions have the effect of a vote against the proposal.

Who pays the costs of proxy solicitors?

The cost of soliciting proxies will be borne by us. After the original delivery of the Notice and other proxy soliciting material, further solicitation of proxies may be made by mail, telephone, facsimile, electronic mail, and personal interview by our regular employees, who will not receive additional compensation for the solicitation. We will also request that brokerage firms and other nominees or fiduciaries deliver the Notice and proxy soliciting material to beneficial owners of the stock held in their names, and we will reimburse them for reasonable out-of-pocket expenses they incur.

How can I see a list of stockholders?

Under Delaware law, a list of stockholders entitled to vote at our annual meeting will be available at the meeting and for ten days before our annual meeting in our principal executive office, located at 9001 Spectrum Center Boulevard, San Diego, California, 92123 USA, between the hours of 9:00 a.m. and 4:00 p.m. US Pacific Time.

How will I receive my proxy materials?

We are furnishing proxy materials (proxy statement and annual report on Form 10-K) to our stockholders via the internet, instead of mailing printed copies of proxy materials to each stockholder. Accordingly, we are sending a notice of internet availability of proxy materials (Notice) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial

6

Table of Contents

owners will be sending their own similar notice if your shares are listed on the NYSE. If you hold our CHESS Units of Foreign Securities listed on the ASX, you will receive your Notice from our ASX share registry, Computershare Limited. If you received the Notice by mail, you will not automatically receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review this proxy statement, our annual report on Form 10-K, and proxy voting card via the internet. The Notice also instructs you on how you may submit your proxy via the internet.

You can, however, still receive a hard copy of our proxy materials by following the instructions contained in the Notice on how you may request to receive your materials in printed form on a one-time or ongoing basis. Certain stockholders who have previously given us a permanent request to receive a paper copy of our proxy materials will be sent paper copies in the mail.

7

Table of Contents

Proposals

8

Table of Contents

Proposal 1: Election of directors

Our bylaws authorize a board of directors with between one and thirteen members, with the exact number to be specified by the board from time to time. Our board has currently authorized eight directors.

The board is divided into three classes. One class is elected every year at our annual meeting for a term of three years. The class of directors whose term expires in 2013 has two current members: Michael Quinn and Richard Sulpizio. Accordingly, two directors are to be elected at this annual meeting, who will hold office until the 2016 annual meeting or until the directors earlier death, disability, resignation, or removal. Mr. Quinn is not standing for re-election at this annual meeting.

On the nominating and governance committees recommendation, our board has nominated Carol Burt and Richard Sulpizio for election and re-election, respectively, as directors at this annual meeting. We are soliciting proxies in favor of these nominees and proxies will be voted for them unless otherwise specified. If Carol Burt or Richard Sulpizio becomes unable or unwilling to serve as director, the proxies will be voted for the election of such other person, if any, as the board designates. Ms. Burt was initially recommended as a potential board member by cSTONE & ASSOCIATES, a search consultant we retained.

Information concerning the nominees for director and the other directors who will continue in office after our annual meeting is set forth below:

| Current term expiration |

Age as of September 16, 2013 |

|||||

| Carol Burt |

- | 55 | Nominee for election | |||

| Richard Sulpizio |

2013 | 63 | Director, nominee for re-election | |||

| Michael Farrell |

2014 | 41 | Chief executive officer | |||

| Christopher Roberts |

2014 | 59 | Director | |||

| John Wareham |

2014 | 72 | Director | |||

| Peter Farrell |

2015 | 71 | Founder and executive chairman of the board | |||

| Gary Pace |

2015 | 65 | Director | |||

| Ronald Taylor |

2015 | 65 | Lead director |

9

Table of Contents

The following biographical information is furnished with regard to our directors (including nominees) as of September 16, 2013.

Nominees for election at our annual meeting to serve for a three-year term expiring at the 2016 annual meeting:

|

|

Carol Burt is a newly-nominated candidate for director.

Carol J. Burt, a principal of Burt-Hilliard Investments since 2008, is a private investor with more than 30 years of experience in operations, strategy, corporate finance and investment banking. Ms. Burt has served as an operating partner for Consonance Capital Partners, a New York-based private equity firm focused on the healthcare industry, since January 2013.

Ms. Burt serves on the board of WellCare Health Plans, Inc., a publicly-held managed care company focused on government-sponsored healthcare programs including Medicare and Medicaid plans; and Envision Healthcare, a publicly-held company providing physician-led outsourced medical services. |

|

| Ms. Burt chairs WellCares compensation committee and serves on the audit and finance and nominating and governance committees. She also serves on Envisions audit, finance, and nominating and governance committees. Ms. Burt qualifies as an audit committee financial expert. |

||

| Ms. Burt was formerly an executive of WellPoint, Inc., where she served from 1997 to 2007, most recently as WellPoints senior vice president, corporate finance and development. Ms. Burt was a member of the executive team that built WellPoint from a single state health plan to one of the US leading health benefits companies, with revenue of $61 billion. In her time at WellPoint, Ms. Burt was responsible for, among other things, corporate strategic planning and execution, mergers and acquisitions, strategic investments, finance, treasury, and real estate management. In addition, WellPoints financial services and international insurance business units reported to her.

Before joining WellPoint, Ms. Burt was senior vice president finance and treasurer at American Medical Response, a medical transportation company. Ms. Burt also spent 16 years at Chase Securities, Inc. (now JP Morgan), most recently as managing director and head of the healthcare investment banking group.

Ms. Burt served on the board of Vanguard Health Systems, Inc., a publicly-held hospital management company focused on developing regionally-focused integrated healthcare delivery networks through Vanguards acquisition by Tenet Healthcare on October 1, 2013. She also formerly served on the board of Transitional Hospitals Corporation, a publicly-held company that operated long-term care and psychiatric hospitals, and was a member of the advisory board of Psilos Group, a healthcare venture capital firm.

Ms. Burt graduated magna cum laude from the University of Houston, earning a bachelor of business administration degree, majoring in finance with a minor in accounting. In addition, Ms. Burt has completed advanced studies in business, finance, strategy and leadership through various universities including Rutgers Graduate School of Management, Darden Graduate School of Business, and The University of Chicago Graduate School of Business.

Ms. Burts skills and experience, particularly her 30 years of experience in operations, strategy, corporate finance and investment banking in the health insurance, healthcare services and financial services industries, combined with her board experience, led our board to the conclusion that she should serve as a director. |

||

10

Table of Contents

|

|

Richard Sulpizio has served as our director since August 2005. He is chair of our compensation committee.

From December 2009 until February 2013, Mr. Sulpizio served as president and chief executive officer of Qualcomm Enterprise Services, a division of Qualcomm Incorporated responsible for mobile communications and services to the transportation industry. He currently serves as a senior advisor to Qualcomm Enterprise Services. Mr. Sulpizio held numerous leadership positions with Qualcomm during his 20-year tenure there, including president and chief operating officer. He served as a member of Qualcomms board of directors from 2000 until 2007. Before joining Qualcomm, Mr. Sulpizio worked for eight years at Unisys Corporation, a diversified computer and electronics |

|

| company, and ten years at Fluor Corporation, an engineering and construction company. Mr. Sulpizio currently serves as a director of CA, Inc., an information technology management software company. He also serves as an honorary board member of the advisory board of the University of California San Diegos Sulpizio Family Cardiovascular Center and the board of directors of the Danny Thompson Memorial Leukemia Foundation. Mr. Sulpizio holds a B.A. from California State University, Los Angeles, and an M.S. in Systems Management from the University of Southern California. |

||

| Mr. Sulpizios background reflects significant executive and operational experience with publicly-held technology companies, including his service as the president and chief operating officer of Qualcomm, and seven years as a member of the Qualcomm boards strategic committee. In addition, Mr. Sulpizio also serves as a member of the compensation and governance committees of CA Technologies. Mr. Sulpizios experience and skills led our board to the conclusion that he should serve as a director. |

||

BOARD RECOMMENDATION

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE TWO NOMINEES TO THE BOARD OF DIRECTORS.

Directors continuing in office until our 2014 annual meeting:

|

|

Michael Farrell has served as our director since March 1, 2013.

Mr. Farrell has been our chief executive officer and a director since March 1, 2013. Before that appointment, he served as our president Americas from May 2011. He was previously our senior vice president, strategic business unit sleep from July 2007 to May 2011, and before that role he was our vice president, marketing for the Americas from June 2005 through July 2007, and prior to that he was our vice president, business development.

Before joining ResMed in September 2000, Mr. Farrell worked in management consulting and biotechnology, as well as in chemicals and steel |

|

| manufacturing at Arthur D. Little, Genzyme Corporation, The Dow Chemical Company, and BHP Billiton. |

||

| Mr. Farrell sits on the board of directors of the La Jolla Playhouse and the New Childrens Museum, San Diego.

Mr. Farrell holds a bachelor of engineering, with first-class honors, from the University of New South Wales, a master of science in chemical engineering from the Massachusetts Institute of Technology, and an M.B.A. from the MIT Sloan School of Management. |

||

11

Table of Contents

| Mr. Farrell was appointed to serve as a director on the board effective March 1, 2013, at the same time he was appointed as chief executive officer. Mr. Farrell does not serve on any of the boards committees. Mr. Farrells skills and over 13 years experience with ResMed and 20 years experience with technology and healthcare industries provides him with a unique and deep understanding of our operations, technology and market, and led our board to the conclusion that he should serve as a director. In addition, the board believes it appropriate for the chief executive officer to serve as a member of the board. |

||

| Mr. Farrells father, Dr. Peter Farrell, is our founder and chairman of the board. |

||

|

|

Christopher Roberts has served as our director since September 1992 and is a member of our audit committee. He also served as a director from August 1989 to November 1990.

Since February 2004, Dr. Roberts has been chief executive officer and president of Cochlear Limited, an ASX-listed hearing implant company for the treatment of severe and profound hearing impairment. Between August 1992 and January 2004 he was ResMeds executive vice president responsible for European and Asia Pacific activities. Between 1976 and 1989 he served in various positions in medical device companies, including president of BGS Medical (Denver, Colorado), an orthopedic implant company. |

|

| Dr. Roberts holds a B.E. in chemical engineering with honors from the University of New South Wales, an M.B.A. from Macquarie University, a Ph.D. in biomedical engineering from the University of New South Wales, and a Doctor of Science (honoris causa) from both Macquarie University and from University of New South Wales. He is a fellow of the Australian Academy of Technological Sciences and Engineering, a fellow of the Australian Institute of Company Directors, and a fellow of the Institution of Engineers Australia. He was a member of the National Health and Medical Research Council, Australias health and medical research and advisory body for the 2003-2006 triennium, and the chairman of Research Australia, a non-profit organization from 2004 to 2010. |

||

| Dr. Roberts knowledge of our business gained through his significant executive service as our executive vice president responsible for our European and Asia Pacific commercial operations, combined with his executive experience with other publicly-held international medical device companies, led our board to the conclusion that he should serve as a director. In particular, the board believes Dr. Roberts lengthy tenure as a director of ResMed, especially when combined with his experience as a senior executive with ResMed, provides valuable depth of understanding of ResMed and its business environment, and continuity with board decisions and discussions. The board also believes that directors with longer tenure are more willing to criticize and challenge management, thus providing more independence. In addition, the board believes that the length of time that has elapsed since Dr. Roberts was an executive of ResMed enhances his independence. The board also believes that Dr. Roberts background and ongoing experience as the chief executive officer of a global medical device company based in Australia provides an important perspective for the board. |

||

12

Table of Contents

|

|

John Wareham has served as our director since January 2005. He is chair of our audit committee and a member of our nominating and governance committee.

From September 1993 to January 2004, Mr. Wareham was the president of Beckman Coulter, Inc. a NYSE-listed biomedical company that develops and markets instruments, chemistries, software and supplies to simplify and automate laboratory processes. Mr. Wareham also served as chief executive officer from August 1998 to February 2005 and chairman from January 1999 to April 2005. Before joining Beckman Coulter in 1984, Mr. Wareham was president of Norden Laboratories, Inc., a wholly-owned |

|

| subsidiary of SmithKline Beckman. He first joined a predecessor of SmithKline Beckman Corporation in 1968. |

||

| Mr. Wareham is a director and non-executive chairman of STERIS Corporation, a NYSE-listed market leader in infection prevention, decontamination and health science technologies, products and services. Mr. Wareham previously served as a director on the boards of Beckman Coulter, Inc., Greatbatch, Inc. and Accuray Incorporated. From 2000-2001, Mr. Wareham served as chairman of the Advanced Medical Technology Association, or AdvaMed, a medical device industry trade association.

Mr. Wareham holds a B.S. in pharmacy from Creighton University in Omaha, Nebraska, and an M.B.A. from Washington University in St. Louis, Missouri.

Mr. Warehams background reflects significant executive and operational experience with publicly-held medical technology companies, including president, chief executive officer, and chairman of Beckman Coulter, as well as governance experience on other public companies boards. In particular, this experience includes more than five and six years of service on the STERIS compliance and compensation committees, respectively, six years of experience on the Greatbatch technology and audit committee and two years of experience on the Accuray governance committee. Mr. Warehams experience and skills led our board to the conclusion that he should serve as a director. |

||

Directors continuing in office until our 2015 annual meeting

|

|

Peter Farrell is the founder and executive chairman of ResMed and has been chairman and a director since our inception in June 1989. He served as chief executive officer from July 1990 until December 2007 when he became executive chairman. In February 2011, he resumed the role of chief executive officer until March 2013, when he resumed the role of executive chairman.

From July 1984 to June 1989, Dr. Farrell served as vice president, research and development at various subsidiaries of Baxter International, Inc., and from August 1985 to June 1989, he also served as managing director of the Baxter Center for Medical Research Pty Ltd., a Baxter subsidiary. From |

|

| January 1978 to December 1989, he was foundation director of the Graduate School for Biomedical Engineering at the University of New South Wales where he currently serves as a visiting professor and as chairman of the UNSW Centre for Innovation and Entrepreneurship. |

||

13

Table of Contents

| Dr. Farrell also serves on two faculty advisory boards at the University of California, San Diego: the Rady Business School and the Jacobs Engineering School. He holds a B.E. in chemical engineering with honors from the University of Sydney, an S.M. in chemical engineering from the Massachusetts |

||

| Institute of Technology, a Ph.D. in chemical engineering and bioengineering from the University of Washington, Seattle and a D.Sc. from the University of New South Wales for research contributions in the field of treatment with the artificial kidney. |

||

| Since 2005, Dr. Farrell has been a director of NuVasive, Inc., a NASDAQ-listed company which develops and markets products for the surgical treatment of spine disorders. He also serves as the non-executive chair of QRxPharma, a clinical-stage specialty pharmaceutical company listed on the ASX.

Dr. Farrell is a fellow or honorary fellow of several professional bodies, including a member of the National Academy of Engineering, to which he was elected in 2012. Dr. Farrell was named 1998 San Diego Entrepreneur of the Year for Health Sciences, Australian Entrepreneur of the Year in 2001 and US National Entrepreneur of the Year for Health Sciences in 2005. Dr. Farrell joined the Executive Council of the Division of Sleep Medicine at Harvard Medical School in 1998, served as vice chairman from 2000 until 2010 when he became chairman; he served in that capacity until May 2013.

Dr. Farrells role as our founder and chief executive officer for over 19 years provides him with a unique and deep understanding of our operations, technology and industry. In addition, his background reflects significant executive experience with other publicly-held medical technology companies and public company governance experience and training. This experience and training includes more than seven years of experience on the nominating and governance committee and one year of experience on the compensation committee of NuVasive, four years of experience on the nominations and remuneration committees of QRxPharma, as well as coursework specific to corporate governance from the Harvard Business School. Dr. Farrells experience and skills led our board to the conclusion that he should serve as a director. |

||

Dr. Farrells son, Michael Farrell, is our chief executive officer and one of our directors.

|

|

Gary Pace has served as our director since July 1994. He is a member of our nominating and governance committee and our compensation committee.

Dr. Pace is a co-founder, director, and consultant to QRxPharma Limited, a clinical-stage specialty pharmaceutical company listed on the ASX, and he was formerly the chairman and chief executive officer of a predecessor company to QRxPharma. In addition to ResMed, he serves as director of Transition Therapeutics, a NASDAQ and TSX-listed company developing new therapies, and as a director of Pacira Pharmaceuticals, a NASDAQ-listed specialty pharmaceutical company developing non-opioid products for post-surgical pain control. He is also a founder and director of Sova Pharmaceuticals, Inc., a privately-held pharmaceutical development company targeting central sleep apnea. |

|

| From 1995 to 2001, Dr. Pace was president and chief executive officer of RTPPharma, a developer of nano-articulate technology. From 2000 to 2002, Dr. Pace was chairman and chief executive officer of Waratah Pharmaceuticals Inc., a spin-off company from RTPPharma. From 1993 to 1994, Dr. Pace was the founding president and chief executive officer of Transcend Therapeutics Inc. (formerly Free Radical Sciences Inc.), a biopharmaceutical company. From 1989 to 1993, he was senior vice president of Clintec International, Inc., a Baxter/Nestle joint venture and manufacturer of clinical nutritional products. |

||

14

Table of Contents

| Dr. Pace holds a B.Sc. with honors from the University of New South Wales and a Ph.D. from Massachusetts Institute of Technology. He is a fellow of the Australian Academy of Technological Sciences and Engineering. |

||

|

Dr. Paces background reflects significant executive and operational experience in publicly-held pharmaceutical companies as well as scientific knowledge and directorial and governance experience. In 2011 the Corporate Directors Forum honored Dr. Pace as Director of the Year in Corporate Governance. His experience includes more than five years of service on the compensation committee of Peplin Inc., a specialty pharmaceutical company focused on advancing and commercializing innovative medical dermatology products listed on the ASX, seven years experience on the nominating and governance and compensation committees of Celsion Corp., an oncology drug development company listed on NASDAQ, and eight years experience as lead director and a member of the compensation and audit committees of Transition Therapeutics.

Dr. Paces executive and operational experience and skills led our board to the conclusion that he should serve as a director. In addition, the board believes Dr. Paces lengthy tenure as a director of ResMed provides valuable depth of understanding of ResMed and its business environment, and continuity with board decisions and discussions. The board also believes that directors with longer tenure are more willing to criticize and challenge management, thus providing more independence. The board also believes that Dr. Paces background and ongoing experience in pharmaceutical areas provides an important resource for the board.

|

||

|

|

Ronald Taylor has served as our director since January 2005 and our lead director since July 1, 2013. He is chair of our nominating and governance committee and a member of our compensation committee.

Mr. Taylor is a director of Actavis, Inc., a NYSE-listed specialty pharmaceutical company, and Red Lion Hotels Corp, a NYSE-listed hospitality company. From 2002 until his appointment to the ResMed board in 2005, he served as chairman of the ResMed Foundation.

In 1987, Mr. Taylor founded Pyxis Corporation, a manufacturer of automated drug dispensers for hospitals, where he served as chairman, president, and chief executive officer until its purchase by Cardinal Health, Inc., in 1996. For |

|

| six years before founding Pyxis, Mr. Taylor was responsible for operations and international sales at Hybritech, Inc., a biotechnology company. Before joining Hybritech, he served over 10 years in management roles at Allergan Pharmaceuticals. Mr. Taylor received a B.A. from the University of Saskatchewan and an M.A. from the University of California, Irvine.

Mr. Taylors background reflects significant executive and operational experience with publicly-held medical technology and pharmaceutical companies, including experience in evaluating and investing in healthcare companies as a partner in a venture capital firm, and public company governance experience. He has been a director of approximately 20 public and privately held companies over the past 20 years. In addition, he has more than 15 years of experience as a member of the Red Lion Hotels governance, compensation and audit committees, and more than 16 years of experience as a member of the Actavis (formerly Watson Pharmaceuticals) audit, compensation and governance committees. Mr. Taylors experience and skills led our board to the conclusion that he should serve as a director. |

||

15

Table of Contents

Proposal 2: Ratification of selection of KPMG LLP as our independent auditors for fiscal year ending June 2014

The audit committee has appointed the firm of KPMG LLP as our independent auditors for the fiscal year ending June 30, 2014. KPMG has served as our independent auditors since 1994. Neither the firm nor any of its members has any relationship with us or any of our affiliates except in the firms capacity as our auditor.

Stockholder ratification of the selection of KPMG LLP as our independent public auditors is not required by our bylaws or otherwise. However, the board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether to retain KPMG. Even if the selection is ratified, the audit committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if the audit committee determines that the change would be in our and our stockholders best interests.

We expect representatives of KPMG LLP to be present at the meeting. They will be able to make statements if they so desire and to respond to appropriate questions from stockholders.

BOARD RECOMMENDATION

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL OF THE RATIFICATION OF THE SELECTION OF KPMG LLP AS OUR INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING JUNE 2014.

16

Table of Contents

Proposal 3: Advisory vote to approve named executive officer compensation

Background

We are providing stockholders with an opportunity to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. This proposal is commonly known as a Say on Pay proposal.

In November 2011, our stockholders approved, on an advisory basis, that we conduct this vote annually. Based on that approval, our board decided that it will hold a Say on Pay vote annually, at least until the next required vote on the frequency of an advisory vote. Because the Say on Pay vote is advisory, it does not bind us. But the boards compensation committee, which consists entirely of independent directors, values our stockholders opinions, and will take the results of the Say on Pay vote into account when making future executive compensation decisions.

Summary

We are asking our stockholders to provide advisory approval of the compensation paid to the executive officers we have described in the Compensation Discussion and Analysis section of this proxy statement and the related executive compensation tables. Our executive compensation program is designed to:

| | provide a total compensation program that is competitive with similarly-sized companies in the medical device and medical technology industries with which we compete for executive talent; |

| | subject a significant portion of our executives compensation to the achievement of pre-established short-term corporate financial objectives through our annual cash incentive programs and our long-term shareholder value creation through our performance-based restricted stock unit (RSU) and performance-based stock unit (PSU) programs; and |

| | align the interests of our executives with those of our stockholders through equity-based incentive awards, in the form of stock options and RSUs, both of which align our executives financial rewards with those of our stockholders through appreciation of our stock price. |

In 2013, our compensation programs aligned well with our goals and objectives and we continued to implement best pay practices and policies.

Overview of fiscal year 2013 executive summary

Fiscal 2013 financial success.

| | During the 2013 fiscal year, we continued our trend of successful financial performance with 10% growth in net revenue, 21% growth in net income and 23% growth in diluted earnings per share. |

| | We attained strong one-, three-, and five-year absolute total stockholder returns (TSR) on the NYSE of 47%, 15% and 21%, respectively. Our relative TSR on the NYSE was above the 75th percentile of our US compensation peer group for the one- and three-year periods and approximated the median of our US compensation peer group for the three-year period. |

17

Table of Contents

| Similarly, we attained strong one-, three- and five-year absolute TSR on the ASX of 63%, 12%, and 22%, respectively. On a relative basis, as compared to our Australian peers, our ASX TSR for the one- and five-year periods are above the 75th percentile and for the 3-year period approximates the median. |

| | During fiscal year 2013, we began paying a quarterly dividend of $0.17 per share. In August 2013, we announced an increase in the dividend to $0.25 per share. |

Successful implementation of succession plan. Effective as of March 1, 2013, we implemented a chief executive officer succession plan with the appointment of Michael Farrell, our former president Americas, to serve as our chief executive officer. In conjunction with this appointment, Dr. Peter Farrell, the then-current chairman of the board, president and chief executive officer, was appointed to serve solely as the executive chairman of the board, and Robert Douglas, our then-chief operating officer also assumed the role of president, while James Hollingshead assumed the position of president Americas. In making these important management changes, the board noted Mr. Farrells leadership skills in sales, marketing, business development and commercial strategy, and Mr. Douglas expertise and excellent track record of increasing productivity and efficiencies of global operations.

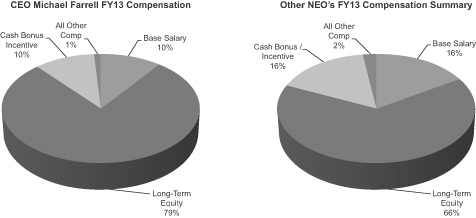

Compensation tied to performance. We believe that our executive officers were instrumental in achieving our positive financial results. We further believe that the compensation paid to our named executive officers for fiscal year 2013 reflects and is tied to their contributions to our success. During 2013, approximately 85% of our chief executive officers compensation, and 82% of our other named executive officers compensation was at risk and tied to our financial and stock price performance.

| | Annual cash awards reflect our improved performance in two key measures. Based on strong 2013 performance for adjusted revenue and adjusted EBITDA, we paid bonuses ranging from 101% to 118% of target bonus opportunity. These were the formulaic outcomes of the bonus plan based on achievement versus pre-established goals, and there was no discretion applied. We believe that the goals achieved reflected above-median performance based on benchmark performance data provided by the compensation committees independent compensation consultant. Our short-term bonus program has a minimum requirement that we achieve 85% of our target before any payment is received on that target, and the maximum payout is 200% of target bonus (which would require that we achieve 130% of our targeted metrics). We do not guarantee bonuses, or have multi-year guaranteed bonuses. |

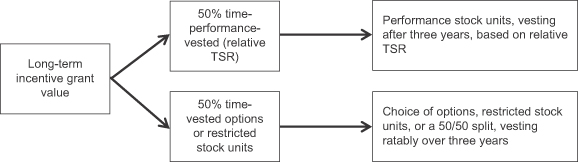

| | We implemented long-term performance-based equity awards. In order to better align our compensation with our performance and to tie managements interests with those of our stockholders, beginning in fiscal year 2013, we began granting 50% of the value of the equity grant made to executive officers as PSUs, measured over a three-year period beginning on the date of grant, with the ultimate number of shares to be received depending on ResMeds total stockholder returns compared to the total shareholder returns (TSRs) of companies included in the US Dow Jones Medical Device Index, a broad-based index of medical device companies. The PSUs require us to perform at the median of the index companies before any portion of the performance-based equity awards are earned. |

The other 50% of the value of our equity awards is granted in the form of either (1) stock options, or (2) restricted stock awards. Commencing in 2013, both the options and RSU awards vest over a three-year period, but the RSU awards are also subject to the performance condition that we achieve 50% of our budgeted net profit in our third and fourth quarters, either individually or combined. We believe this design best balances the competing considerations of pay-for-performance orientation, stockholder alignment, retention, and administrative complexity.

18

Table of Contents

Last years say on pay vote. At our 2012 annual meeting, approximately 81% of our stockholders voted to approve, on an advisory basis, the compensation paid to our executive officers disclosed in last years proxy statement. While the compensation committee believes this is a signal of support for our programs, it has taken strides in 2013 to further align the interests of our management with our stockholders and tie our compensation to our performance by introducing long-term performance based units. We believe that the company may have complexities in achieving a high say on pay vote that are not experienced by many of our competitors because of the dual listing of our shares in the US and Australia, as well as the fact that our compensation philosophy is consistent with our US peer companies. The US-based pay philosophy results in executive compensation that is different than the Australian model, with lower salary and higher equity value than our Australian peers. But we believe these arrangements best balance the competing philosophies and are in the best long-term interests of our stockholders because most of our executive officers are in the US, and we compete for talent mostly with companies that pay using US compensation structures.

Recent implementation of emerging best practices. Our compensation committee, assisted by its independent compensation consultant, continuously monitors emerging best executive compensation practices, particularly among our peer companies. In addition, we have continued to use compensation practices that we understand to be consistent with best practices, and do not have practices generally viewed as problematic.

| | Eliminated excise tax gross-ups in change of control agreements. Effective June 30, 2012, we revised all of our change of control agreements with our executive officers to eliminate any excise tax gross-ups. The agreements include instead a best pay limitation, which reduces the severance payments and benefits payable to the extent necessary so that no portion of any payments or benefits payable upon a change of control would be subject to excise tax. |

| | Limited change of control severance and no other severance. The cash severance on change of control is limited to a double-trigger (requiring both a change of control and a termination) and the highest multipliers are for our executive chairman and our chief executive officer, at 200% of salary and bonus. All of our named executive officers are employed at-will, without contracts, and have no right to severance on termination, except for terminations in the event of a change of control. |

| | Limited retirement plans. We do not provide supplemental pension plans for our named executives. Our executives in the US and Australia participate in our 401(k) plan and superannuation plan on the same statutory basis as all other employees. |

| | Equity award ownership guidelines. We have stock ownership guidelines for our executives and in 2013 increased the ownership guidelines for our directors. The guidelines require our executive chairman and our chief executive officer to hold ResMed stock with a value target of three times annual base salary, while other executive officers are required to hold at one and one-half times their annual base salaries. Members of our board are required to hold five times their annual retainer. As of the end of fiscal year 2013, each of our directors and named executive officers met their value target. |

BOARD RECOMMENDATION

The board believes that the information provided above and within the Compensation Discussion and Analysis section of this proxy statement demonstrates that our executive compensation program was designed appropriately and is working to ensure that managements interests are aligned with our stockholders interests to support long-term value creation.

19

Table of Contents

The following resolution will be submitted for a stockholder vote at the annual meeting:

RESOLVED, that the stockholders of ResMed approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in the Compensation Discussion and Analysis, compensation tables and narrative discussion of this proxy statement.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL, ON AN ADVISORY BASIS, OF THE EXECUTIVE COMPENSATION OF RESMEDS NAMED EXECUTIVE OFFICERS.

20

Table of Contents

Proposal 4: Approval of the Amendment to the ResMed Inc. 2009 Incentive Award Plan

We are asking our stockholders to approve an amendment (the Amendment) to the ResMed Inc. 2009 Incentive Award Plan, as approved by our stockholders on November 18, 2009 and subsequently amended and approved by our stockholders on November 17, 2011 (the 2009 Plan). The Amendment would provide for the following changes to the 2009 Plan:

| | Increase the number of shares of our common stock reserved for issuance under the 2009 Plan by 8,345,000 shares; |

| | Modify the method by which shares of common stock subject to full value awards are counted, such that the shares of common stock available for issuance under the 2009 Plan (a) will be reduced by 2.8 shares (instead of 3.0 shares) for each share of common stock subject to a full value award and reduced by one share for each share subject to a stock option or SAR, in each case, that is granted on or after June 30, 2013; and (b) will be increased by 2.8 shares (instead of 3.0 shares) for each share of common stock subject to a full value award, and one share for each share subject to an option or SAR in each case, that terminates, expires, lapses or is forfeited or is settled for cash or, with respect to full value awards, is tendered or withheld to satisfy tax withholding liabilities; |

| | Amend the performance criteria under the 2009 Plan to permit the grant of performance-based awards tied to achievement of the following additional performance goals: productivity, operating efficiency and return on net assets; |

| | Extend the term of the 2009 Plan from September 29, 2019 to September 11, 2023; |

| | Require that dividends, dividend equivalents, or stock or other property distributed as a dividend not be payable with respect to stock options or SAR or paid out on any unvested RSUs and require that dividends and dividend equivalents payable in connection with performance-based awards will only be paid to the extent that the performance-based vesting conditions are satisfied and the shares underlying the awards are earned and vest; |

| | Clarifies certain non-discretionary equitable adjustments to be made to the 2009 Plan and outstanding awards in the event of certain restructurings of our common stock; and |

| | Clarifies that the administrator may not amend a stock option to extend the term beyond its seven-year limit. |

We are also asking our stockholders to approve the 2009 Plan, as amended by the Amendment, to satisfy the stockholder approval requirements of section 162(m) of the US Internal Revenue Code.

On September 12, 2013, based on our compensation committees recommendation, our board approved and adopted the Amendment, subject to approval by our stockholders. The Amendment will become effective on its adoption by our board, subject to our stockholders approval at our 2013 annual stockholders meeting, except as otherwise provided in this Proposal 4. Unless and until our stockholders approve the Amendment, we will continue to grant awards under the 2009 Plans terms and from the shares available for issuance under the 2009 Plan, without regard to the Amendment proposed in this Proposal 4. We will not grant any awards under the changes proposed in this Amendment unless and until our stockholders approve this Proposal 4.

Accordingly, if our stockholders do not approve this Proposal 4, we will not be able to grant performance-based awards tied to the achievement of the additional performance criteria for which we

21

Table of Contents

are seeking approval. If this Proposal 4 is not approved by our stockholders, we may continue to grant performance-based compensation under the current terms of the 2009 Plan (without regard to the Amendment) within the meaning of section 162(m) of the US Internal Revenue Code, subject to the terms and limitations of the current 2009 Plan until our 2014 annual meeting of stockholders, based on our stockholders November 18, 2009 approval of the 2009 Plan, and we expect that, absent stockholder approval of the proposal set forth in this Proposal 4, we will seek stockholder approval of the material terms of the performance goals under the 2009 Plan at the 2014 annual meeting of stockholders.

Stockholder approval of the Amendment is necessary for us to (1) meet the stockholder approval requirements of the NYSE; (2) take tax deductions for certain compensation resulting from awards granted under the 2009 Plan that may be intended to qualify as performance-based compensation under section 162(m) of the Internal Revenue Code; and (3) grant incentive stock options (ISOs) under the 2009 Plan.

Specifically, stockholder approval of the Amendment will constitute approval of the material terms of the performance goals set forth in the 2009 Plan under the stockholder approval requirements of section 162(m) of the Internal Revenue Code, which will enable us to continue to award performance-based compensation within the meaning of section 162(m) through our 2018 annual meeting of stockholders, preserving the deductibility of these awards for federal income tax purposes. In addition, approval of the Amendment will constitute approval under the stockholder approval requirements of section 422 of the US Internal Revenue Code, relating to ISOs.

Introduction

We believe that equity and incentive awards are an important way to attract and retain a talented executive team and align the executives interests with our stockholders interests. The 2009 Plan was approved by our stockholders in 2009 and currently, without giving effect to the proposed Amendment, authorizes 35,475,000 shares for issuance under the Plan since the Plans inception. As of June 30, 2013, there were 10,654,934 shares remaining available for future awards under the 2009 Plan. The Amendment provides for an increase in the authorized and available shares by 8,345,000 shares, less any grants made between June 30, 2013, and the date our stockholders approve the Amendment (counted at the new 2.8-to-1 ratio for full value awards). The Amendment results in an aggregate number of shares authorized for issuance under the Plan since its inception of 43,820,000. After giving effect to the share increase in the Amendment, and presuming no awards are granted between June 30, 2013, and the date of the annual stockholder meeting, there will be no more than 18,999,934 shares available for grant under the Plan.

In deciding to approve the Amendment, our board and compensation committee reviewed reports prepared by Frederic W. Cook & Co., Inc. (FW Cook), our independent compensation consultant, which included an analysis of certain metrics related to the 2009 Plan, as proposed to be amended by the Amendment (the Amended Plan or the incentive plan), including burn rate, dilution and overhang, and the costs of the incentive plan, including the estimated stockholder value transfer cost. Specifically, our board and compensation committee considered that:

| | For fiscal years 2011-2013, our three-year adjusted average net burn rate was 2.56% of the fully diluted common shares outstanding. For fiscal year 2013, the burn rate was 3.48%. This calculation gives effect to full value award multipliers and is net of forfeitures. See detail in Burn Rate and Overhang below. |

| | If we do not increase the shares available for issuance under our 2009 Plan, then based on our historical share usage rates, we would expect to exhaust the share limit under the 2009 |

22

Table of Contents

| Plan by the end of fiscal year 2015, at which time we would lose an important compensation tool aligned with stockholder interests to attract, motivate and retain highly qualified talent. |

| | At the end of fiscal year 2013, our end of year overhang rate was 12.1%, calculated by dividing (i) the number of shares subject to equity awards outstanding at the end of the fiscal year plus the number of shares remaining available for issuance under our incentive plan by (ii) the number of our shares outstanding at the end of the fiscal year. If approved, issuing the additional shares to be reserved under the 2009 Plan would dilute stockholders holdings by an additional 4.8% on a fully-diluted basis, based on the number of shares of our common stock outstanding as of June 30, 2013. Accordingly, if the Amendment is approved, we expect our overhang at the time of the 2013 annual stockholders meeting will be approximately 16.9%. |

Stockholder approval of the Amendment will allow us to continue to provide equity awards as part of our compensation program, an important tool for motivating, attracting and retaining talented employees and for creating stockholder value. If we do not increase the shares available for issuance under the 2009 Plan, we would expect to exhaust the share limit under the 2009 Plan by the end of fiscal year 2015, based on historical usage. This would cause us to lose an important compensation tool, and may compel us to increase the cash component of employee compensation because we would need to replace components of compensation previously delivered in equity awards. Replacing equity compensation with cash may lead to a greater cash compensation expense and a decrease in cash flow.

If our stockholders do not approve this Proposal 4, we will seek stockholder approval of the material terms of the performance goals under the 2009 Plan at our 2014 annual meeting of stockholders, so we may continue to grant performance-based compensation within the meaning of section 162(m) of the US Internal Revenue Code. If our stockholders do not approve the performance criteria under the 2009 Plan at our 2014 annual meeting of stockholders, we will lose the tax deduction for grants of performance-based awards to our named executive officers that are intended to qualify as performance-based compensation under section 162(m). Currently, our annual cash incentive program, our PSUs (which typically comprise 50% of the equity value granted to our executives) and our performance-based RSUs are all intended to qualify as performance-based compensation under Section 162(m). Because these awards are key to our executive compensation program, the loss of this tax deduction will put us at a disadvantage and will compromise our executive compensation program.

The compensation committee, which administers the 2009 Plan, recognizes its responsibility to strike a balance between stockholder concerns regarding the potential dilutive effect of equity awards and the ability to attract, retain and reward employees whose contributions are critical to the long-term success of ResMed. The incentive plan reflects a broad range of compensation and governance best practices, including the following key features:

| | Limitations on grants. The maximum aggregate number of shares with respect to one or more awards that may be granted to any one person during any calendar year is 3,000,000 shares or $3,000,000 with respect to cash-based performance awards. However, the maximum aggregate number of shares may be adjusted to take into account equity restructurings and certain other corporate transactions as described below, the issuance of rights and certain other events described in the incentive plan. |

| | No or replacement of options or stock appreciation rights. The incentive plan prohibits us from, without stockholder approval: (1) amending options or stock appreciation rights to reduce the exercise price, (2) cancelling any outstanding option or stock appreciation right in exchange for cash or another award (other than in connection with a change of control); or (3) taking any other action with respect to an option or stock appreciation right that would be treated as a repricing under the rules and regulations of the principal US national securities exchange on which the shares are listed. |

23

Table of Contents

| | Limited dividends or dividend equivalents. The Amendment requires that dividends and dividend equivalents payable in connection with performance-based awards will only be paid out to the extent that the performance-based vesting conditions are satisfied and the shares underlying the awards are earned and vested. In addition, our policy is not to pay dividends or dividend equivalents on restricted stock, RSUs, or PSUs that vest or are earned based on performance conditions unless and until the performance conditions have been met and the award vests or is earned. The incentive plan requires that dividends and dividend equivalents not be payable with respect to stock options or SARs or paid out on any unvested RSUs. |

| | No in-the-money option or stock appreciation right grants. The incentive plan prohibits us from granting options or SARs with an exercise or base price less than the fair market value, generally the closing price, of our common stock on the date of grant. |

| | Section 162(m) qualification. The incentive plan is designed to allow awards made under the incentive plan, including equity awards and incentive cash bonuses that are intended to qualify as performance-based compensation under section 162(m) of the US Internal Revenue Code. |

If our stockholders approve this Proposal 4, their approval will be considered approval of the incentive plan for purposes of sections 162(m) and 422 of the US Internal Revenue Code.

Burn rate and overhang

In administering our equity program, we consider both our net burn rate and our overhang.

We define net burn rate as the number of equity awards granted in the year, net of cancellations and expirations, divided by the sum of the undiluted weighted average shares of our common stock outstanding during the year. The net burn rate measures the potential dilutive effect of our annual equity grants. During the previous three fiscal years, we granted the equity awards, and experienced the forfeitures set forth below:

| ResMed average annual equity usage |

3-year average |

|||||||||||||||

| FY2013 | FY2012 | FY2011 | (FY2011-2013) | |||||||||||||

| Options Granted |

444,766 | 791,265 | 1,032,800 | 756,277 | ||||||||||||

| Time-vested RSUs Granted |

994,621 | 1,220,335 | 992,479 | 1,069,145 | ||||||||||||

| Target PSUs Granted |