EX-99.2

Published on June 14, 2022

Acquisition of MEDIFOX DAN June 14, 2022 Exhibit 99.2

Forward-looking statements Historical financial and operating data in this presentation reflect the consolidated results of ResMed Inc., its subsidiaries, and its legal entities, for the periods indicated. This presentation includes financial information prepared in accordance with accounting principles generally accepted in the United States, or GAAP, as well as other financial measures referred to as non-GAAP. The non-GAAP financial measures in this presentation, which include non-GAAP Income from Operations, non-GAAP Net Income, and non-GAAP Diluted Earnings per Share, should be considered in addition to, but not as substitutes for, the information prepared in accordance with GAAP. For reconciliations of the non-GAAP financial measures to the most comparable GAAP measures, please refer to the earnings release associated with the relevant reporting period, which can be found on the investor relations section of our corporate website (investor.resmed.com). In addition to historical information, this presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on ResMed’s current expectations of future revenue or earnings, new product development, new product launches, new markets for its products, integration of acquisitions, leveraging of strategic investments, litigation, tax outlook, and the length and severity of the recent coronavirus outbreak, including its impacts across our business and operations. Forward-looking statements can generally be identified by terminology such as “may”, “will”, “should”, “expects”, “intends”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential”, or “continue”, or variations of these terms, or the negative of these terms or other comparable terminology. ResMed’s expectations, beliefs, and forecasts are expressed in good faith and are believed to have a reasonable basis, but actual results could differ materially from those stated or implied by these forward-looking statements. ResMed assumes no obligation to update the forward-looking information in this presentation, whether as a result of new information, future events, or otherwise. For further discussion of the various factors that could impact actual events or results, please review the “Risk Factors” identified in ResMed’s quarterly and annual reports filed with the SEC. All forward-looking statements included in this presentation should be considered in the context of these risks. Investors and prospective investors are cautioned not to unduly rely on our forward-looking statements.

Creation of a global leader in out-of-hospital software Leading provider of mission critical software in out-of-hospital markets across the U.S. Leading provider of end-to-end software solutions for home health providers, nursing homes, and outpatient therapy practices in Germany

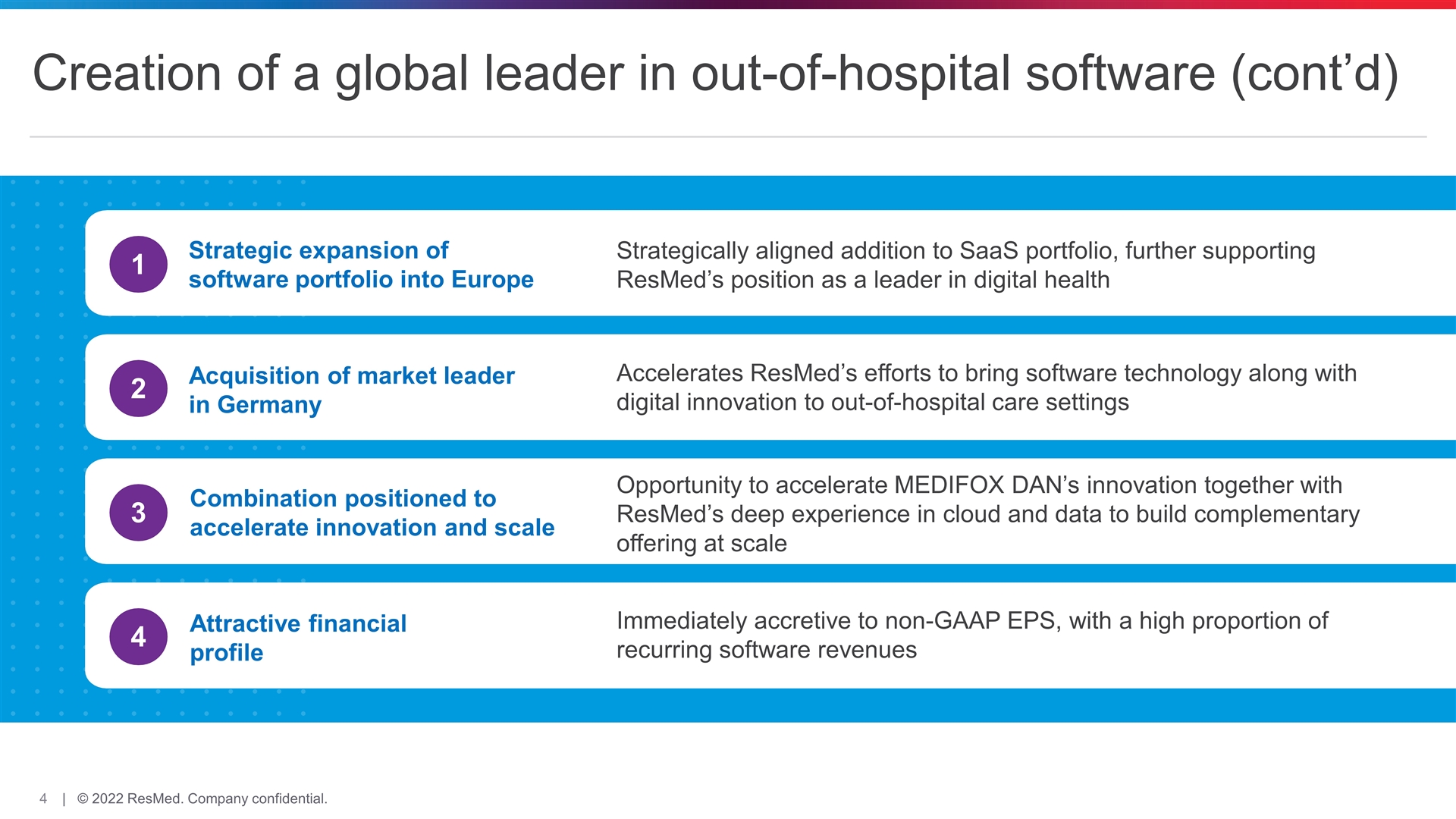

Creation of a global leader in out-of-hospital software (cont’d) 2 Accelerates ResMed’s efforts to bring software technology along with digital innovation to out-of-hospital care settings 1 3 4 Strategic expansion of software portfolio into Europe Acquisition of market leader in Germany Attractive financial profile Combination positioned to accelerate innovation and scale Opportunity to accelerate MEDIFOX DAN’s innovation together with ResMed’s deep experience in cloud and data to build complementary offering at scale Immediately accretive to non-GAAP EPS, with a high proportion of recurring software revenues Strategically aligned addition to SaaS portfolio, further supporting ResMed’s position as a leader in digital health

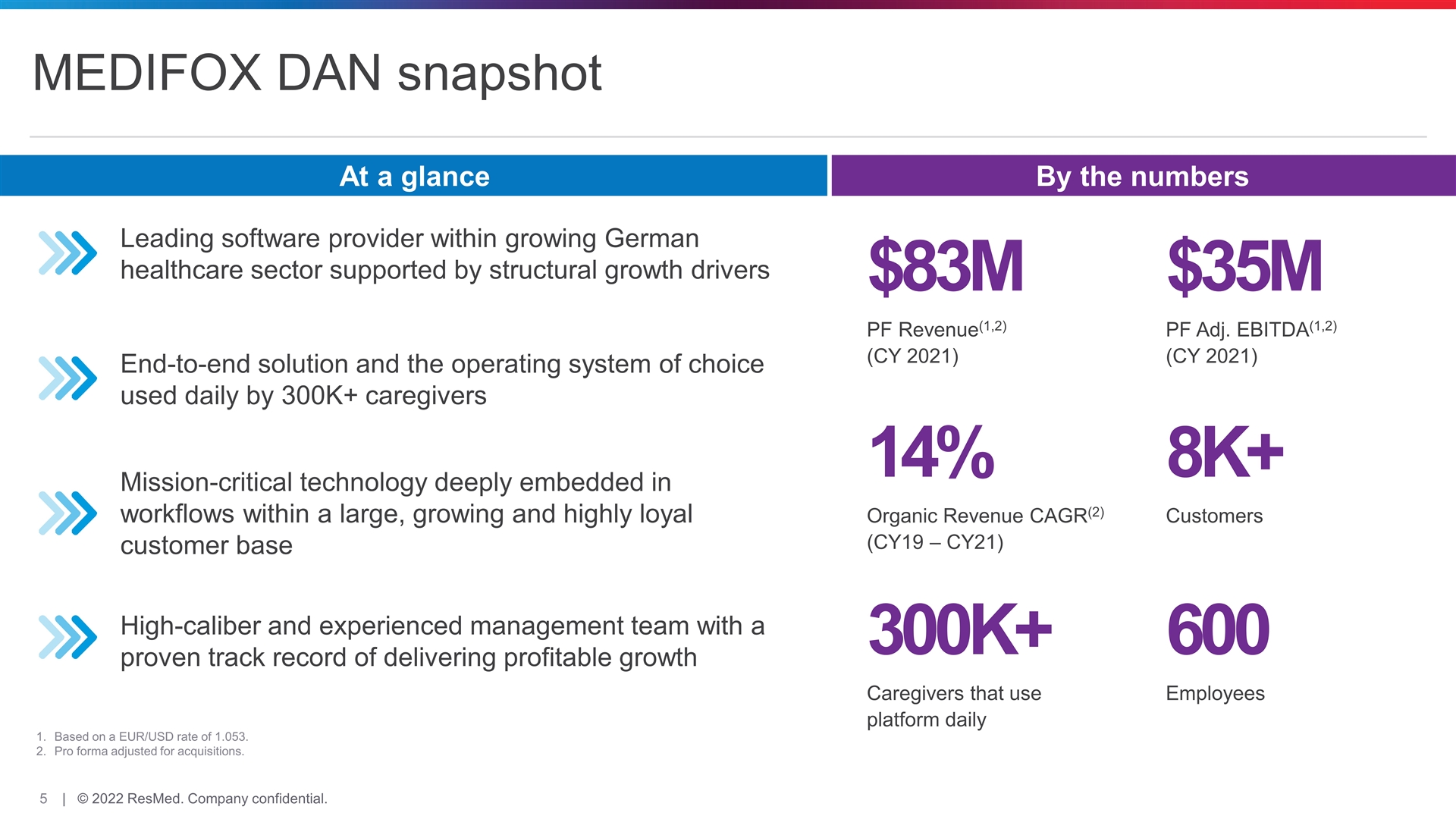

MEDIFOX DAN snapshot By the numbers At a glance Based on a EUR/USD rate of 1.053. Pro forma adjusted for acquisitions. $83M PF Revenue(1,2) (CY 2021) $35M PF Adj. EBITDA(1,2) (CY 2021) 14% Organic Revenue CAGR(2) (CY19 – CY21) 8K+ Customers 600 Employees Leading software provider within growing German healthcare sector supported by structural growth drivers End-to-end solution and the operating system of choice used daily by 300K+ caregivers Mission-critical technology deeply embedded in workflows within a large, growing and highly loyal customer base High-caliber and experienced management team with a proven track record of delivering profitable growth 300K+ Caregivers that use platform daily

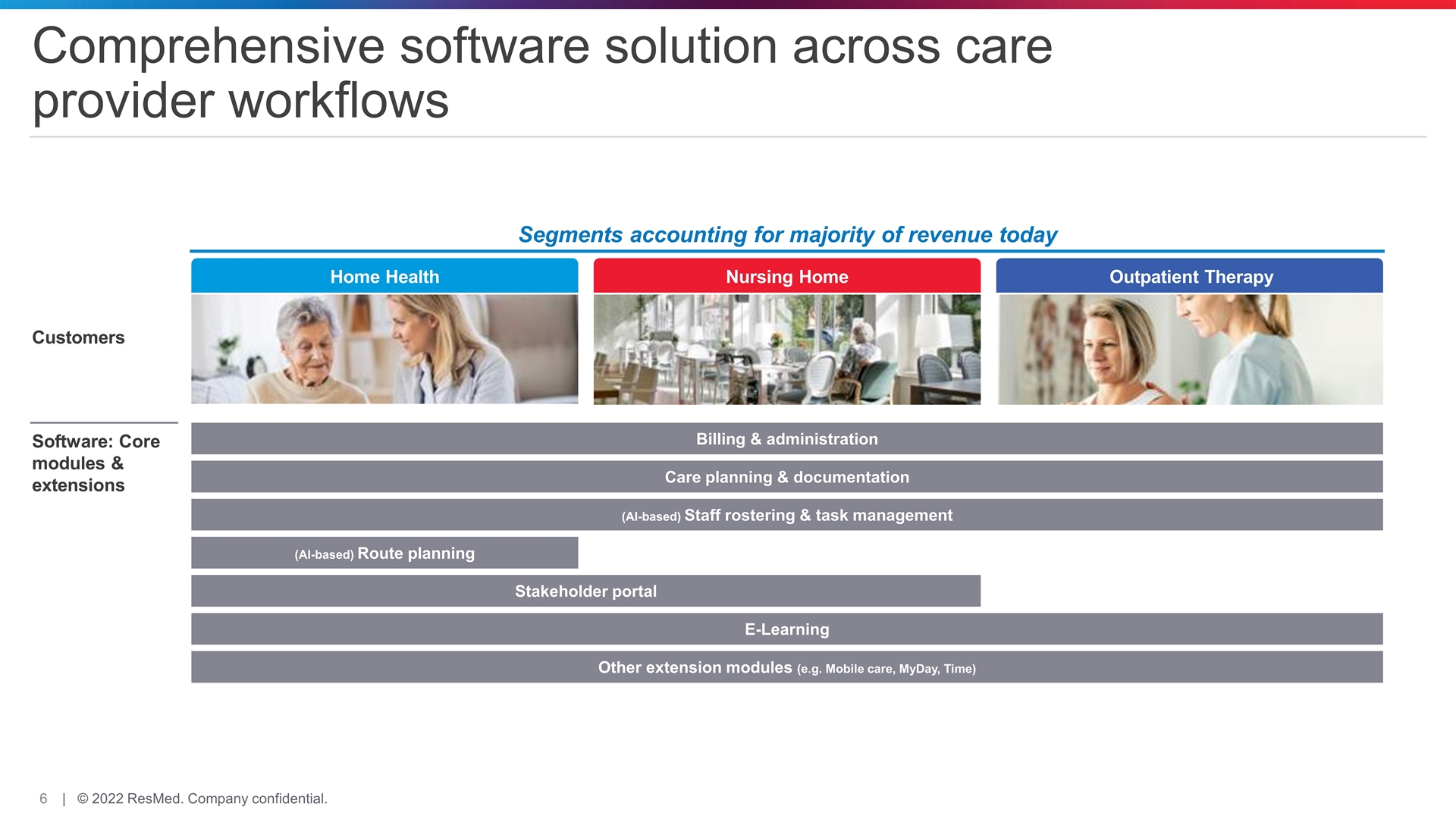

Comprehensive software solution across care provider workflows Outpatient Therapy Nursing Home Home Health Software: Core modules & extensions Billing & administration Care planning & documentation (AI-based) Staff rostering & task management (AI-based) Route planning Stakeholder portal E-Learning Other extension modules (e.g. Mobile care, MyDay, Time) Customers Segments accounting for majority of revenue today

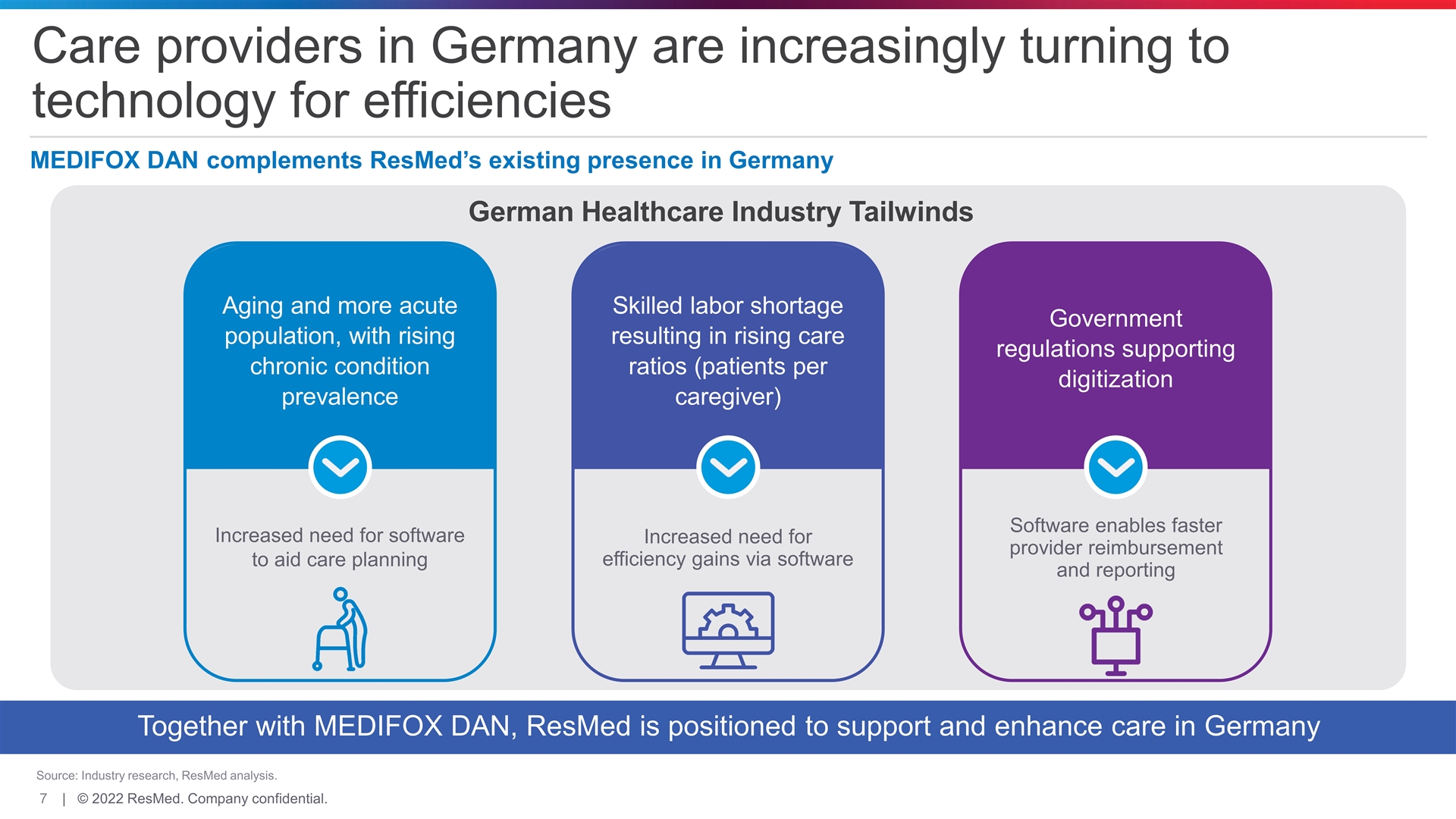

Care providers in Germany are increasingly turning to technology for efficiencies Source: Industry research, ResMed analysis. MEDIFOX DAN complements ResMed’s existing presence in Germany Together with MEDIFOX DAN, ResMed is positioned to support and enhance care in Germany Aging and more acute population, with rising chronic condition prevalence Increased need for software to aid care planning Increased need for efficiency gains via software Skilled labor shortage resulting in rising care ratios (patients per caregiver) Government regulations supporting digitization Software enables faster provider reimbursement and reporting German Healthcare Industry Tailwinds

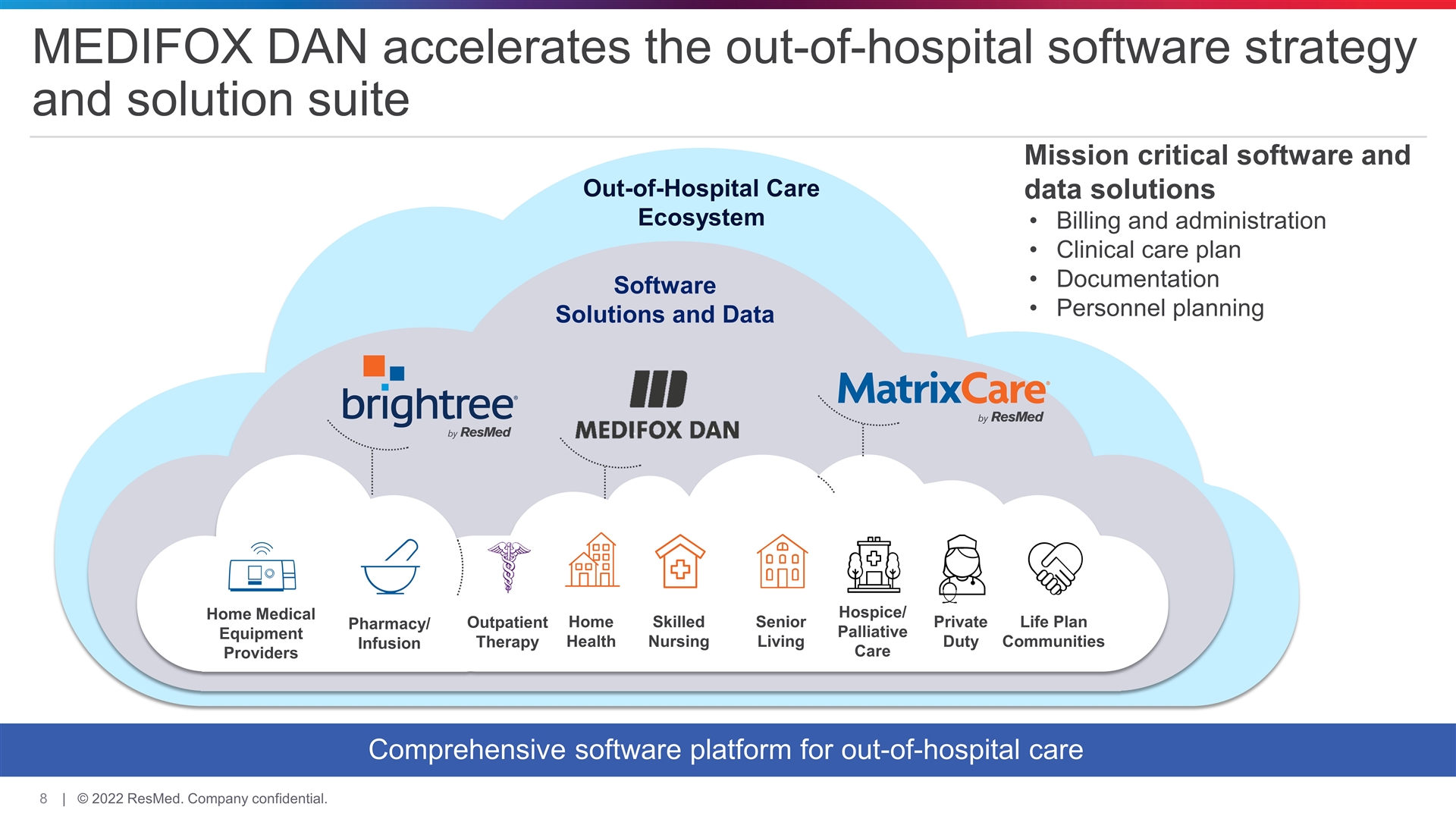

MEDIFOX DAN accelerates the out-of-hospital software strategy and solution suite Comprehensive software platform for out-of-hospital care Mission critical software and data solutions Billing and administration Clinical care plan Documentation Personnel planning Software Solutions and Data Home Medical Equipment Providers Pharmacy/ Infusion Home Health Hospice/ Palliative Care Private Duty Skilled Nursing Senior Living Life Plan Communities Out-of-Hospital Care Ecosystem Outpatient Therapy

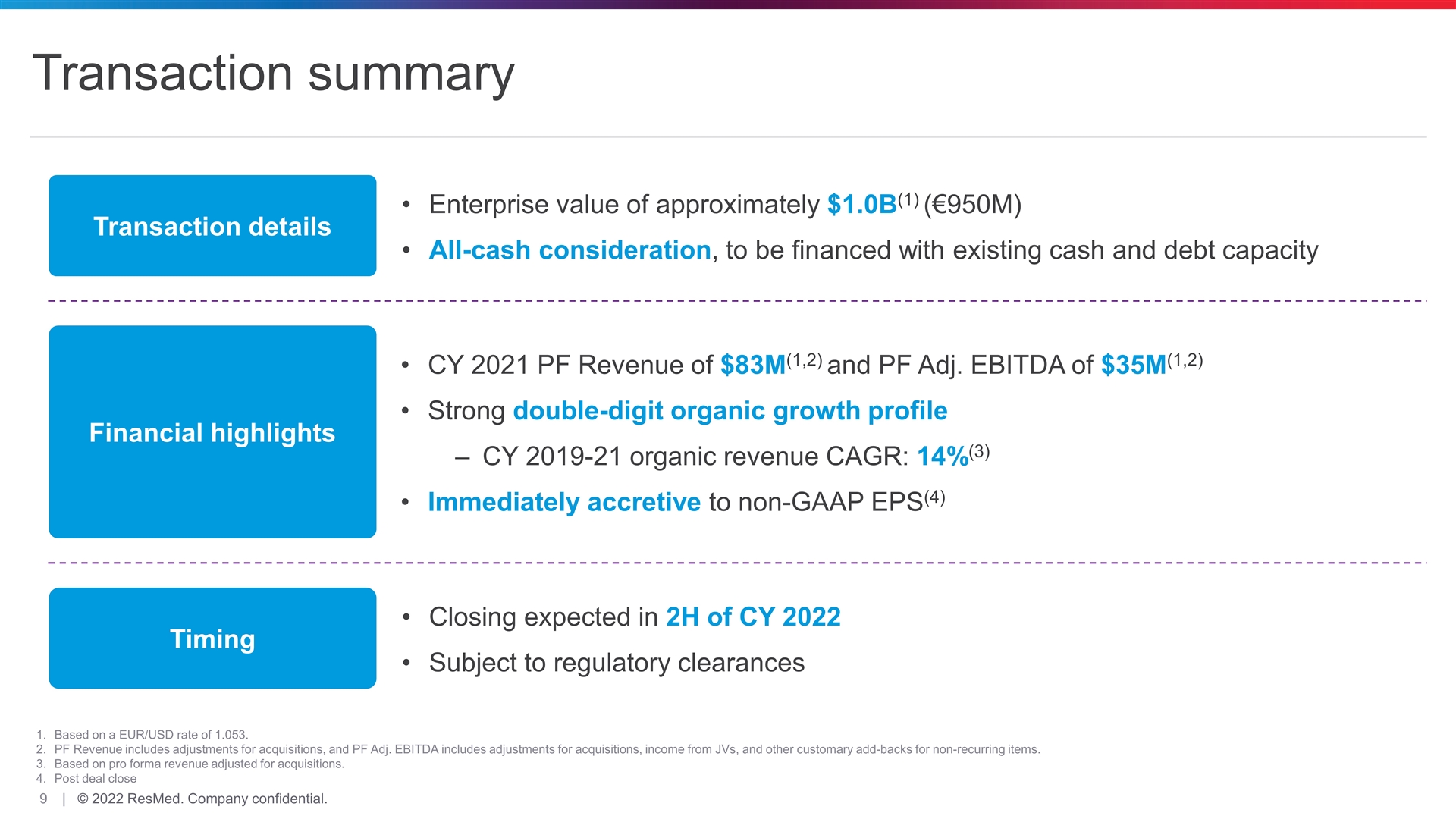

Transaction summary Transaction details Financial highlights Enterprise value of approximately $1.0B(1) (€950M) All-cash consideration, to be financed with existing cash and debt capacity CY 2021 PF Revenue of $83M(1,2) and PF Adj. EBITDA of $35M(1,2) Strong double-digit organic growth profile CY 2019-21 organic revenue CAGR: 14%(3) Immediately accretive to non-GAAP EPS(4) Based on a EUR/USD rate of 1.053. PF Revenue includes adjustments for acquisitions, and PF Adj. EBITDA includes adjustments for acquisitions, income from JVs, and other customary add-backs for non-recurring items. Based on pro forma revenue adjusted for acquisitions. Post deal close Timing Closing expected in 2H of CY 2022 Subject to regulatory clearances

Q&A