EX-99.2

Published on February 22, 2016

ResMed Inc. Acquisition of Brightree February 22, 2016 Exhibit 99.2

Forward Looking Statements Statements contained in this presentation that are not historical facts are “forward-looking” statements as contemplated by the Private Securities Litigation Reform Act of 1995. These forward-looking statements — including statements regarding ResMed's projections of future revenue or earnings, expenses, new product development, new product launches and new markets for its products and the integration of acquisitions — are subject to risks and uncertainties, which could cause actual results to materially differ from those projected or implied in the forward-looking statements. Additional risks and uncertainties are discussed in ResMed’s periodic reports on file with the U.S. Securities & Exchange Commission. ResMed does not undertake to update its forward-looking statements.

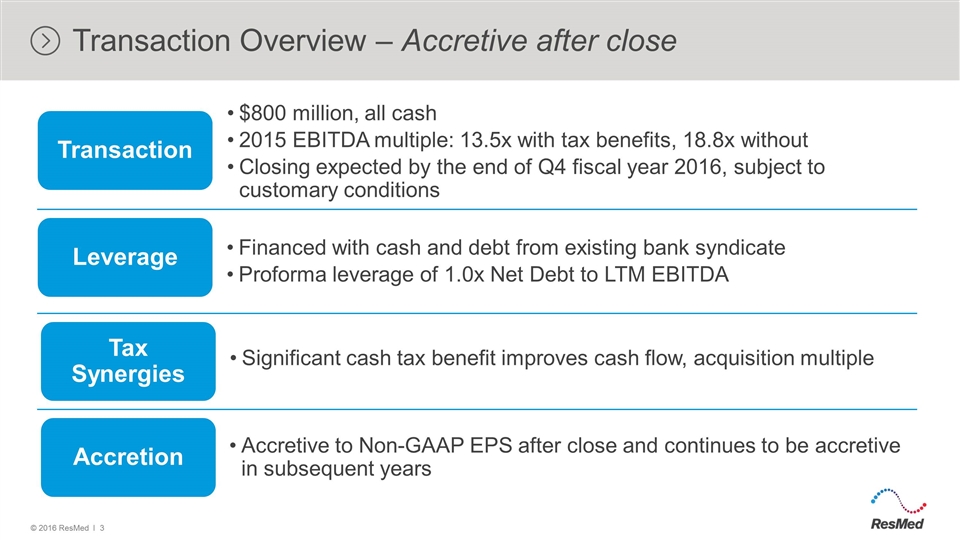

Transaction Overview – Accretive after close $800 million, all cash 2015 EBITDA multiple: 13.5x with tax benefits, 18.8x without Closing expected by the end of Q4 fiscal year 2016, subject to customary conditions Transaction Accretive to Non-GAAP EPS after close and continues to be accretive in subsequent years Tax Synergies Financed with cash and debt from existing bank syndicate Proforma leverage of 1.0x Net Debt to LTM EBITDA Leverage Accretion Significant cash tax benefit improves cash flow, acquisition multiple

Strategic Rationale – Reinforces ResMed’s tech-driven focus Strengthens ResMed’s global leadership in connected care solutions Adds to growth opportunities for software revenues Complements ResMed’s Air Solutions platform Creates expansion opportunities in home health, hospice and post-acute coordination Combination gives new tools to HME customers to help improve operating efficiencies, cash flows and patient care Adds recurring stream of software revenue

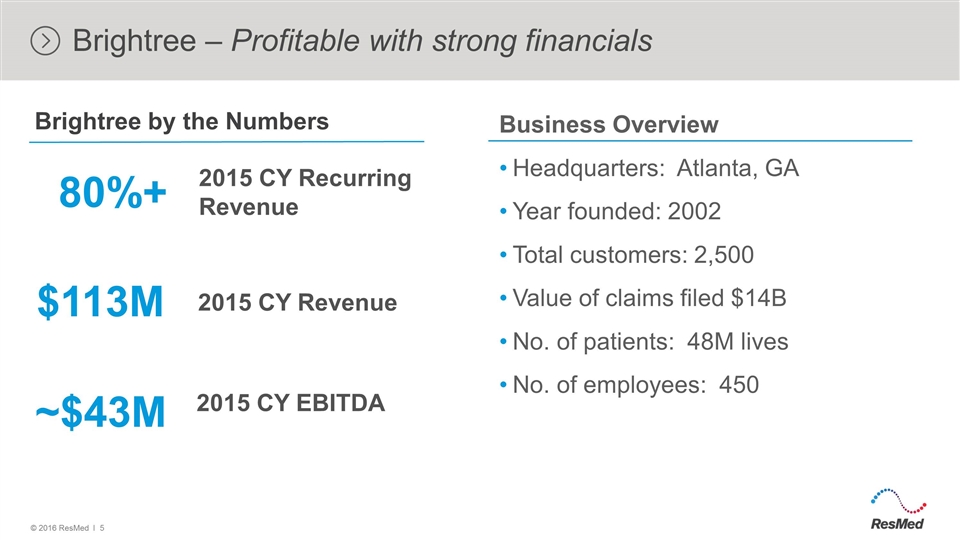

Brightree – Profitable with strong financials Business Overview Headquarters: Atlanta, GA Year founded: 2002 Total customers: 2,500 Value of claims filed $14B No. of patients: 48M lives No. of employees: 450 2015 CY Revenue $113M 2015 CY EBITDA ~$43M 2015 CY Recurring Revenue 80%+ Brightree by the Numbers

Tax synergy – A benefit to cash flow and acquisition multiple Brightree is structured as a limited liability company, allowing transaction to be treated as an asset sale for all tax purposes ResMed to receive a step-up in the cost basis of the assets being acquired ResMed expects a reduction in future cash income taxes as a result of tax-deductible goodwill Anticipated cash tax benefit improves acquisition multiple PV of the tax benefit reduces acquisition price, brings multiple to 13.5 times 2015 adjusted EBITDA Without the tax benefit, the acquisition multiple would be 18.8 times 2015 adjusted EBITDA Benefit estimated at ~$300 million over 15 years, with a present value estimated at ~$225 million

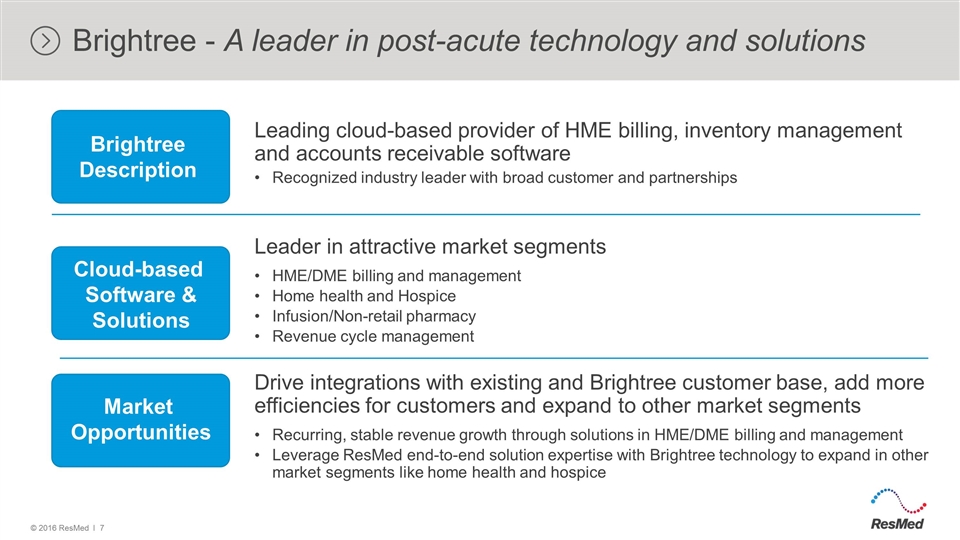

Brightree - A leader in post-acute technology and solutions Leading cloud-based provider of HME billing, inventory management and accounts receivable software Recognized industry leader with broad customer and partnerships Leader in attractive market segments HME/DME billing and management Home health and Hospice Infusion/Non-retail pharmacy Revenue cycle management Drive integrations with existing and Brightree customer base, add more efficiencies for customers and expand to other market segments Recurring, stable revenue growth through solutions in HME/DME billing and management Leverage ResMed end-to-end solution expertise with Brightree technology to expand in other market segments like home health and hospice Brightree Description Cloud-based Software & Solutions Market Opportunities

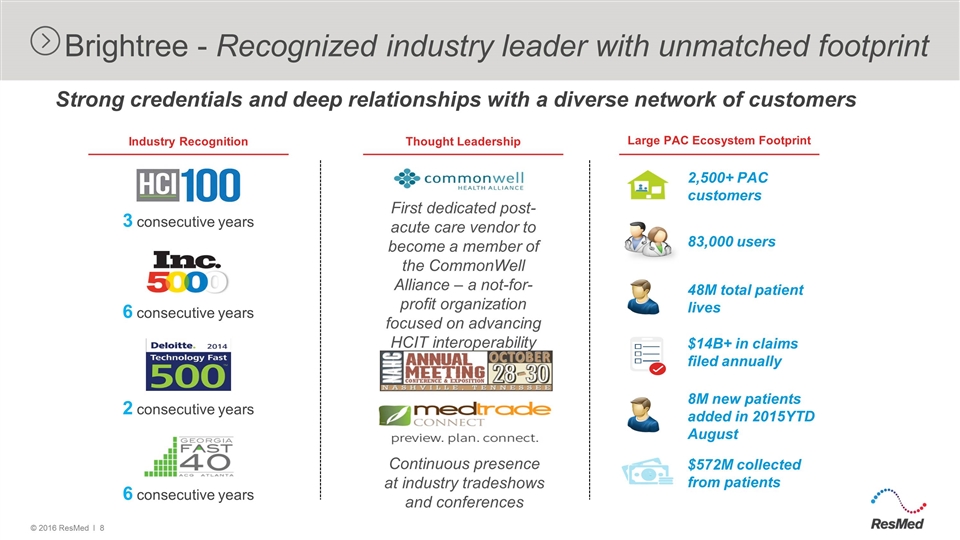

Brightree - Recognized industry leader with unmatched footprint Strong credentials and deep relationships with a diverse network of customers Thought Leadership Industry Recognition Large PAC Ecosystem Footprint 3 consecutive years 6 consecutive years 2 consecutive years 6 consecutive years 2,500+ PAC customers 8M new patients added in 2015YTD August 48M total patient lives 83,000 users $14B+ in claims filed annually $572M collected from patients First dedicated post-acute care vendor to become a member of the CommonWell Alliance – a not-for-profit organization focused on advancing HCIT interoperability Continuous presence at industry tradeshows and conferences

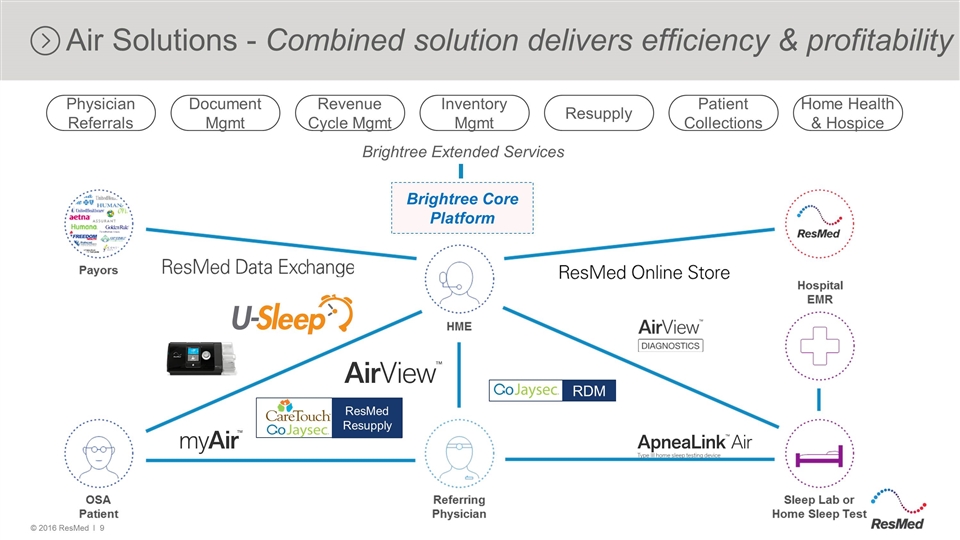

Physician Referrals Document Mgmt Revenue Cycle Mgmt Inventory Mgmt Resupply Patient Collections Home Health & Hospice Brightree Core Platform Brightree Extended Services Air Solutions - Combined solution delivers efficiency & profitability ResMed Resupply RDM

After Closing – Expanded capabilities with little disruption Brightree will operate as a separate entity Brightree’s suite of business management and clinical software will enhance Air Solutions Platform for our HME customers Brightree will expand ResMed’s capabilities to help customers be more profitable as they use embedded solutions and resupply to more efficiently manage their business and patients The acquisition of Brightree will allow ResMed to drive further enhancements and innovations for a broader range of healthcare providers including home health, hospice and post-acute coordination, across an increasingly interconnected continuum of care

Questions & Answers