EX-99.1

Published on January 29, 2019

Exhibit 99.1

Board of Directors

MatrixCare Holdings, Inc. and Subsidiaries

Report on the Financial Statements

We have audited the accompanying consolidated financial statements of MatrixCare Holdings, Inc. and its subsidiaries (the Company), which comprise the consolidated balance sheet as of December 31, 2017, the related consolidated statements of operations, stockholders' equity and cash flows for the year then ended, and the related notes to the consolidated financial statements (collectively, the financial statements).

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of MatrixCare Holdings, Inc. and its subsidiaries as of December 31, 2017, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Emphasis of Matter

As discussed in Note 9 to the financial statements, the Company was acquired by a public company on November 13, 2018. The Company had previously adopted the private company accounting alternative Accounting Standards Update (ASU) No. 2014-02, Intangibles—Goodwill and Other (Topic 350): Accounting for Goodwill, issued by the Financial Accounting Standards Board. The Company has changed their accounting principle to reverse the effects of this adoption as a result of the acquisition. Our opinion is not modified with respect to this matter.

/s/ RSM US LLP

Minneapolis, Minnesota

April 3, 2018, except for Note 9, as to which the date is January 28, 2019

1

MatrixCare Holdings, Inc. and Subsidiaries

CONSOLIDATED BALANCE SHEETS

|

|

|||||

|

|

September 30, |

December 31, |

|||

|

|

(Unaudited) |

(Adjusted) |

|||

|

Assets |

|||||

|

Current assets: |

|||||

|

Cash |

$ |

15,293,246 |

$ |

3,602,748 | |

|

Restricted cash |

3,454,281 | 3,860,045 | |||

|

Accounts receivable, less allowance for doubtful accounts of $2,958,759 and $1,697,414, respectively |

18,230,025 | 16,248,218 | |||

|

Prepaid expenses and other current assets |

6,730,237 | 3,781,694 | |||

|

Deferred costs |

536,775 | 1,686,932 | |||

|

Total current assets |

$ |

44,244,564 |

$ |

29,179,637 | |

|

Non-current assets: |

|||||

|

Deferred costs |

3,017,762 | 1,350,484 | |||

|

Property and equipment, net |

5,695,179 | 6,957,610 | |||

|

Software development costs, net |

15,099,827 | 11,952,528 | |||

|

Goodwill |

213,837,806 | 213,858,344 | |||

|

Intangible assets, net |

82,762,070 | 93,691,923 | |||

|

Other assets |

530,747 | 559,666 | |||

|

Total non-current assets |

320,943,391 | 328,370,555 | |||

|

Total assets |

$ |

365,187,955 |

$ |

357,550,192 | |

|

Liabilities and Stockholders’ Equity |

|||||

|

Current liabilities: |

|||||

|

Current maturities of long-term debt, net of discounts |

$ |

149,421,194 |

$ |

1,162,500 | |

|

Accounts payable |

4,838,073 | 5,427,801 | |||

|

Accrued expenses |

9,111,050 | 4,950,095 | |||

|

Deferred revenue |

24,340,732 | 21,904,258 | |||

|

Related-party payable |

243,716 | 275,000 | |||

|

Total current liabilities |

$ |

187,954,765 |

$ |

33,719,654 | |

|

Non-current liabilities: |

|||||

|

Long-term debt, net of discounts and current maturities |

- |

148,512,729 | |||

|

Deferred revenue |

3,440,768 | 3,107,905 | |||

|

Deferred income taxes |

17,313,000 | 17,313,000 | |||

|

Other long-term liabilities |

994,248 | 1,162,778 | |||

|

Total non-current liabilities |

$ |

21,748,016 |

$ |

170,096,412 | |

|

Total liabilities |

$ |

209,702,781 |

$ |

203,816,066 | |

|

Commitments and contingencies (note 2, 4 and 6) |

|||||

|

Stockholders’ equity: |

|||||

|

Common stock, Class A, $.01 par value; 1,348,807 shares issued as of September 30, 2018 and December 31, 2017, respectively Class B; $.01 par value, 120 shares issued |

13,490 | 13,490 | |||

|

Treasury stock |

(144,164) | (144,164) | |||

|

Additional paid-in capital |

175,285,795 | 174,918,961 | |||

|

Accumulated deficit |

(19,669,947) | (21,054,161) | |||

|

Total stockholders’ equity |

$ |

155,485,174 |

$ |

153,734,126 | |

|

Total liabilities and stockholders’ equity |

$ |

365,187,955 |

$ |

357,550,192 | |

See accompanying notes to consolidated financial statements.

2

MatrixCare Holdings, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|||||

|

|

Nine Months Ended |

Year Ended |

|||

|

|

(Unaudited) |

(Adjusted) |

|||

|

|

|||||

|

Revenues |

$ |

88,061,255 |

$ |

105,645,260 | |

|

Cost of revenues |

24,157,515 | 31,504,990 | |||

|

Gross profit |

63,903,740 | 74,140,270 | |||

|

Operating expenses: |

|||||

|

Selling, general, and administrative |

33,900,351 | 46,075,609 | |||

|

Depreciation expense |

2,535,858 | 3,427,391 | |||

|

Amortization expense |

16,506,541 | 22,438,955 | |||

|

Operating income |

10,960,990 | 2,198,315 | |||

|

|

|||||

|

Other income |

(11,130) | (17,219) | |||

|

Interest expense |

9,086,727 | 9,621,968 | |||

|

Income (loss) before income tax expense (benefit) |

1,885,393 | (7,406,434) | |||

|

Income tax expense (benefit) |

501,179 | (11,174,465) | |||

|

Net income |

$ |

1,384,214 |

$ |

3,768,031 | |

See accompanying notes to consolidated financial statements.

3

MatrixCare Holdings, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

|

|

||||||||||||

|

|

Class A Common |

Class B Common |

Treasury |

Additional |

Accumulated |

Total Stockholders' Equity |

||||||

|

Balances at December 31, 2016 (adjusted) |

$ |

13,491 |

$ |

1 |

$ |

- |

$ |

174,597,997 |

$ |

(24,747,192) |

$ |

149,864,297 |

|

Issuance of Class A Common Stock for acquisition of SigmaCare, Inc. |

6 |

- |

- |

99,994 |

- |

100,000 | ||||||

|

Share repurchases of Class A Common Stock |

(8) |

- |

(144,164) |

- |

- |

(144,172) | ||||||

|

Class B Common Stock Dividend |

- |

- |

- |

- |

(75,000) | (75,000) | ||||||

|

Stock option exercises |

- |

- |

- |

(153,050) |

- |

(153,050) | ||||||

|

Stock based compensation |

- |

- |

- |

374,020 |

- |

374,020 | ||||||

|

Net income |

- |

- |

- |

- |

3,768,031 | 3,768,031 | ||||||

|

Balances at December 31, 2017 (adjusted) |

$ |

13,489 |

$ |

1 |

$ |

(144,164) |

$ |

174,918,961 |

$ |

(21,054,161) |

$ |

153,734,126 |

|

Stock based compensation |

- |

- |

- |

366,834 |

- |

366,834 | ||||||

|

Net income |

- |

- |

- |

- |

1,384,214 | 1,384,214 | ||||||

|

Balances at September 30, 2018 (unaudited) |

$ |

13,489 |

$ |

1 |

$ |

(144,164) |

$ |

175,285,795 |

$ |

(19,669,947) |

$ |

155,485,174 |

See accompanying notes to consolidated financial statements.

4

MatrixCare Holdings, Inc. and Subsidiaries

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|||||

|

|

Nine Months Ended September 30, 2018 |

Year Ended |

|||

|

|

(Unaudited) |

(Adjusted) |

|||

|

Cash flows from operating activities: |

|||||

|

Net income |

$ |

1,384,214 |

$ |

3,768,031 | |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|||||

|

Depreciation of property and equipment |

2,535,858 | 3,427,391 | |||

|

Provision for doubtful accounts |

1,433,813 | 1,609,153 | |||

|

Stock based compensation expense |

366,834 | 374,020 | |||

|

Amortization of software development costs |

5,576,688 | 6,730,055 | |||

|

Amortization of intangible assets |

10,929,853 | 15,708,900 | |||

|

Amortization of debt discount |

520,965 | 567,707 | |||

|

Disposals of property and equipment |

(16,054) | 56,625 | |||

|

Deferred taxes |

- |

(11,403,783) | |||

|

Changes in operating assets and liabilities, net of acquisition: |

|||||

|

Accounts receivable |

(3,415,620) | (6,138,625) | |||

|

Prepaid expenses |

(517,121) | (1,098,962) | |||

|

Deferred costs |

(2,919,624) | 205,974 | |||

|

Accounts payable |

(915,774) | 679,559 | |||

|

Accrued expenses |

3,981,679 | (1,495,904) | |||

|

Deferred revenue |

2,769,337 | (1,138,016) | |||

|

Net cash provided by operating activities |

$ |

21,715,048 |

$ |

11,852,125 | |

|

Cash flows from investing activities: |

|||||

|

Acquisition of SigmaCare, Inc., net of cash acquired |

- |

(36,940,033) | |||

|

Release of restricted cash held in escrow |

405,764 | (1,451,336) | |||

|

Software development costs |

(8,723,987) | (8,735,342) | |||

|

Purchases of property and equipment |

(1,337,091) | (3,241,104) | |||

|

Net cash used in investing activities |

$ |

(9,655,314) |

$ |

(50,367,815) | |

|

Cash flows from financing activities: |

|||||

|

Share repurchases of Class A Common Stock |

- |

(144,172) | |||

|

Stock option repurchases |

- |

(153,050) | |||

|

Borrowings on term loan |

- |

35,000,000 | |||

|

Payments on term loan |

(775,000) | (1,375,000) | |||

|

Debt issuance costs |

- |

(1,246,086) | |||

|

Payment of Class B Common Stock dividend |

- |

(75,000) | |||

|

Net cash provided by (used in) financing activities |

$ |

(775,000) |

$ |

32,006,692 | |

|

Net increase (decrease) in cash |

11,284,734 | (6,508,998) | |||

|

Cash at beginning of year, including restricted cash |

7,462,793 | 13,971,791 | |||

|

Cash at end of year, including restricted cash |

$ |

18,747,527 |

$ |

7,462,793 | |

|

|

|||||

|

Supplemental disclosures of cash flow information: |

|||||

|

Income taxes paid |

$ |

340,480 |

$ |

662,898 | |

|

Interest expense paid |

$ |

7,519,224 |

$ |

8,941,167 | |

|

|

|||||

|

Supplemental disclosures of noncash investing and financing activities: |

|||||

|

Stock issued in consideration for acquisition |

$ |

- |

$ |

100,000 | |

|

Cash held in escrow for acquisition |

3,371,094 | 3,810,000 | |||

|

Purchase of property and equipment included in accounts payable |

- |

79,718 | |||

See accompanying notes to consolidated financial statements.

5

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1: Description of the Business and Significant Accounting Policies

Nature of Business

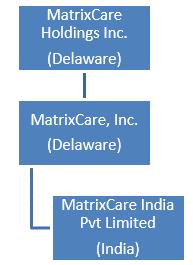

MatrixCare Holdings, Inc. (MatrixCare or the Company) is a Delaware corporation headquartered in Bloomington, Minnesota. The wholly-owned subsidiaries of MatrixCare Holdings, Inc. include MatrixCare, Inc. and MatrixCare India Private Limited (MC India). The Company has significant operations located in Bloomington, Minnesota, Coral Springs, Florida, New York, New York, Birmingham, Alabama, Bedford, New Hampshire, and Chennai, India. The following organizational chart presents the ownership and jurisdiction of incorporation of each subsidiary:

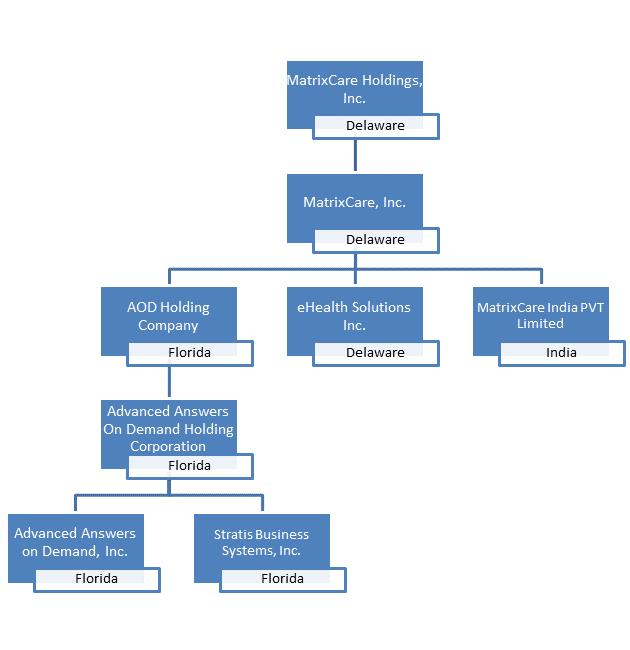

Prior to the merger of the legal entities into MatrixCare, Inc. on April 5, 2018, the wholly-owned subsidiaries of MatrixCare Holdings, Inc. included MatrixCare Inc., AOD Holding Company, Advanced Answers on Demand Holding Corporation, Advanced Answers on Demand, Inc. (AOD), Stratis Business Systems, Inc., eHealth Solutions Inc., and MatrixCare India Private Limited (MC India). The following organizational chart represents the previous ownership and jurisdiction of incorporation of each subsidiary:

Ranked Best in KLAS for Long-Term Care Software in 2018 for the third year in a row, MatrixCare is the largest U.S. based long-term and post-acute care (LTPAC) technology provider and the first to offer a true full-spectrum solution. Used in more than 13,000 facility-based care settings and 2,100 home care/home health and hospice agency locations, MatrixCare’s solutions help skilled nursing and senior living providers, life plan communities, and home health and hospice organizations to connect, collaborate and prosper.

6

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

A summary of the Company’s significant accounting policies follows.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of MatrixCare Holdings, Inc. and its subsidiaries. All intercompany accounts and transactions have been eliminated.

Use of Estimates

The preparation of these consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. Actual results could differ from those estimates.

Revenue Recognition

The Company’s products consist of two general types: license and software as a service (SaaS). Depending on the product solution, customers may also purchase post contract support and/or professional services including software setup and interface customization, training, and data migration. Post contract support can include unspecified updates on licensed software, technical corrections, and support. The Company’s arrangements do not contain general rights of return. The Company recognizes revenue when all of the following conditions are met:

|

· |

There is persuasive evidence of an arrangement. |

|

· |

The service has been provided to the customer. |

|

· |

The collection of the fees is reasonably assured. |

|

· |

The amount of fees to be paid by the customer is fixed or determinable. |

License

Under the license model, the software solution is sold in the form of a perpetual license that the customer takes possession of. Maintenance contracts are generally 12-month renewable agreements and are required in order to use the software.

The methodology the Company uses to recognize selling price allocated to the software license and related consulting services is dependent on whether the Company has established vendor specific objective evidence (VSOE) of fair value for the separate elements of a multiple-element agreement. If an agreement includes license, consulting service and maintenance elements, and VSOE of fair value on the undelivered consulting service and maintenance elements has been established, the license revenue for the agreement will be recognized based on the residual method. Under the residual method, the VSOE of fair value is assigned to the consulting service and maintenance elements, and the remaining agreement consideration is allocated to the license element. Consulting services are not considered essential to the functionality of the software. Therefore, the license fee is generally recognized ratably over the related maintenance contract term because maintenance is considered mandatory. The Company’s VSOE of fair value for maintenance and consulting services is determined by reference to the price the Company’s customers pay for the maintenance and consulting services when sold separately, or when sold independent of any of the Company’s other product or service offerings.

Revenue based on the VSOE of fair value for the consulting service and maintenance elements of the agreement that are to be delivered at a future date is initially deferred. Maintenance revenue is recognized ratably over the maintenance period. When VSOE of fair value for the consulting service and maintenance elements does not exist, the entire contract is recognized ratably over the longer of the consulting service or contractual maintenance service periods.

7

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Software as a Service

The SaaS product is made available to the customer through a hosted cloud-based solution. Consulting service revenues are accounted for separately from SaaS (subscription and support) revenues when these consulting services have value to the customer on a stand-alone basis, resulting in consulting service revenues being recognized either as the consulting services are delivered or upon completion of the consulting services when the proportional-performance model is not appropriate. Amounts that have been invoiced are recorded in accounts receivable and in deferred revenue or revenue, depending on when the revenue recognition criteria have been met.

The company uses VSOE to determine the fair value of the consulting service when available. If VSOE does not exist, the Company uses third-party evidence (TPE) of the fair value for similar consulting services. For consulting services in which there is no VSOE or TPE of fair value, the best estimate of selling price is used.

In determining whether the consulting service can be accounted for separately from subscription and support revenues, the Company considers the value of the consulting service on a stand-alone basis and the availability of the consulting services from other vendors. If a consulting service arrangement does not qualify for separate accounting, the Company records the consulting service revenue together with the hosted software and support revenue as one unit of accounting recognized over the contract term.

The Company accounts for sales tax and any other taxes that are collected from its customers and remitted to governmental authorities on a net basis. The assessment, collection, and payment of these taxes are not reflected in the consolidated statements of operations.

Deferred Revenue

Deferred revenue consists of fees paid by customers for undelivered consulting services, including maintenance, hosting and consulting services, as well as fees for which VSOE of fair value for the related undelivered elements does not exist. Deferred revenues not expected to be recognized within one year of the balance sheet date are classified as noncurrent for financial reporting purposes. Deferred revenue is recognized ratably over the term of the underlying contract.

Restricted Cash

The restricted cash represents cash held in escrow related to deferred compensation for certain employees and acquisition consideration. The cash is held in custody by the issuing bank and is restricted as to withdrawal or use.

Concentrations of Credit Risk

Financial instruments that could potentially subject the Company to concentrations of credit risk consist primarily of cash. The Company places its cash in accounts with financial institutions that management considers creditworthy. However, these balances may not be fully insured by the Federal Deposit Insurance Corporation. The Company has not experienced any losses in these accounts.

Accounts Receivable

The Company grants credit to customers in the normal course of business. Accounts receivable are carried at original invoice amount less an estimate made for doubtful receivables based on a review of all outstanding amounts on a periodic basis. The allowance for uncollectible amounts is an estimate and is regularly evaluated by the Company for adequacy by taking into consideration the age of the receivable balances. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded into operations when received.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Expenditures for repairs and maintenance are expensed as incurred. Assets held under capital leases, consisting primarily of computer equipment, are recorded in property with the corresponding obligations carried in long-term debt. The amount capitalized is the present value at the beginning of the lease term of the aggregate future minimum lease payments.

Depreciation is calculated using the straight-line method over the estimated useful lives of the related assets, as follows:

|

|

|

|

|

Years |

|

Computer and office equipment |

5 |

|

Computer software |

3 |

|

Leasehold improvements |

Shorter asset life or term of lease |

|

Assets held under capital lease |

5 |

8

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Property and equipment at December 31, 2017 and September 30, 2018 consisted of the following:

|

|

||||||

|

|

September 30, |

December 31, |

||||

|

|

(Unaudited) |

|||||

|

Computer equipment |

$ |

3,980,993 |

$ |

6,532,670 | ||

|

Computer software |

8,885,273 | 9,947,372 | ||||

|

Furniture & fixtures |

1,614,417 | 1,777,062 | ||||

|

Leasehold improvements |

1,369,332 | 1,625,676 | ||||

|

Assets held under capital leases |

225,000 | 225,000 | ||||

|

|

16,075,015 | 20,107,780 | ||||

|

Accumulated depreciation and amortization |

(10,379,836) | (13,150,170) | ||||

|

Property and equipment, net |

$ |

5,695,179 |

$ |

6,957,610 | ||

Depreciation expense for property and equipment was $3,427,391 for the year ended December 31, 2017 and $2,535,858 for the nine months ended September 30, 2018 (unaudited).

Deferred Costs

Deferred costs are costs that are directly associated with subscription contracts or sold with mandatory maintenance and support with customers and consist of sales commissions paid to the Company’s sales force and wages and benefits paid during the customer implementation process. These costs are deferred and amortized over the terms of the related customer contracts. In the accompanying consolidated statements of operations, amortization of deferred implementation costs is included in costs of revenues, and amortization of deferred commissions is included in selling, general, and administrative expenses.

Software Development Costs

The Company capitalizes certain software development costs related to software. Capitalized software development costs consist primarily of internal labor costs and external services. Software development costs are expensed as incurred until the planning phase of a project is complete, at which time future costs incurred are capitalized until the development phase is complete. Once a software product is placed into service, capitalized development costs associated with that product will begin to be amortized to amortization expense over its estimated economic life using the straight-line method.

Costs related to research, design and development of software products licensed are charged to selling, general, and administrative expenses as incurred.

Impairment of Long-Lived Assets

Long-lived assets, including finite-lived intangible assets, are evaluated for impairment whenever events or changes in circumstances indicate that an asset may not be recoverable, or depreciation or amortization lives should be modified. No impairment charges were recorded during the year ended December 31, 2017 or the nine months ended September 30, 2018 (unaudited).

Goodwill

Goodwill results from business acquisitions and represents the excess of the purchase price over the fair value of the identifiable net assets acquired. Goodwill is reviewed for impairment at least annually. The goodwill impairment is a two-step test. Under the first step, the fair value of the reporting unit is compared with its carrying value (including goodwill). If the fair value of the reporting unit exceeds its carrying value, step two does not need to be performed. If the fair value of the reporting unit is less than its carrying value, an indication of goodwill impairment exists for the reporting unit, and the enterprise must perform step two of the impairment test. Under step two, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill.

The implied fair value of goodwill is determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation. The residual fair value after this allocation is the implied fair value of the reporting unit’s goodwill. For the year ended December 31, 2017 and for the nine months ended September 30, 2018 (unaudited), management has determined that the Company has four reporting units and performed its annual test for impairment of goodwill and concluded that there was no impairment.

9

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Income Taxes

The Company files a federal income tax return and returns in states where it has determined it has a filing requirement. Deferred taxes are provided on an asset and liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carryforwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. The Company is in a net deferred tax liability position as a result of the deferred tax liability on intangible assets established as a result of recent acquisitions. The reversal of these acquired deferred tax liabilities can be a source of income to support the recognition of deferred tax assets in our valuation allowance determination. Consequently, the Company has determined it is “more likely than not” that the deferred tax assets will be realized and is not recording a valuation allowance.

The Company evaluates its tax positions in accordance with the accounting standard for uncertainty in income taxes, which addresses the determination of whether tax benefits claimed or expected to be claimed in a tax jurisdiction should be recorded in the financial statements. Under this guidance, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. The guidance on accounting for uncertainty in income taxes also addresses derecognition, classification, interest and penalties on income taxes, and accounting in interim periods.

Advertising

Advertising and marketing costs are expensed as incurred. The Company incurred advertising costs of $3,164,779 for the year ended December 31, 2017 and $2,317,227 for the nine months ended September 30, 2018 (unaudited), and are recorded within selling, general, and administrative expenses on the statements of operations.

Recently Issued Accounting Pronouncements

In May 2014, the FASB issued Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606). This standard outlines a single comprehensive model for companies to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that revenue is recognized when a customer obtains control of a good or service. A customer obtains control when it has the ability to direct the use of and obtain the benefits from the good or service. Transfer of control is not the same as transfer of risks and rewards, as it is considered in current guidance. The Company will also need to apply new guidance to determine whether revenue should be recognized over time or at a point in time. This standard will be effective for the Company in 2019, using either of two methods: (a) retrospective to each prior reporting period presented with the option to elect certain practical expedients as defined within ASU 2014-09 or (b) retrospective with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures as defined in ASU 2014-09. On November 13, 2018, the Company entered into an agreement to be purchased by ResMed Inc., a public company. As a result of the acquisition, the Company was required to adopt this standard as of the acquisition date. The standard was adopted on a modified retrospective basis and therefore did not impact any balances reported for the year ended December 31, 2017 or nine months ended September 30, 2018 (unaudited).

In September 2015, the FASB issued ASU 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments. This ASU eliminates the requirement to retrospectively account for changes to provisional amounts initially recorded in a business combination. ASU 2015-16 requires that an acquirer recognize adjustments to provisional amounts that are identified during the measurement period in the reporting period in which the adjustments are determined, including the effect of the change in provisional amount as if the accounting had been completed at the acquisition date. The Company adopted ASU 2015-16 on January 1, 2017. The adoption of this guidance did not have a material effect on the Company’s consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in this ASU supersedes the leasing guidance in Topic 840, Leases. Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition in the income statement. The new standard will be effective for the Company in 2020. The Company is currently evaluating the impact the adoption of this standard will have on its financial statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash (a consensus of the FASB Emerging Issues Task Force), which provides guidance on the presentation of restricted cash or restricted cash equivalents in the statement of cash flows. ASU 2016-08 is effective for non-public business entities for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company early adopted ASU 2016-18 on January 1, 2017. The adoption of this guidance did not have a material effect on the Company’s consolidated financial statements.

10

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the Definition of a Business. This ASU provides a “screen” to determine when an asset is not a business. The screen requires that when substantially all the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the asset is not a business. This screen reduces the number of transactions that need to be further evaluated. If the screen is not met, the amendments (a) require that to be considered a business, a set must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create output, and (b) remove the evaluation of whether a market participant could replace missing elements. Among other amendments, the ASU also provides a framework to assist entities in evaluating whether both an input and a substantive process are present. ASU 2017-01 is effective for non-public business entities for fiscal years beginning after December 15, 2018, with early adoption permitted. The Company early adopted ASU 2017-01 on January 1, 2017. The adoption of this guidance did not have a material effect on the Company’s consolidated financial statements.

In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting, to provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to apply modification accounting in ASC 718. The amendments in the ASU are effective for the Company in 2018, and should be applied prospectively to an award modified on or after the adoption date. The Company is currently evaluating the impact of the adoption of this guidance on its consolidated financial statements.

All other recently issued accounting standards will not have a material impact on our consolidated financial statements, or do not apply to our operations.

Subsequent Events

In preparing these consolidated financial statements, the Company has evaluated events and transactions for potential recognition or disclosure through April 3, 2018 and January 28, 2019, the date the consolidated financial statements were available to be issued.

On November 13, 2018, the Company entered into an agreement to be purchased by ResMed Inc. for approximately $750 million in cash.

Note 2: Acquisition

On June 19, 2017, the Company acquired all of the outstanding stock of eHealth Solutions Inc. (dba SigmaCare) for a total purchase price of $42,605,757, which included cash of $39,145,757, $100,000 of rollover equity from the acquired company, and $3,360,000 of cash still held in escrow. The cash in the escrow account is recorded as restricted cash and accounts payable within the consolidated balance sheet at December 31, 2017 and will be released in January 2019.

SigmaCare is a provider of electronic health records technology and the related services to health care providers, with a focus on LTPAC communities and senior living. SigmaCare was acquired to expand market share and create a company of greater scale with a stronger market position. Several synergies in selling, general, and administrative expenses as well as cross selling opportunities also improve the attractiveness of the acquisition.

The acquisition has been accounted for using the acquisition method of accounting and, accordingly, all assets and liabilities of SigmaCare have been recorded at their fair value as of the date of the acquisition. The Company paid a premium over the fair value of the net tangible and identifiable intangible assets acquired, resulting in an allocation to goodwill. The premium paid is due to forecasted revenue and cash flow growth. Goodwill and identified specific intangibles recorded in this transaction are not deductible for federal income tax purposes. The Company reflected the operating results of the acquired company in its consolidated operations beginning on June 19, 2017.

The Company incurred transaction costs of $817,595 in 2017 related to the acquisition of SigmaCare, which are included in selling, general, and administrative expenses within the statement of operations.

11

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The following table summarizes the estimated fair values of the assets acquired at the date of the acquisition, net of $1,755,724 cash acquired:

|

|

||

|

Cash paid, net of cash acquired |

$ |

36,940,033 |

|

Equity of MatrixCare Holdings, Inc. |

100,000 | |

|

Cash in escrow |

3,810,000 | |

|

Total purchase consideration |

$ |

40,850,033 |

|

|

||

|

Identifiable intangible assets: |

||

|

Customer relationships |

$ |

12,600,000 |

|

Developed software |

5,000,000 | |

|

Trademarks |

600,000 | |

|

Property and equipment |

225,000 | |

|

Current assets |

2,800,008 | |

|

Current liabilities |

(2,184,875) | |

|

Deferred revenue |

(593,654) | |

|

Deferred income tax liabilities |

(1,785,493) | |

|

Goodwill |

24,189,047 | |

|

Allocation of purchase consideration |

$ |

40,850,033 |

The weighted-average life of acquired intangible assets, excluding goodwill, was 8.2 years.

Note 3: Goodwill and Other Intangible Assets

Information regarding other intangible assets as of December 31, 2017 and September 30, 2018 was as follows:

|

|

|||||||||||

|

|

At and for the Twelve Months Ended |

||||||||||

|

|

(Adjusted) |

||||||||||

|

|

Amortization Period |

Gross Carrying Value |

Accumulated Amortization |

Net Carrying Amount |

|||||||

|

Trademarks |

5-10 |

$ |

1,769,835 |

$ |

(320,085) |

$ |

1,449,750 | ||||

|

Customer relationships |

9-10 |

105,619,000 | (46,190,235) | 59,428,765 | |||||||

|

Non-compete agreements |

4-5 |

3,753,000 | (1,903,800) | 1,849,200 | |||||||

|

Technology |

4-10 |

45,936,000 | (14,971,792) | 30,964,208 | |||||||

|

Intangibles, net |

$ |

157,077,835 |

$ |

(63,385,912) |

$ |

93,691,923 | |||||

|

|

At and for the Nine Months Ended |

||||||||||

|

|

(Unaudited) |

||||||||||

|

|

Amortization Period |

Gross Carrying Value |

Accumulated Amortization |

Net Carrying Amount |

|||||||

|

Trademarks |

5-10 |

$ |

1,769,835 |

$ |

(497,950) |

$ |

1,271,885 | ||||

|

Customer relationships |

9-10 |

105,619,000 | (51,683,847) | 53,935,153 | |||||||

|

Non-compete agreements |

4-5 |

3,753,000 | (2,601,750) | 1,151,250 | |||||||

|

Technology |

4-10 |

45,936,000 | (19,532,218) | 26,403,782 | |||||||

|

Intangibles, net |

$ |

157,077,835 |

$ |

(74,315,765) |

$ |

82,762,070 | |||||

The Company amortizes its intangible assets on an accelerated or a straight-line basis.

The changes in the carrying amount of goodwill were as follows:

|

|

||||||

|

|

September 30, |

December 31, |

||||

|

|

(Unaudited) |

(Adjusted) |

||||

|

Balance at the beginning of the period |

$ |

213,858,344 |

$ |

189,669,297 | ||

|

Business acquisition |

- |

24,189,047 | ||||

|

Other adjustments, net |

(20,538) |

- |

||||

|

Balance at the end of the period |

$ |

213,837,806 |

$ |

213,858,344 | ||

12

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The future annual amortization expense for other intangible assets is as follows:

|

|

||

|

Year Ending December 31, |

||

|

2018 |

14,563,493 | |

|

2019 |

14,121,182 | |

|

2020 |

12,776,587 | |

|

2021 |

12,167,656 | |

|

2022 |

11,847,398 | |

|

Thereafter |

28,215,608 | |

|

|

$ |

93,691,923 |

Note 4: Stock-Based Compensation

The Company compensates employees and directors with stock-based compensation under the 2015 Equity Incentive Plan (the Plan), which is shareholder-approved and permits the grant of 149,607.75 shares of common stock. The Company believes that such awards better align the interests of its employees with those of its shareholders. Option awards are generally granted with an exercise price equal to the market price of the Company’s stock at the date of grant. Options granted under the Plan are time or performance vesting, with each grant typically consisting of 50% of each type of option. Time based options typically vest 20% after the first year and then 5% per quarter until fully vested in five years. Performance based options do not vest until a change of control with sufficient return measured against a 20% IRR (internal rate of return) target with pro-rata vesting based on achievement. Holders of options granted under the Plan may put the options to the Company for a cash redemption at the current fair market value upon their death, disability, or reaching 65 years of age. Option grants expire 10 years after issuance date.

The fair value of each time-based option award under the Plan is estimated on the date of grant using the Black-Scholes option-pricing model that uses the assumptions noted in the following table. The Company uses historical volatility data from comparable software companies for expected volatility and estimates the expected term of its stock options based on the effective vesting period and contractual term. The expected term represents an estimate of the time options are expected to remain outstanding. The risk-free rate for periods within the contractual life of the option is based on the U.S. Treasury yield curve in effect at the time of grant. When accounting for stock-based compensation, including the income tax consequences, the Company follows the guidance of ASC 718.

The following assumptions were used to estimate the fair value of options granted during the twelve months ended December 31, 2017 and the nine months ended September 30, 2018:

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

||

|

|

|

(Unaudited) |

|

|

||

|

Expected annual dividend yield |

|

0.00 |

% |

|

0.00 |

% |

|

Expected volatility |

|

33.30 |

% |

|

38.20 |

% |

|

Risk-free rate of return |

|

2.70 |

% |

|

2.04 |

% |

|

Expected option term (years) |

|

6.35 |

% |

|

6.35 |

% |

A summary of option activity under the Plan as of December 31, 2017 and changes during the year then ended are presented below:

|

|

|

|

|

|

|

|

|

|

|

|

Options |

|

Weighted-Average Exercise Price |

|

Weighted-Average Remaining Contractual Term |

|||

|

Outstanding at January 1, 2017 |

|

123,822 |

|

|

110.46 |

|

|

7.73 |

|

Granted |

|

5,743 |

|

|

180.00 |

|

|

- |

|

Exercised |

|

(1,446) |

|

|

73.53 |

|

|

- |

|

Forfeited or expired |

|

(9,311) |

|

|

90.78 |

|

|

- |

|

Outstanding at December 31, 2017 |

|

118,808 |

|

|

115.81 |

|

|

6.90 |

|

Vested and expected to vest at December 31, 2017 |

|

10,127 |

|

|

157.81 |

|

|

8.02 |

A summary of option activity under the Plan as of September 30, 2018 and changes during the nine months then ended are presented below:

|

|

||||||||

|

|

Options |

Weighted-Average Exercise Price |

Weighted-Average Remaining Contractual Term |

|||||

|

|

(Unaudited) |

(Unaudited) |

(Unaudited) |

|||||

|

Outstanding at January 1, 2018 |

118,808 | 115.81 | 6.90 | |||||

|

Granted |

17,100 | 177.05 |

- |

|||||

|

Forfeited or expired |

(634) | 157.81 |

- |

|||||

|

Outstanding at September 30, 2018 |

135,274 | 123.35 | 6.84 | |||||

|

Vested and expected to vest at September 30, 2018 |

14,943 | 159.03 | 7.34 | |||||

13

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Unrecognized compensation expense related to the non-vested time-based options was $1,217,278 at December 31, 2017 and is expected to be recognized over a weighted average period of 3.3 years. Compensation expense related to these time-based options was $374,020 and $366,834 for the year ended December 31, 2017 and nine months ended September 30, 2018 (unaudited), respectively. Total intrinsic value of options exercised was $153,050 and $0 for the year ended December 31, 2017 and nine months ended September 30, 2018 (unaudited), respectively. There were no options exercisable as of December 31, 2017 or September 30, 2018 (unaudited).

Note 5: Long-Term Debt

On December 17, 2015, the Company entered into a Secured Credit Agreement (the Credit Agreement) which provided the Company a maximum borrowing capacity of $128,000,000. The Credit Agreement was comprised of a $120,000,000 Term Loan (the Term Loan) and an $8,000,000 Revolving Credit Line (the Revolver). Direct loan origination fees of $2,506,270 were capitalized as deferred charges.

On June 11, 2017, the Company entered into the Second Amendment to the Credit Agreement and borrowed an additional $35,000,000. There were no changes to the payment terms, interest rate or financial covenants in connection with the Second Amendment, with the exception that SigmaCare’s results are now included for purposes of calculating the financial covenants and the quarterly principal payments increased from $300,000 to $387,500. The incremental loan was accounted for as a debt modification. As a result, new lender fees of $1,246,086 were recorded as deferred charges. Proceeds from the incremental loan were used to finance the purchase of SigmaCare. See Note 2, Acquisition, for further information.

Deferred charges are amortized under the straight-line method, which approximates the effective interest method, as interest expense over the remaining term of the loan. The deferred charges were recorded as a reduction from the carrying amount of the Term Loan on the Company’s consolidated balance sheets.

Interest on the Term Loan and Revolver is determined based on either the LIBOR Rate or the Base Rate plus applicable margin. The applicable margin for a Base Rate loan is 4.25%. The applicable margin for a LIBOR Rate loan is 5.25%. The rate to be utilized is at the option of the Company and can be changed with each borrowing period. A LIBOR Rate loan has a floor of 1% prior to adding the applicable margin. A Base Rate means for any day the highest of the fluctuating rate of either Federal Funds plus .5%, the Prime Rate, or the 1-month LIBOR Rate with a 1% floor plus 1%. The interest rate for both the Term Loan and the Revolver was 6.58% at December 31, 2017. At December 31, 2017, no amounts were outstanding under the Revolver, with $8,000,000 available for future borrowings. The Company is required to make four quarterly interest and principal payments each year through November 1, 2021. The final payment on December 17, 2021 will be equal to the entire remaining principal balance on the Term Loan.

The Credit Agreement requires the Company to meet certain restrictive covenants, including, but not limited to, a fixed charge coverage ratio and a net leverage ratio. Additionally, there are certain restrictions including, but not limited to, limitations on total indebtedness and certain types of loans and investments, declaring and paying dividends, and payments allowed under the subordination agreements. The Agreement is also subject to an excess cash flow requirement whereby the Company is required to prepay on the term note an amount equal to anywhere between 0-50% of its excess cash flow, as defined by the Agreement. The Company did not generate sufficient excess cash flow during the year ended December 31, 2017 to require a prepayment.

The Agreement requires the Company to pay an unused commitment fee equal to the Revolving loan commitment each fiscal quarter at a rate of 0.5% per annum.

Long-term debt at December 31, 2017 and September 30, 2018 consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

||

|

|

|

(Unaudited) |

|

|

||

|

Term loan |

|

|

151,650,000 |

|

|

152,425,000 |

|

Revolver loan |

|

|

|

|

|

- |

|

|

|

|

151,650,000 |

|

|

152,425,000 |

|

Debt issuance costs |

|

|

(2,228,806) |

|

|

(2,749,771) |

|

Less: Current portion |

|

|

(149,421,194) |

|

|

(1,162,500) |

|

|

|

$ |

- |

|

$ |

148,512,729 |

14

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Aggregate maturities of long-term debt were as follows:

|

|

||

|

Year Ending December 31, |

||

|

2018 |

1,162,500 | |

|

2019 |

1,550,000 | |

|

2020 |

1,550,000 | |

|

2021 |

148,162,500 | |

|

Debt discount |

(2,749,711) | |

|

|

$ |

149,675,289 |

Note 6. Commitments and Contingencies

Retirement Plan

On January 1, 2017, the Company merged the two defined contribution plans into one plan with the MatrixCare 401(k) Plan (the 401(k) Plan) surviving the merger. The 401(k) Plan covers substantially all employees and allows participants to contribute their compensation under a 401(k)-salary reduction arrangement, up to the maximum amount allowed by tax law. In addition, the Company made matching contributions each pay period, up to predetermined percentages of the employee’s deferral. The Company recognized expense related to contributions to the 401(k) Plan of $1,234,848 for the year ended December 31, 2017 and $1,014,818 for the nine months ended September 30, 2018 (unaudited).

Operating Leases

The Company leases its facilities under noncancelable operating leases that expire at various dates through June 2024. The Company recognizes rent on a straight-line basis. Certain leases provide free rent, tenant allowances, other lease incentives and escalating rents over the lease term, resulting in a deferred rent liability of $1,268,502 at December 31, 2017, of which the current portion is included within accrued expenses and the non-current portion is included within other liabilities on the consolidated balance sheets. The Company is required to pay a pro rata share of the lessor’s insurance, property taxes and other operating expenses on certain facility leases. Total rent expense was $1,583,566 for the year ended December 31, 2017 and $1,361,421 for the nine months ended September 30, 2018 (unaudited).

Future minimum lease payments are as follows:

|

|

||

|

Year Ending December 31, |

||

|

2018 |

1,999,881 | |

|

2019 |

2,055,227 | |

|

2020 |

1,671,223 | |

|

2021 |

823,037 | |

|

2022 |

463,250 | |

|

Thereafter |

718,281 | |

|

|

$ |

7,730,899 |

|

|

$ |

7,730,899 |

Capital Leases

The Company holds assets under capital lease commitments, principally computer equipment, and is obligated under existing capital lease commitments to make future payments, including interest. Future capital lease payments are as follows:

|

|

||

|

Year Ending December 31, |

||

|

2018 |

88,771 | |

|

2019 |

46,041 | |

|

|

$ |

134,812 |

Microsoft Azure

In December 2016, the Company entered into an agreement (MSFT Agreement) in which Microsoft will provide hosting services to the Company over a 3-year period. The terms of the MSFT Agreement required an initial payment of $3,500,000 in January 2017, a second installment of $3,250,000 in January 2018, and a third and final installment payment of $3,250,000 in January 2019. Additionally, the Company would receive 12%, or $1,200,000, of additional hosting at no extra charge, if, and only if, the Company were able to use the entire $10,000,000 of hosting services over the 3-year period. Based on the facts and circumstances available at December 31, 2017, reaching $10,000,000 of hosting services over a 3-year period was not deemed probable. As a result, the 12% of additional hosting at no extra charge was not recorded during the year ended December 31, 2017.

15

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

On March 29, 2018, the MSFT Agreement was amended (MSFT Amendment). Under the terms of the MSFT Amendment, the contract period was extended for two additional years and the Company received an additional $2,750,000 of hosting services, at no additional cost to the Company. Due to the extension of the contract period, the Company now considers reaching $10,000,000 of hosting services probable and will recognize the aggregate amount of hosting services to be received at no extra charge, or $3,950,000, on a weighted-average basis over the remaining 4 years of the MSFT Amendment beginning January 1, 2018.

First National Technology Solutions (FNTS)

On February 14, 2018, the company entered into a Technology Services and Data Center Resources Agreement (FNTS Agreement) to form a mutually beneficial strategic alliance with FNTS, which provides hosting services to the Company, for the next five years. The terms of the FNTS Agreement require a one-time $1,088,171 upfront payment in exchange for $1,088,171 of discounts on future purchases of hosting services provided by FNTS. The discount percentage is based on the hosting services purchased each month and ranges from 5% to 10%. Any discounts that remain unused at the end of the five-year period will be forfeited. The Company expects to use the entire balance of future discounts by the end of year four.

Note 7: Income Taxes

As of December 31, 2017 (adjusted)

Net deferred tax assets and liabilities consist of the following components as of December 31, 2017 (in thousands):

|

|

|||

|

|

December 31, |

||

|

Deferred tax assets: |

(Adjusted) |

||

|

Net operating loss carryforwards |

6,999 | ||

|

Stock based compensation |

149 | ||

|

Accrued expenses |

530 | ||

|

Trade receivables |

396 | ||

|

Interest expense |

2,207 | ||

|

Deferred revenue |

1,294 | ||

|

Total deferred tax assets |

$ |

11,575 | |

|

|

|||

|

Deferred tax liabilities: |

|||

|

Definite lived intangible assets |

(24,470) | ||

|

Capitalized research and development |

(2,953) | ||

|

Property and equipment |

(952) | ||

|

Deferred expenses |

(513) | ||

|

Total deferred tax liabilities |

$ |

(28,888) | |

|

|

|||

|

Net deferred tax liabilities |

$ |

(17,313) | |

As of December 31, 2017, the Company has federal net operating loss carryforwards totaling approximately $26,497,000 and state net operating loss carryforwards totaling approximately $23,244,000 that may be used to offset future taxable income. The federal net operating loss carryforwards will expire in 2028 through 2038. The net operating loss expiration related to the various state income tax returns that the Company files varies by state. The Company evaluates the recoverability of its deferred tax assets by considering the expected reversals of deferred tax assets and liabilities to determine whether net operating loss carryforwards are recoverable prior to expiration. As the Company is in an overall net deferred liability position, no valuation allowance has been recorded.

To the extent these net operating loss carryforwards are available, the Company intends to use them to reduce the corporate income tax liability associated with its operations. Section 382 of the U.S. Internal Revenue Code generally imposes an annual limitation on the amount of net operating loss carryforwards that may be used to offset taxable income when a corporation has undergone significant changes in stock ownership. The Company believes an ownership change under Section 382 has not occurred for the Parent entity. However, the newly acquired SigmaCare has incurred a Section 382 change as a result of the acquisition on June 19, 2017 (See Note 2, Acquisition, for further information). We believe that approximately $9,100,000 and $10,400,000 of federal and state losses respectively are available from the SigmaCare acquisition. The maximum annual limitation of federal net operating losses applicable to us is approximately $2,100,000 per year over the next 5 years. Thus, the total $19,500,000 of federal and state losses as of June 19, 2017 is available to offset future income.

16

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The income tax benefit reflected in the statements of operations for the year ended December 31, 2017 consists of the following (in thousands):

|

|

|||

|

|

December 31, |

||

|

|

(Adjusted) |

||

|

Current state tax expense |

$ |

(140) | |

|

Current federal tax expense |

(45) | ||

|

Current foreign tax expense |

(45) | ||

|

Deferred benefit |

11,404 | ||

|

Total income tax benefit |

$ |

11,174 | |

The income tax provision differs from the amount of income tax determined by applying the U.S. federal income tax rate of 34% for the year ended December 31, 2017, respectively, to the Company’s pretax loss due to the following (in thousands):

|

|

|||

|

|

December 31, |

||

|

|

(Adjusted) |

||

|

Computed expected benefit |

$ |

2,518 | |

|

State taxes net of federal benefit |

567 | ||

|

Tax impact of foreign activity |

(5) | ||

|

State income, franchise and minimum fees |

(331) | ||

|

Change in deferred tax rate |

7,636 | ||

|

Permanent expenses and other |

789 | ||

|

Total income tax benefit |

$ |

11,174 | |

The Company is subject to income taxes in the U.S. federal, various other state jurisdictions and in India. With few exceptions, the Company is not subject to income tax examinations by tax authorities in jurisdictions in which it files for years before 2014. The final timing and resolution of any particular uncertain tax position is difficult to predict. The Company’s management evaluated the Company’s tax positions considering many factors, including past experience and complex judgments about future events and concluded that the Company had taken no uncertain tax positions at December 31, 2017 that require adjustment to the financial statements. The Company does not anticipate significant changes in its uncertain tax positions over the next twelve months. It is the Company’s practice to recognize interest and penalties accrued on any unrecognized tax benefits as a component of income tax expense.

As of September 30, 2018 (unaudited)

In accordance with ASC 740 Income Taxes, each interim reporting period is considered integral to the annual period, and tax expense is measured using an estimated annual effective tax rate. An entity is required to record income tax expense each quarter based on its annual effective tax rate estimated for the full fiscal year and use that rate to provide for income taxes on a current year-to-date basis, adjusted for discrete taxable events that occur during the interim period.

Tax Cuts and Jobs Act (Tax Act)

On December 22, 2017, President Trump signed into law the statute commonly referred to as the Tax Act which enacts a broad range of changes to the Internal Revenue Code of 1986, as amended. The new legislation, among other things, includes changes to U.S. federal tax rates, imposes significant additional limitations on the deductibility of interest, allows for the expensing of capital expenditures and puts into effect the migration from a “worldwide” system of taxation to a territorial system. The Company is still evaluating the impact of the tax reform. The Company’s net deferred tax assets and liabilities have been revalued at the newly enacted U.S. corporate rate resulting in a tax benefit of $7,636,000 primarily due to the reduction in corporate tax rate to 21%. The Company continues to examine the impact this tax reform legislation may have on its business.

17

MatrixCare Holdings, Inc. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 8: Related Party Transactions

The Company and their former owners, OMERS Private Equity (“OPE”) were under a Management Agreement pursuant to which general advisory and management services were provided to the Company with respect to operating matters. Under the Management Agreement, OPE charged the Company management fees of $275,000 and $206,250 for the year ended December 31, 2017 and nine months ended September 30, 2018 (unaudited), respectively. OPE waived the remaining $75,000 in management fees for the year ended December 31, 2017 and for the nine months ended September 30, 2018 (unaudited), in exchange for a $75,000 cash dividend payment to the holders of Class B Common Stock on December 19, 2017 and October 17, 2018. The December 19, 2017 dividend payment was reflected as a reduction to retained earnings within the consolidated statement of stockholders’ equity.

Note 9: Accounting Changes

The Company was acquired by a public company on November 13, 2018. The Company had previously adopted the private company accounting alternative Accounting Standards Update (ASU) No 2014-02, Intangibles—Goodwill and Other (Topic 350): Accounting for Goodwill. The Company has changed its accounting principle to reverse the effects of this adoption as a result of the acquisition. The following financial statement line items for the year ended December 31, 2017, were affected by the change.

The impact of these changes on the financial statements consists of the following:

|

|

||||||||

|

|

December 31, 2017 |

|||||||

|

Consolidated Balance Sheet impact: |

As Previously Reported |

As Adjusted |

Effect of Change |

|||||

|

Goodwill |

$ |

161,583,611 |

$ |

213,858,344 |

$ |

52,274,733 | ||

|

Total assets |

305,275,459 | 357,550,192 | 52,274,733 | |||||

|

Deferred income taxes |

(12,678,098) | (17,313,000) | (4,634,902) | |||||

|

Accumulated deficit |

(68,693,992) | (21,054,161) | 47,639,831 | |||||

|

Total stockholders’ equity |

106,094,295 | 153,734,126 | 47,639,831 | |||||

|

Total liabilities and stockholders’ equity |

305,275,459 | 357,550,192 | 52,274,733 | |||||

|

|

||||||||

|

|

Year Ended December 31, 2017 |

|||||||

|

Consolidated Statement of Operations impact: |

As Previously Reported |

As Adjusted |

Effect of Change |

|||||

|

Revenues |

$ |

105,645,260 |

$ |

105,645,260 |

$ |

- |

||

|

Cost of revenues |

31,504,990 | 31,504,990 |

- |

|||||

|

Gross profit |

74,140,270 | 74,140,270 |

- |

|||||

|

Operating expenses: |

||||||||

|

Selling, general, and administrative |

46,075,609 | 46,075,609 |

- |

|||||

|

Depreciation expense |

3,427,391 | 3,427,391 |

- |

|||||

|

Amortization expense |

42,693,460 | 22,438,955 | (20,254,505) | |||||

|

Operating (loss) income |

(18,056,190) | 2,198,315 | 20,254,505 | |||||

|

|

||||||||

|

Other income |

(17,219) | (17,219) |

- |

|||||

|

Interest expense |

9,621,968 | 9,621,968 |

- |

|||||

|

Loss before income tax expense (benefit) |

(27,660,939) | (7,406,434) | 20,254,505 | |||||

|

Income tax benefit |

(11,244,508) | (11,174,465) | 70,043 | |||||

|

Net income (loss) |

(16,416,431) | 3,768,031 | 20,184,462 | |||||

|

|

||||||||

|

|

December 31, 2017 |

|||||||

|

Consolidated Statement of Stockholders' Equity impact: |

As Previously Reported |

As Adjusted |

Effect of Change |

|||||

|

Balance at December 31, 2016 |

$ |

(52,202,561) |

$ |

(24,747,192) |

$ |

27,455,369 | ||

|

Net income (loss) |

(16,416,431) | 3,768,031 | 20,184,462 | |||||

|

Balance at December 31, 2017 |

(68,618,992) | (20,979,161) | 47,639,831 | |||||

|

|

||||||||

|

|

December 31, 2017 |

|||||||

|

Consolidated Statement of Cash Flows impact: |

As Previously Reported |

As Adjusted |

Effect of Change |

|||||

|

Net income (loss) |

$ |

(16,416,431) |

$ |

3,768,031 |

$ |

20,184,462 | ||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

- |

- |

- |

|||||

|

Amortization of intangible assets and goodwill |

35,963,405 | 15,708,900 | (20,254,505) | |||||

|

Deferred taxes |

(11,473,826) | (11,403,783) | 70,043 | |||||

|

Net cash provided by operating activities |

11,852,125 | 11,852,125 |

- |

|||||

|

Decrease in cash |

(6,508,998) | (6,508,998) |

- |

|||||

|

Cash at beginning of year, including restricted cash |

13,971,791 | 13,971,791 |

- |

|||||

|

Cash at end of year, including restricted cash |

7,462,793 | 7,462,793 |

- |

|||||

18